Domestic gold price today April 22, 2025

As of 5:00 p.m. closing time on April 22, 2025, domestic gold prices increased incredibly compared to yesterday, continuing to set a new record. Specifically:

The price of SJC gold bars listed by DOJI Group is at 122-124 million VND/tael (buy - sell), a sharp increase of 6 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 122-124 million VND/tael (buy - sell), a sharp increase of 6 million VND/tael in both buying and selling directions compared to yesterday.

The price of SJC gold at Ngoc Tham Jewelry Company Limited was traded by businesses at the highest level of 121.5-124.5 million VND/tael (buy - sell), an increase of 3 million VND/tael in the buying direction - an increase of 500 thousand VND in the selling direction compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 120.5-122.5 million VND/tael (buying - selling), an increase of 4.5 million VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 120-123 million VND/tael (buy - sell), gold price increased by 4.5 million VND/tael in buying direction - increased by 5 million VND in selling direction compared to yesterday.

As of the closing price at 5:00 p.m., the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 117.2-119 million VND/tael (buy - sell); the gold price increased by 3.7 million VND/tael in the buying direction - increased by 2 million VND in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 119-122 million VND/tael (buy - sell); an increase of 4.5 million VND/tael in buying - an increase of 4 million VND in selling compared to yesterday.

The latest gold price list today, April 22, 2025 is as follows:

| Gold price today | April 22, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 122 | 124 | +6000 | +6000 |

| DOJI Group | 122 | 124 | +6000 | +6000 |

| Ngoc Tham | 121.5 | 124.5 | +3000 | +500 |

| PNJ | 122 | 124 | +6000 | +6000 |

| Vietinbank Gold | 124 | +6000 | ||

| Bao Tin Minh Chau | 120.5 | 122.5 | +4500 | +4500 |

| Phu Quy | 120 | 123 | +4500 | +5000 |

| 1. DOJI - Updated: April 22, 2025 17:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 122,000 ▲6000K | 124,000 ▲6000K |

| AVPL/SJC HCM | 122,000 ▲6000K | 124,000 ▲6000K |

| AVPL/SJC DN | 122,000 ▲6000K | 124,000 ▲6000K |

| Raw material 9999 - HN | 117,000 ▲3700K | 118,100 ▲2000K |

| Raw material 999 - HN | 116,900 ▲3700K | 118,090 ▲2090K |

| 2. PNJ - Updated: April 22, 2025 17:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| HCMC - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Hanoi - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Hanoi - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Da Nang - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Da Nang - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Western Region - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Western Region - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Jewelry gold price - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Jewelry gold price - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Jewelry gold price - Southeast | PNJ | 117,000 ▲3500K |

| Jewelry gold price - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 117,000 ▲3500K |

| Jewelry gold price - Kim Bao Gold 999.9 | 117,000 ▲3500K | 120,000 ▲3100K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 117,000 ▲3500K | 120,000 ▲3100K |

| Jewelry gold price - Jewelry gold 999.9 | 117,000 ▲3500K | 119,500 ▲3500K |

| Jewelry gold price - Jewelry gold 999 | 116,880 ▲3500K | 119,380 ▲3500K |

| Jewelry gold price - Jewelry gold 9920 | 116,140 ▲3470K | 118,640 ▲3470K |

| Jewelry gold price - Jewelry gold 99 | 115,910 ▲3470K | 118,410 ▲3470K |

| Jewelry gold price - 750 gold (18K) | 82,280 ▲2630K | 89,780 ▲2630K |

| Jewelry gold price - 585 gold (14K) | 62,560 ▲2050K | 70,060 ▲2050K |

| Jewelry gold price - 416 gold (10K) | 42,360 ▲1450K | 49,860 ▲1450K |

| Jewelry gold price - 916 gold (22K) | 107,060 ▲3200K | 109,560 ▲3200K |

| Jewelry gold price - 610 gold (14.6K) | 65,550 ▲2140K | 73,050 ▲2140K |

| Jewelry gold price - 650 gold (15.6K) | 70,330 ▲2280K | 77,830 ▲2280K |

| Jewelry gold price - 680 gold (16.3K) | 73,910 ▲2380K | 81,410 ▲2380K |

| Jewelry gold price - 375 gold (9K) | 37,460 ▲1310K | 44,960 ▲1310K |

| Jewelry gold price - 333 gold (8K) | 32,090 ▲1160K | 39,590 ▲1160K |

| 3. SJC - Updated: 04/22/2025 17:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 122,000 ▲6000K | 124,000 ▲6000K |

