Domestic gold price today April 10, 2025

At the time of survey at 11:30 on April 10, 2025, domestic gold prices skyrocketed, setting a new record. Specifically:

DOJI Group listed the price of SJC gold bars at 100.9-103.9 million VND/tael (buy - sell), an increase of 1.2 million VND/tael for buying - an increase of 2 million VND/tael for selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 100.9-103.9 million VND/tael (buy - sell), an increase of 1.2 million VND/tael for buying - an increase of 2 million VND/tael for selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 101.2-103.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 1 million VND/tael for buying and 1.6 million VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 100.9-103.9 million VND/tael (buying - selling, up 1.1 million VND/tael in buying - up 2 million VND/tael in selling compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 100.6-103.9 million VND/tael (buy - sell), gold price increased by 1.7 million VND/tael in buying direction - increased by 2 million VND/tael in selling direction compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 100.4-103.4 million VND/tael (buy - sell); an increase of 700 thousand VND/tael in the buying direction - an increase of 1.5 million VND/tael in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 101-104 million VND/tael (buy - sell); increased 1.1 million VND/tael for buying - increased 2 million VND/tael for selling.

The latest gold price list today, April 10, 2025 is as follows:

| Gold price today | April 10, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 100.9 | 103.9 | +1200 | +2000 |

| DOJI Group | 100.9 | 103.9 | +1200 | +2000 |

| Red Eyelashes | 101.2 | 103.5 | +1000 | +1600 |

| PNJ | 100.9 | 103.9 | +1200 | +2000 |

| Vietinbank Gold | 103.9 | +2000 | ||

| Bao Tin Minh Chau | 100.9 | 103.9 | +1100 | +2000 |

| Phu Quy | 100.6 | 103.9 | +1700 | +2000 |

| 1. DOJI - Updated: April 10, 2025 11:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 100,900 | 103,900 |

| AVPL/SJC HCM | 100,900 | 103,900 |

| AVPL/SJC DN | 100,900 | 103,900 |

| Raw material 9999 - HN | 100,200 | 102,500 |

| Raw material 999 - HN | 100,100 | 102,400 |

| 2. PNJ - Updated: April 10, 2025 11:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 10,090 | 10,390 |

| PNJ 999.9 Plain Ring | 9,980 | 10,190 |

| Kim Bao Gold 999.9 | 9,980 | 10,190 |

| Gold Phuc Loc Tai 999.9 | 9,980 | 10,190 |

| 999.9 gold jewelry | 9,940 | 10,190 |

| 999 gold jewelry | 9,930 | 10,180 |

| 9920 jewelry gold | 9,869 | 10,119 |

| 99 gold jewelry | 9,848 | 10,098 |

| 750 Gold (18K) | 7,408 | 7,658 |

| 585 Gold (14K) | 5,726 | 5,976 |

| 416 Gold (10K) | 4,004 | 4,254 |

| PNJ Gold - Phoenix | 9,980 | 10,190 |

| 916 Gold (22K) | 9,094 | 9,344 |

| 610 Gold (14.6K) | 5,981 | 6,231 |

| 650 Gold (15.6K) | 6,389 | 6,639 |

| 680 Gold (16.3K) | 6,694 | 6,944 |

| 375 Gold (9K) | 3,586 | 3,836 |

| 333 Gold (8K) | 3,128 | 3,378 |

| 3. SJC - Updated: 10/4/2025 11:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 100,900 ▲1200K | 103,900 ▲2000K |

| SJC gold 5 chi | 100,900 ▲1200K | 103,920 ▲2000K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 100,900 ▲1200K | 103,930 ▲2000K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 100,300 ▲800K | 103,300 ▲1600K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 100,300 ▲800K | 103,400 ▲1600K |

