The God of Wealth's Day (January 10) is often associated with the custom of buying gold for luck, but in recent years, investors have tended to expand to other asset channels such as silver, even stocks and Bitcoin.

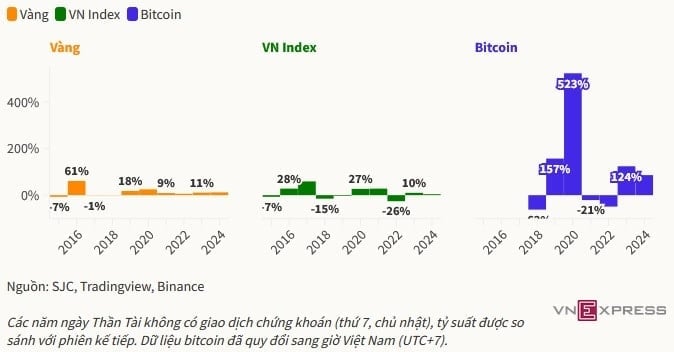

Statistics from reporters over the past 10 years show that gold is the asset with the most stable rate of return over the years. Investors holding Gold God of Wealth from 2015 to now can achieve a profit of 144%. Meanwhile, silver, stocks and Bitcoin have greater profit fluctuations. The VN-Index only increased by 116% in the period 2015-2025, silver increased by 400%, and Bitcoin price increased more than 376 times.

Gold is the asset most affected by the God of Wealth Day. Statistics from 2015 to present show that the price of SJC gold tends to increase and create a short-term peak in the half month before this day. However, on the 8th and 9th, the price drops sharply. This scenario has repeated itself 8 times in 10 years.

Explaining, expert Tran Duy Phuong, co-founder of Saigon Gold Forum, said that besides people's need to buy gold for luck, part of the reason comes from the pricing strategy of business units.

"Stores usually import raw materials from before Tet until around the 7th, causing demand to spike, pushing gold prices up. By the 8th and 9th, most stores have finished preparing and reduced demand, so gold prices tend to reverse," Mr. Phuong analyzed.

However, this scenario did not repeat itself this year. Gold prices maintained a steady upward trend since the beginning of the year and only had one small adjustment session, similar to world price movements. As of the end of February 8 (January 11), the selling price of SJC gold bars was at 90.3 million VND/tael - equal to the selling price on God of Wealth Day.

Experts say that demand for buying God of Wealth gold this year has weakened due to high gold prices and profit-taking pressure from investors who previously bought gold bars and 24K gold.

"This is different from previous years," Mr. Phuong commented.

According to experts, in the long term, gold prices still tend to increase and generate profits. Statistics from 2015 show that in just 3 years, investors have to suffer a loss of 1 to 7% if they buy gold and hold it until the next year. In 2016 alone, investing in Than Tai gold can enjoy profits of up to 61% in 2017.

Besides gold, many customers also prefer to buy silver on the occasion of God of Wealth Day this year. The price of silver in early 2015 was around 15.7 USD per ounce, equivalent to nearly 400,000 VND per tael according to the exchange rate at the same time.

In the early part of this year, silver prices peaked at nearly $18.33 before cooling down from February 2015. In Vietnam, silver prices at major brands are often 10-20% higher due to manufacturing costs (very few people buy silver bars or silver rings as smooth as gold), shipping costs and profit margins depending on the units.

After 10 years, the closing price of silver on God of Wealth Day was VND1,223 million per tael, according to the listed price of Phu Quy Group. Over the past month, this metal has increased by 9%, higher than the 5% of gold. Compared to the beginning of 2015, silver buyers can record a profit of 3 times (up 400%).

Similarly, the world silver price is also on a strong upward trend. At the close of the session on February 8, the market price was recorded at 31.79 USD per ounce, an increase of more than 5% over the past month, while the world gold price, despite setting consecutive records, only increased by approximately 4%.

During the God of Wealth Day this year, the market also recorded a trend of buying silver instead of gold when the supply of gold was scarce and the price was high. However, according to the personal finance website Moneyweek, investing in silver is completely different from investing in gold.