| SJC gold 5 chi | 122,000 ▲6000K | 124,020 ▲6000K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 122,000 ▲6000K | 124,030 ▲6000K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,500 ▲3500K | 119,500 ▲3500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,500 ▲3500K | 119,600 ▲3500K |

| Jewelry 99.99% | 116,500 ▲3500K | 118,900 ▲3500K |

| Jewelry 99% | 112,722 ▲3965K | 117,722 ▲3465K |

| Jewelry 68% | 75,010 ▲2380K | 81,010 ▲2380K |

| Jewelry 41.7% | 43,736 ▲1459K | 49,736 ▲1459K |

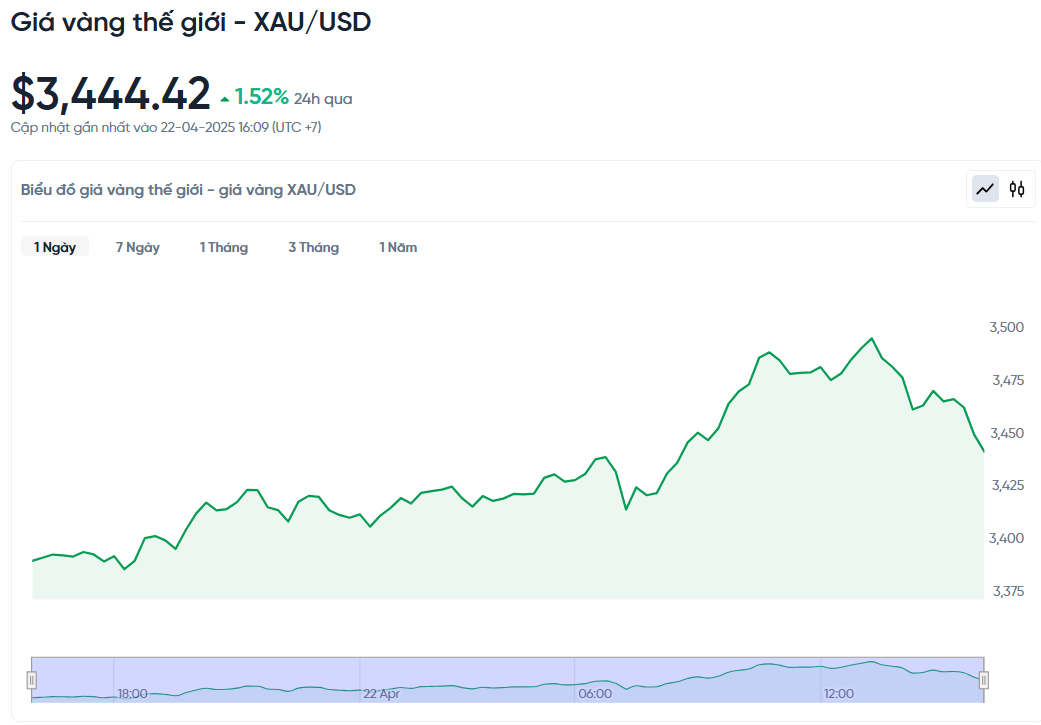

World gold price today April 22, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 5:00 p.m. today's closing price, Vietnam time, was 3,444.42 USD/ounce. The gold price increased by 51.71 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,115 VND/USD), the world gold price is about 109.5 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 14.5 million VND/tael higher than the international gold price.

World gold prices continued to rise sharply to a new record due to concerns about US President Donald Trump's criticism of Federal Reserve Chairman Jerome Powell. This made investors afraid of risks and rushed to buy gold as a safe haven.

Yesterday, Mr. Trump continued to call for the Fed to cut interest rates immediately, warning that failure to act could send the U.S. economy into recession. In contrast, Mr. Powell maintained a cautious stance, saying that it was necessary to wait for clearer signals from inflation before deciding to adjust monetary policy. This difference in views has added pressure to financial markets and made investors more worried.