| Jewelry 99.99% | 100,300 ▲800K | 103,000 ▲1600K |

| Jewelry 99% | 98,980 ▲1584K | 101,980 ▲1584K |

| Jewelry 68% | 67,197 ▲1088K | 70,197 ▲1088K |

| Jewelry 41.7% | 40,105 ▲667K | 43,105 ▲667K |

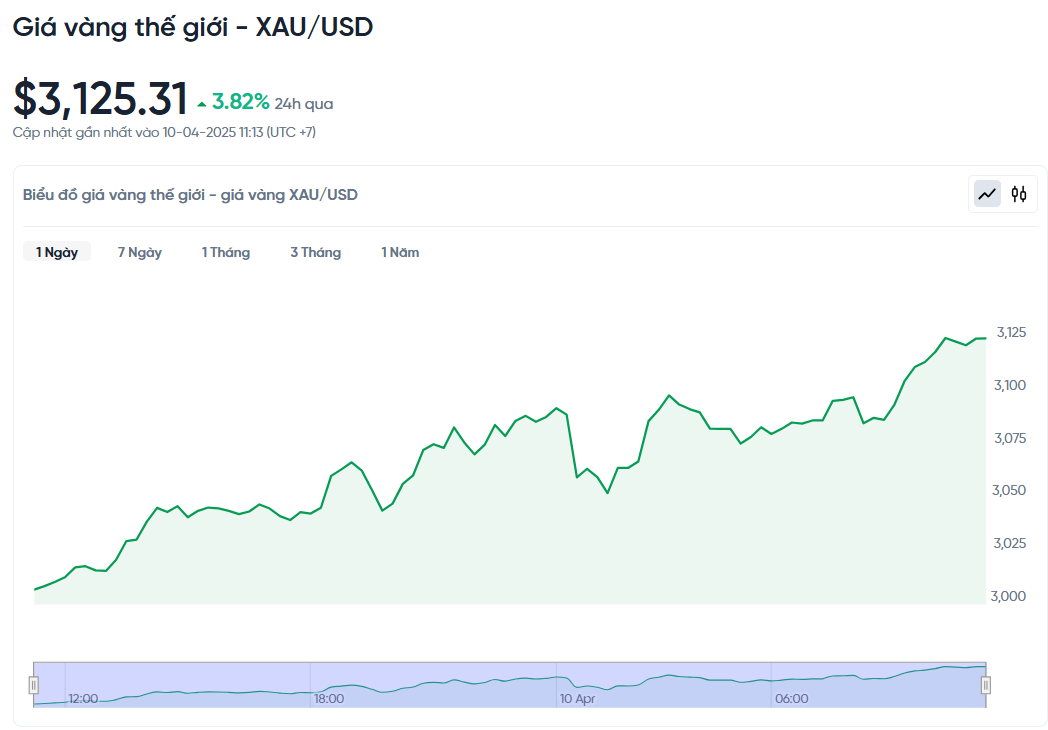

World gold price today April 10, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 11:30 today, Vietnam time, was 3,125.31 USD/ounce. Today's gold price increased by 114.8 USD/ounce compared to yesterday. Converted according to the USD exchange rate in the free market (26,250 VND/USD), the world gold price is about 99.98 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.92 million VND/tael higher than the international gold price.

The price of gold has skyrocketed as investors have rushed to buy gold as a safe haven. The reason is that the US has increased import tariffs on China - the world's leading consumer of metals, making the already tense trade war even hotter. Notably, the US has temporarily suspended high tariffs on some other countries for 90 days.

World gold prices recorded the highest increase since October 2023. Meanwhile, US gold futures also increased by 1.8% to 3,135.5 USD.

US President Donald Trump announced that he would increase tariffs on Chinese goods from 104% to 125%. This move will continue to cause the world's two largest economies to confront each other with retaliatory measures. However, Mr. Trump also decided to temporarily reduce tariffs on some other countries.

If economic growth slows as expected, interest rates could fall and push gold higher as the impact of taxes makes inflation a concern this year, said Edward Meir, an analyst at Marex. He predicted gold could hit $3,200 by the end of April or sooner.

In 2025, gold prices increased by more than 18% thanks to factors such as US tax hike plans, expectations of interest rate cuts by the Federal Reserve (Fed), geopolitical tensions in the Middle East and Ukraine, strong buying demand from central banks, and inflows into gold-linked ETFs.

Minutes from the Fed’s recent meeting showed policymakers agreed on the risks of higher inflation and slower growth. Some even warned of “hard choices” ahead. If rising inflation forces the Fed to keep interest rates high, gold could lose its appeal because it doesn’t offer the same return as other assets.

Investors are closely watching the US consumer price index (CPI) and producer price index (PPI), due later in the day and on Friday. Meanwhile, silver edged up 0.2% to $31.08 an ounce, platinum fell 0.5% to $932.81 and palladium lost 1.2% to $922.72.

Gold Price Forecast

Technically, the gold market is currently tilted towards buyers. After the recent correction, selling pressure has weakened significantly. In the short term, the next target for buyers is to push the price above the important resistance zone at $3,201/ounce. On the other hand, if the price reverses, the support zone to watch is around $2,970.

UBS expert Giovanni Staunovo said that concerns about the trade war are making the US economic outlook less optimistic. In that context, many investors are starting to expect the US Federal Reserve (Fed) to cut interest rates soon to support growth. This expectation is creating more momentum for gold prices to rise, with the target of reaching $ 3,200 / ounce in the next few months.

The market is also watching the minutes of the Fed’s recent meeting and the CPI report – the US consumer price index – due to be released on Thursday. These are two key factors that can strongly influence interest rate expectations and directly influence the next direction of gold.

In terms of long-term prospects, gold prices remain positive. With global geopolitical and economic risks showing no signs of abating, gold continues to maintain its role as a safe haven asset. Goldman Sachs predicted that gold could rise another 8% this year, and in fact, prices exceeded that expectation in the first quarter.

If gold prices continue to hold above the $3,000/ounce mark, the possibility of setting new peaks in the coming years is entirely possible. In the context of global volatility that shows no end in sight, gold is increasingly becoming the top choice for investors who want to protect their assets.

Several major banks have raised their gold price forecasts for 2025. HSBC predicts an average price of $3,015 an ounce. Bank of America expects $3,063, while Standard Chartered believes gold could hit $3,300 in the second quarter. Citigroup also sees gold hitting $3,000 in the next six to 18 months.

Source: https://baonghean.vn/cap-nhat-gia-vang-hom-nay-10-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-vun-vut-lap-ky-luc-10294822.html

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Video]. Building OCOP products based on local strengths](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)