Thanh Hoa Provincial Tax Department has just sent an Open Letter to businesses and business households in Thanh Hoa province warning about the use of electronic invoices through collecting and analyzing the K coefficient.

Recently, the Tax sector has been implementing many measures to control tax fraud and violations of the law on electronic invoices, including measures using information technology to analyze data and warn of risks in using electronic invoices, known as the K coefficient method.

Specifically, the K coefficient is a risk measurement index, calculated based on the formula: K = Total value of goods sold on invoice / (Total value of goods in inventory + Total value of goods purchased).

When a taxpayer's K coefficient exceeds the prescribed threshold, the tax authority will apply many professional measures according to regulations to control and handle cases assessed as high risk.

Due to the analysis and warning of risks using information technology and automatic implementation on the basis of the data collected by the Tax sector's system at the time of review, to avoid being warned that the K coefficient does not reflect the actual situation, the Thanh Hoa Provincial Tax Department recommends that businesses and business households paying taxes by declaration method need to comply with the following measures:

Accurately update the main business lines. If there is any change in the business lines, it is necessary to immediately carry out the update procedure with the tax authority and the business registration authority;

Ensure that inventory figures are updated regularly and accurately;

Comply with legal regulations on electronic invoices, issue invoices that accurately reflect the value and time of transactions of goods and services;

Do not issue fake invoices or use illegal invoices to legitimize transactions.

In case of receiving warnings from tax authorities as well as requests for explanations according to regulations, enterprises and business households must immediately provide relevant documents proving transparency in business.

With the goal of dedicated and professional service towards taxpayers, Thanh Hoa Provincial Tax Department will create the most favorable conditions for organizations and individuals to properly implement tax policies and laws.

Thanh Hoa Provincial Tax Department

Related news:

Source: https://baothanhhoa.vn/canh-bao-viec-su-dung-hoa-don-dien-tu-qua-he-so-k-227996.htm

![[Photo] President Luong Cuong presided over the welcoming ceremony and held talks with Sri Lankan President Anura Kumara Dissanayaka](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/5/bbb34e48c0194f2e81f59748df3f21c7)

![[Photo] Solemn opening of the 9th Session, 15th National Assembly](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/5/ad3b9de4debc46efb4a0e04db0295ad8)

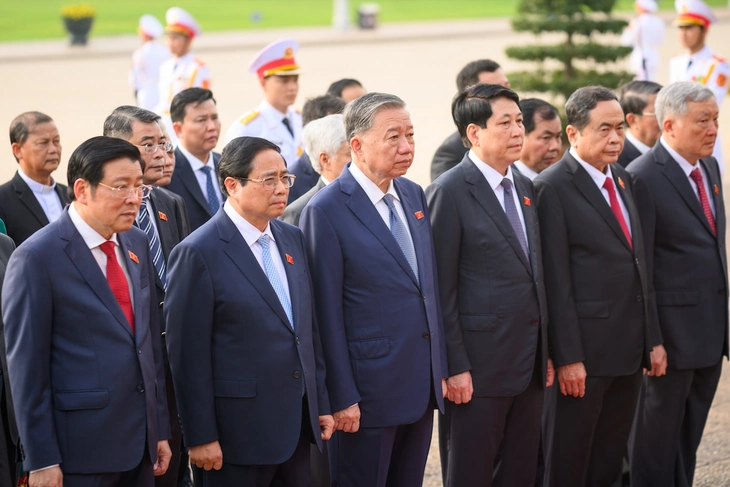

![[Photo] National Assembly delegates visit President Ho Chi Minh's Mausoleum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/5/9c1b8b0a0c264b84a43b60d30df48f75)

Comment (0)