Ms. Hoang Phuong has been a part-time staff member at the ward since October 2022. She is preparing to give birth but does not know whether she will be entitled to maternity benefits after giving birth.

Non-professional staff help commune, village and residential group authorities operate effectively (Illustration: Quoc Trieu).

According to Vietnam Social Security, as stipulated in Point i, Clause 1, Article 2 of the Law on Social Insurance 2014, part-time workers in communes, wards and towns are subjects participating in compulsory social insurance.

However, Article 30 of the 2014 Law on Social Insurance stipulates that the subjects applying maternity benefits do not include the group of employees participating in compulsory social insurance according to Point i, Clause 1, Article 2 (ie the group of non-professional workers in communes, wards and towns).

Employees participating in compulsory social insurance are entitled to sick leave and maternity benefits thanks to the employer's contribution of 3% to the sick leave and maternity fund on the employee's social insurance salary fund.

However, according to Clause 1, Article 86 of the 2014 Law on Social Insurance, which stipulates the contribution level of employers, the group of employees participating in compulsory social insurance according to Point i, Clause 1, Article 2 (ie the group of non-professional workers in communes, wards and towns) are not allowed to have their employers contribute 3% to the sickness and maternity fund.

According to Vietnam Social Security, comparing the above regulations, employers do not have to pay social insurance into the sickness and maternity fund for part-time workers in communes, wards and towns. Therefore, such workers are not eligible for maternity benefits.

The above regulation will be amended when the Social Insurance Law 2024 takes effect from July 1, 2025.

According to Point k, Clause 1, Article 2 of the Law on Social Insurance 2024, part-time workers at the commune level (including wards and towns) and in villages and residential groups are subject to compulsory social insurance participation.

Article 34 of the 2024 Law on Social Insurance stipulates the contribution rate, method and duration of compulsory social insurance for employers.

Accordingly, employees participating in compulsory social insurance according to Point k Clause 1 Article 2 of the Law on Social Insurance 2024 (non-professional workers at the commune, village, and residential group levels) belong to the group whose employers pay 3% of their salary as the basis for compulsory social insurance contributions to the sickness and maternity fund.

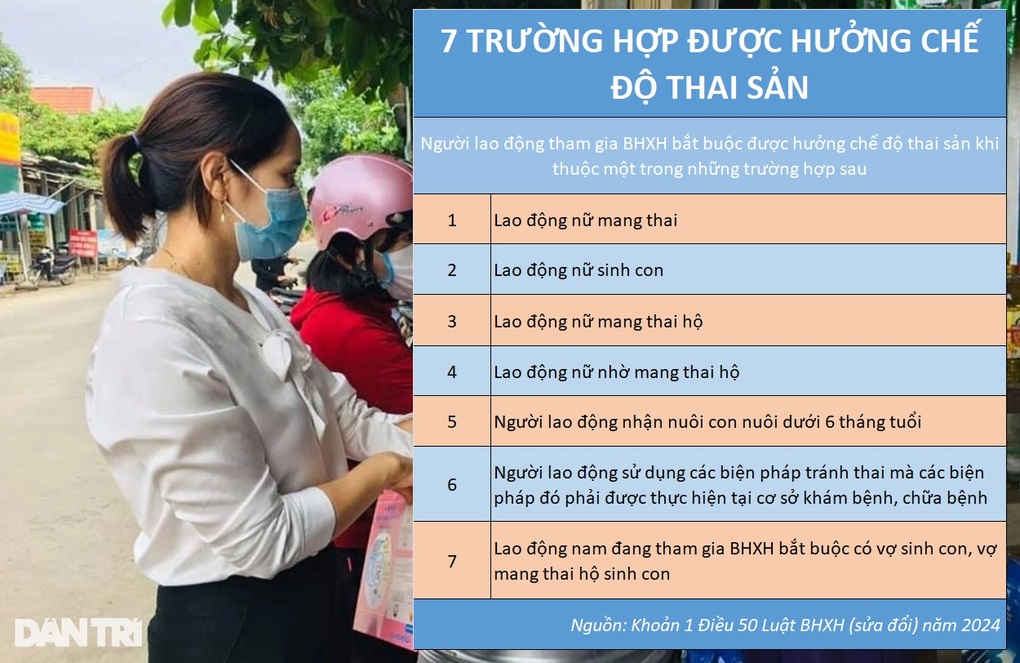

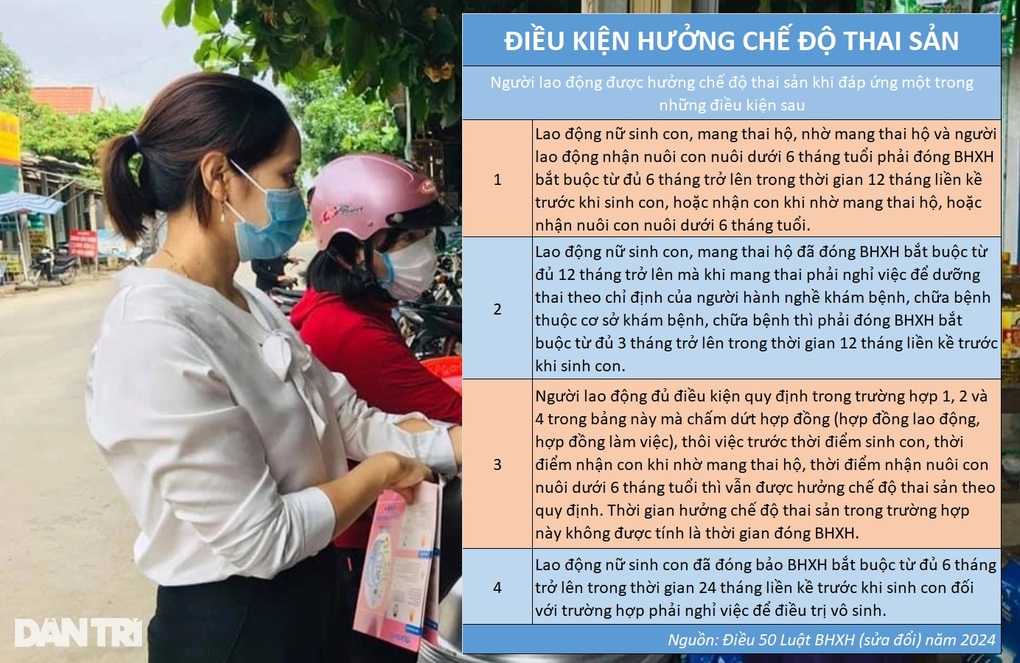

Article 50 of the 2024 Law on Social Insurance stipulates the subjects and conditions for enjoying maternity benefits. Clause 1 of this Article stipulates that the group of employees participating in compulsory social insurance according to Point k Clause 1 Article 2 (non-professional workers at the commune, village, and residential group levels) are eligible for maternity benefits in all 7 cases.

Thus, from July 1, 2025, when the 2024 Social Insurance Law takes effect, part-time workers at the commune, village, and residential group levels will enjoy maternity benefits.

Source: https://dantri.com.vn/an-sinh/can-bo-khong-chuyen-trach-xa-thon-co-duoc-huong-che-do-thai-san-khong-20240914181835059.htm

Comment (0)