At the same time, China has also strongly criticized the US tariffs. Beijing warned that Washington's abuse of tariffs to exert pressure in trade negotiations could harm any country trying to establish a comprehensive economic agreement with the US.

The world gold price today hit a new record high of 3,491.37 USD/ounce in the session. The US gold futures price also increased by 1.7%, to 3,482.4 USD/ounce.

Gold prices have risen more than $400 in just nine trading sessions since the beginning of the month. Much of the increase has come from increased buying interest in the market, accounting for about two-thirds of the increase, with the rest coming from a decline in the US dollar.

The dollar index fell 1.02% to 98.165, making gold more attractive to international investors. Amid market volatility, investors shifted money to safe-haven assets such as gold, the yen and the Swiss franc. Meanwhile, US government bond yields rose and major US stock indexes fell more than 3%.

Asian stock markets also tumbled after a sell-off in US assets, sending the dollar lower. Meanwhile, China accused the US of abusing tariffs and warned countries not to sign economic deals with Washington that would harm Beijing.

"The 'sell-off' of US assets is in full swing. Whether or not President Trump actually intervenes in the Fed, these tensions have damaged the image of America as an outstanding country and created policy risks for investors," said Tapas Strickland, a market economist at NAB.

Considered a safe haven asset in times of uncertainty, gold prices surpassed the $3,300/ounce mark last week and continued to rise to $3,400/ounce on Monday. With this momentum, the world gold price could completely surpass the $3,500/ounce mark today.

Gold Price Forecast

According to Mr. Nguyen Quang Huy, Executive Director of the Faculty of Finance and Banking at Nguyen Trai University, it is very difficult to predict when the gold price will decrease. However, the gold price cannot increase continuously but will have times of adjustment, especially when market sentiment changes, regulatory policies are applied to stabilize, or when large financial institutions take profits.

Over the past month, domestic investors have made significant profits. From March 22 to April 22, profits from SJC gold bars at SJC reached about VND23.1 million/tael. 9999 round gold rings at DOJI brought in profits of about VND18.7 million/tael, while at Bao Tin Minh Chau it was VND20.9 million/tael.

Faced with the continuous and strong increase in gold prices, people need to stay calm and avoid letting emotions or crowd effects influence financial decisions. Investments should be based on understanding and long-term considerations, instead of just relying on the expectation that prices will “never fall”.

Associate Professor Dr. Nguyen Huu Huan, lecturer at Ho Chi Minh City University of Economics, said that the difference between domestic and international gold prices of about 4-5 million VND/tael is reasonable and stable.

From an international perspective, Kitco News said that gold prices are receiving significant support from the European Central Bank (ECB)'s decision to lower key interest rates. The ECB said that the eurozone economy is facing difficulties due to macroeconomic instability and trade tensions, thereby boosting demand for safe havens such as gold.

Loss of confidence in US assets caused the USD to fall sharply, reaching its lowest level since March 2022. Helping gold prices continue to set a new record when it is close to the threshold of 3,500 USD/ounce thanks to safe-haven demand and a weakening USD.

“Investors are staying away from US assets due to concerns about tariffs and tensions between Trump and Powell, making gold an attractive option as the US dollar weakens,” said Tim Waterer, market analyst at KCM Trade.

Meanwhile, Citi Research raised its three-month gold price forecast to $3,500 an ounce from $3,200, due to increased buying from Chinese insurance companies and safe-haven flows. CPM Group is also optimistic that the gold price uptrend could last for at least two more years, as the global economy continues to face many challenges.

However, some opinions such as Colin Cieszynski from SIA Wealth Management believe that in the short term, gold prices may temporarily calm down as investors shift their attention to the financial reporting season. Meanwhile, according to Mr. Rich Checkan from Asset Strategies International, gold prices may correct slightly after continuously reaching new peaks, due to profit-taking activities of investors.

Source: https://baonghean.vn/cap-nhat-gia-vang-chot-phien-22-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-cao-lap-dinh-moi-10295695.html

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

Comment (0)