|

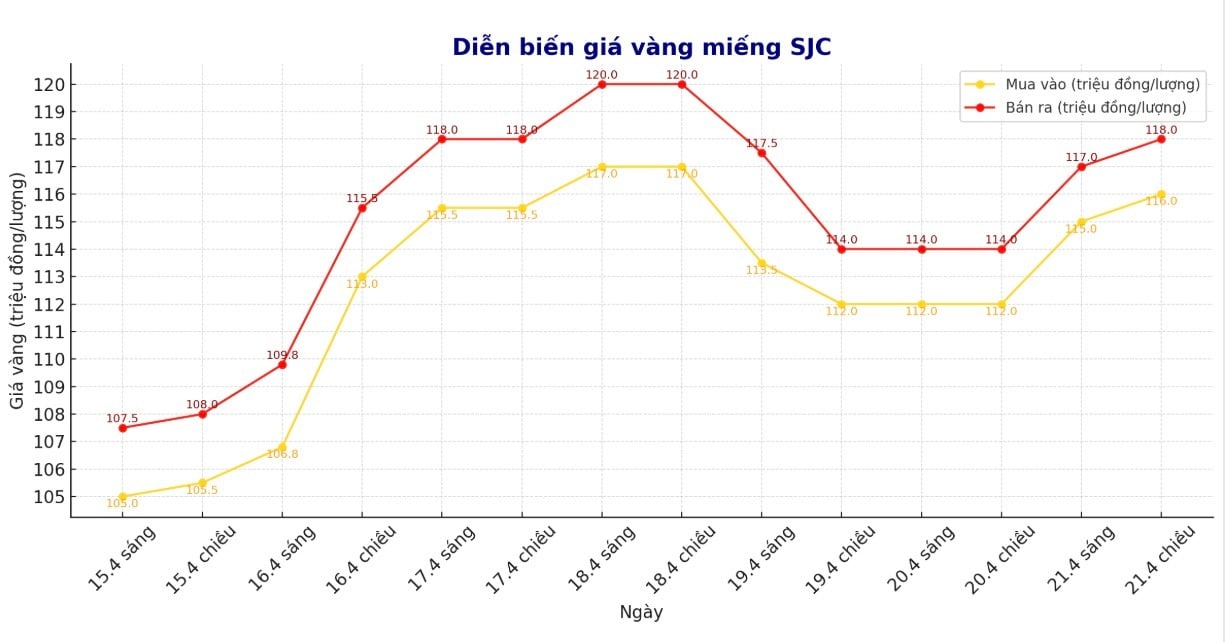

| Gold bar price movements in recent trading sessions. Chart: Phan Anh |

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 116-118 million VND/tael (buy - sell); an increase of 4 million VND/tael for both buying and selling. The difference between buying and selling prices was at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116-118 million VND/tael (buy - sell); an increase of 4 million VND/tael for both buying and selling. The difference between buying and selling prices was at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116-118 million VND/tael (buy - sell); an increase of 4 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 113.5-117 million VND/tael (buy - sell); an increase of 4 million VND/tael for buying and an increase of 3.5 million VND/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-118 million VND/tael (buy - sell); increased by 3.7 million VND/tael for buying and increased by 4 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying and selling gap is pushed too high, increasing risks for individual investors.

In the context of the fluctuating world gold market, the large difference between buying and selling prices in the domestic market is a clear warning sign. If the gold price turns down, buyers will face huge losses. Individual investors, especially those with a “surfing” mentality, need to consider carefully before investing.

Big profit after one month of investment

After one month, domestic gold investors have reaped impressive profits. From March 21 to April 21, the profits recorded at major gold and silver systems were VND16.5 million/tael for SJC gold bars at Saigon Jewelry Company Limited - SJC, VND16.2 million/tael for SJC gold bars at DOJI Group and Bao Tin Minh Chau.

9999 round gold rings at DOJI bring in a profit of 13.6 million VND/tael, while at Bao Tin Minh Chau it is 14.1 million VND/tael.

World gold price

As of 0:10, the world gold price was listed at 3,408 USD/ounce, up 8.9 USD.

Gold Price Forecast

Gold prices have increased by nearly 25% since the beginning of the year, and many experts warn that this could be a short-term peak. Investing in gold at this time is considered risky.

NS Ramaswamy, head of commodities at Ventura, recommends against buying gold at this time. He says that buying should only be considered on short-term corrections, with the price zones at $3,150/ounce and $3,080/ounce being the target. In the medium term, gold could rise to $3,450-$3,550/ounce, but each rally carries the potential for profit-taking and a correction.

He also warned that gold prices may be at their peak and that one should not allocate too much to gold, as the possibility of the FED cutting interest rates has been reflected in gold prices.

However, some experts believe that the outlook for gold prices remains positive. Prolonged trade tensions, inflationary pressures and continued central bank purchases are all factors supporting the price increase.

Navneet Damani - Senior Vice President of Commodity and Currency Research at Motilal Oswal Financial Services (a diversified financial services company based in Mumbai, India) commented: “In the context of a world full of policy uncertainty, high inflation and geopolitical tensions, gold remains a safe haven.

“As central banks increase their reserves and investors seek safety, gold will continue to be a popular asset. Barring a major breakthrough in global trade negotiations, we remain bullish on corrections in the medium to long term.”

Alex Kuptsikevich, senior analyst at FxPro, said gold has regained momentum since touching the 50-day moving average earlier last week, signaling the end of a correction that has lasted since late December 2024.

“We expect gold to surpass $3,500 an ounce in the short term. It is currently about 60% above its 200-week moving average. If it reaches $3,540 an ounce, the premium would be 70%, similar to the 2011 peak before entering the bear market,” he said.

According to laodong.vn

Source: https://baodanang.vn/kinhte/202504/cap-nhat-gia-vang-sang-224-pha-dinh-moi-lai-dam-sau-mot-thang-4005635/

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)