ANTD.VN - Prohibiting banks from sending SMS messages and emails containing links will help customers identify fraudulent messages and emails.

The State Bank of Vietnam (SBV) recently issued Circular 50/2024/TT-NHNN (Circular 50) regulating safety and security for the provision of online services in the banking sector. This Circular will take effect from the beginning of 2025.

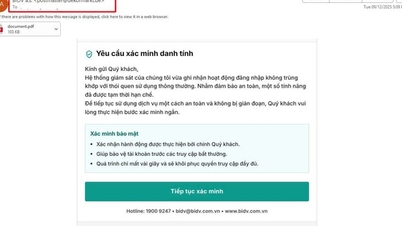

Notably, regarding regulations on protecting customer rights, the Circular stipulates that banks shall not send SMS messages or emails to customers containing links (Hyperlinks) to websites, except at the customer's request.

The above regulations will help customers identify fraudulent messages. Currently, fraudsters impersonating banks often use fake links to send messages to customers via social media (Facebook, Zalo, etc.), SMS messages, and emails. When customers access these fake links, their confidential information from online banking applications (login names, passwords, OTP codes, etc.) can be stolen.

|

Banks are prohibited from sending text messages or emails containing links to customers. |

Furthermore, the Circular also stipulates that credit institutions must guide customers on using online banking services to ensure safety and security. Specifically, they must instruct customers on: protecting the confidentiality of their private key, PIN, and OTP codes, and not sharing devices that store this information; the principles for setting up and changing private keys and PINs for electronic transaction accounts;

Instruct customers not to use public computers to access or conduct transactions; not to use public Wi-Fi networks when using Online Banking services; not to save login names, secret keys, or PINs on browsers; and to log out of the Online Banking application when not in use.

Simultaneously, guide customers on how to identify and handle various fraudulent situations, including fake websites and online banking applications; install all necessary security patches for the operating system and mobile banking applications; consider installing anti-malware software and updating to the latest malware detection patterns on personal devices used for transactions;

Choose transaction confirmation methods that meet regulatory requirements for security and safety, and are suitable for customer needs regarding transaction limits…

Do not use unlocked mobile devices to download and use online banking applications or OTP generation software; do not install unfamiliar software, unlicensed software, or software from unknown sources;

Immediately notify the relevant unit in the following cases: loss, misplacement, or damage of OTP generation devices, SMS receiving phone numbers, or devices storing security keys for generating electronic signatures; being scammed or suspected of being scammed; being hacked or suspected of being hacked.

Source: https://www.anninhthudo.vn/cam-ngan-hang-gui-tin-nhan-email-co-chua-duong-link-cho-khach-hang-post596544.antd

Comment (0)