Although both are precious metals, silver has a rich history of application. Therefore, silver's ability to meet social demand has the greatest impact on its price.

About 55% of annual demand for silver comes from industrial or technology, compared with less than 10% for gold, said Adrian Ash, director of research at BullionVault, the world's largest online gold investment service. "Look around you, if something has an on/off switch, it probably contains silver," he said.

Its other uses include solder and alloys, the chemical industry, and medical devices (bacteria cannot grow on silver). For these reasons, silver prices move according to industrial and technological needs and sometimes follow the price of copper more closely than a safe haven precious metal.

In addition to the two channels above, stocks are also one of the markets that investors choose to "get lucky" on this occasion.

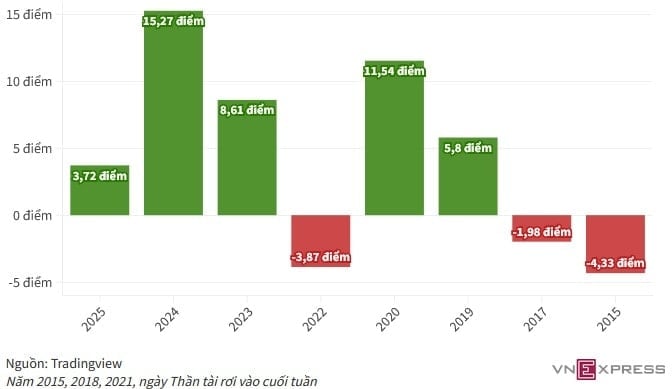

According to FIDT personal finance expert Nguyen An Huy, investors are in a buying mood after the Tet holiday, creating a small short-term demand and a positive impact on stocks. Before the holiday, trading will be slow because many people are afraid of not being able to react quickly to the impacts from the world market.

According to Mr. Nguyen The Minh, Director of Research and Development of Individual Clients at Yuanta Securities, the beginning of the year is the period when institutional investors tend to disburse. At the same time, the Government and enterprises also announce information about the results of the old year and plans for the new year. This creates a catalyst for the market.

Short-term investors can take profits right after the God of Wealth day. Data from Investing.com shows that from 2015 to now, there have been 8 trading sessions falling on the God of Wealth day, of which 5 sessions saw the VN-Index increase.

However, in terms of long-term performance, the VN-Index has not maintained a stable growth rate. In the past 10 years, 4 out of 8 trading sessions of this index decreased compared to the previous God of Wealth occasion, with the largest decrease of 26% in 2023.

Experts say that Vietnam's stock market is highly cyclical, so the VN-Index's growth is unstable. In addition, this index does not take into account the free float ratio, so it does not accurately reflect the market's growth.

As a global trading asset, Bitcoin is not affected by the God of Wealth day, but it has also attracted the attention of many Vietnamese investors in recent years. According to statistics from the cryptocurrency payment platform Triple-A in May 2024, Vietnam has more than 21 million people owning cryptocurrencies and the rate of cryptocurrency ownership among the population is the second highest in the world, after the UAE.

However, price data on God of Wealth Day (Hanoi time) from 2018 shows that this type of asset is not as "lucky" as stocks. Only 2/8 days of God of Wealth Day did this asset end the day with a higher price than at the beginning of the day. Of these, the two days of increase fell in the period 2021-2022, when digital assets benefited from the impact of Covid-19 and fluctuations in the world situation.

However, this is an asset that generates a higher rate of return than gold and stocks if held for a long time, because the price in 2025 increased nearly 125 times compared to the God of Fortune day in 2018. However, the digital asset group currently does not have a complete legal framework in Vietnam, leading to high risks for investors.

According to experts, after the God of Wealth day, investors can take early profits with stocks and bitcoin to continue reinvesting. With gold and silver, experts recommend closely monitoring if they want to sell because prices are constantly fluctuating, while they should consider waiting for the adjustment period to "put money down" to buy to optimize profits because prices are high.

TB (according to VnExpress)Source: https://baohaiduong.vn/cac-kenh-tai-san-sinh-loi-the-nao-sau-ngay-via-than-tai-10-nam-qua-404889.html

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)