Carbon credit investments, if not properly managed, can lead to “greenwashing”, where companies or countries claim to reduce emissions but in reality just shift responsibility for emissions elsewhere.

This is also known as the phenomenon of “carbon leakage”, Mr. Bertrand Badré, former Chief Financial Officer of the World Bank, emphasized in his discussion at the International Conference on Climate, Finance and Sustainable Development (ISCFS-2024) at Paris-Dauphine University (France) with analysis of the key role of green finance in responding to climate change.

He also addressed the outcomes and challenges from COP29, placing them in a larger picture of the need for a systemic and value-based transformation.

Important steps at COP29

COP29 is not only a climate conference but also a forum for countries to consider new financial solutions to meet the urgent need to reduce emissions and adapt to climate change.

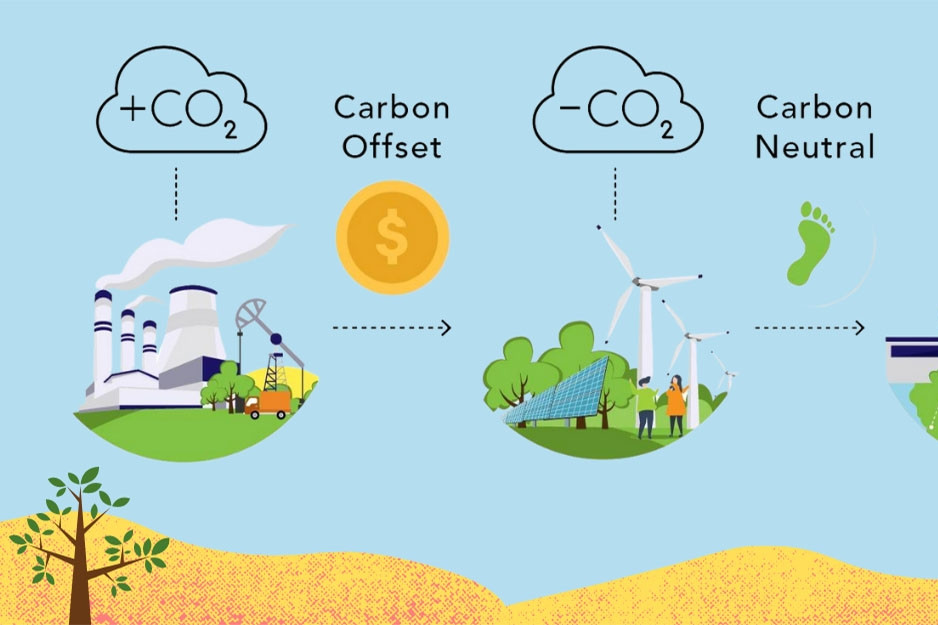

The highlight of this year’s conference was the agreement on a legal framework for a global carbon market under Article 6 of the Paris Agreement. This mechanism allows countries to trade carbon credits, thereby mobilizing large financial resources for green projects.

However, Mr. Bertrand Badré emphasized, if not accompanied by transparency and extensive cooperation, this mechanism can easily be exploited or increase inequality between countries.

In addition, the establishment of the Climate- Health Alliance, connecting the health and environmental sectors in responding to the impacts of climate on public health, is another notable initiative at COP29. From this, it can be seen that climate change is not only an environmental issue but also a multifaceted crisis, requiring cross-sectoral coordination.

However, disagreements between countries on financial responsibility and the level of commitment remain a major challenge, as demonstrated by the fact that developed countries have not yet reached their commitment to provide $100 billion per year to developing countries.

Green Finance: Tools and Responsibilities

According to Bertrand Badré, finance is not just a tool but also a responsibility towards humanity. Therefore, green finance needs to be placed in a system with ethics and sustainable values, instead of just chasing short-term profits.

Accounting standards and asset pricing mechanisms also need to be reviewed to reflect environmental and social impacts. For example, investments in carbon credits, if not properly managed, can lead to “greenwashing”, where companies or countries claim to reduce emissions but in reality just shift responsibility for emissions elsewhere.

This is also known as “carbon leakage” – a concept that quantifies the increase in greenhouse gas emissions in one country as a result of emissions cuts by another country with more stringent climate change mitigation policies.

Mr. Bertrand Badré therefore calls for a more transparent approach, in which financial instruments are not only optimized but also serve the common good of society.

The central message of Mr. Bertrand Badré’s speech was that we cannot solve climate problems with piecemeal solutions. Climate change is a systemic problem that requires a restructuring of the entire global financial and political system. He argued that governments and businesses cannot work alone but need to form sustainable alliances.

The results from COP29 show that mechanisms such as carbon markets or Loss and Damage Funds cannot operate effectively without global coordination, especially in sharing the financial burden to support poor and developing countries.

But he warned that solidarity cannot exist on paper alone. Countries need to demonstrate their commitment through concrete actions, such as increasing funding for the Loss and Damage Fund or providing clean technology to poorer countries. Failure by developed countries to meet the expectations of developing countries not only undermines trust but also creates the risk of geopolitical instability.

According to the former Chief Financial Officer of the World Bank, sustainable development is not just about reducing emissions or protecting the environment, but also about ensuring that society can unite and benefits are distributed equitably.

While delegates at COP29 have highlighted the ethical dimension of negotiations, particularly on financial responsibility between countries, Bertrand Badré said it is necessary to go further. Financial institutions need to make clear ethical commitments, and all investment decisions must consider long-term social and environmental impacts.

He called on countries, organizations and individuals to start with the smallest changes to create a bigger impact. Scientists, industrialists and policymakers need to openly discuss and share the latest research on the role of technology in optimizing green finance to have feasible, quick and effective action programs.

Looking back at the results of COP29 and the lessons shared by Mr. Bertrand Badré, it is clear that we need a comprehensive transformation, not only in our financial instruments but also in our thinking and values.

The world is at a crossroads where the decisions we make today will shape the future of our planet. Green finance, when managed properly, can be the most powerful force in building a more sustainable and equitable world. But it will require us all to move beyond self-interest and work together for the common good. Time is running out, and the future depends on what we do now.

Dr. Nguyen Anh - Sustainable Urban Development Expert SUDNet, AVSE Global

(The article combines the analysis of Dr. Nguyen Anh and the sharing of Mr. Bertrand Badré on green finance and lessons on sustainable transformation at the International Conference on Climate, Finance and Sustainable Development - ISCFS, Paris 2024).

Source: https://vietnamnet.vn/can-trong-voi-hien-tuong-ro-ri-carbon-va-rua-xanh-2345883.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

Comment (0)