|

| The National Assembly discussed the application of corporate income tax and reduction of value added tax in the afternoon session of November 20. |

Investment support policies need to ensure the principle of fairness.

Speaking at the discussion session, Delegate Vu Tien Loc, Hanoi National Assembly Delegation, highly agreed with the issuance of the National Assembly Resolution on applying additional corporate income tax according to regulations against global tax base erosion.

Delegate Vu Tien Loc analyzed that the issuance of this resolution is expected to have a huge impact on reducing the attractiveness of the investment and business environment in our country, especially for strategic investors in the context of fierce competition in attracting foreign investment today.

To minimize adverse impacts, delegates said that, at the same time as issuing a resolution on additional corporate income tax in accordance with regulations against global tax base erosion, the National Assembly needs to issue additional resolutions on preferential and support policies to ensure the maintenance of an attractive investment environment to simultaneously meet both goals of promoting high-quality investment flows into our country's economy , in line with the economic development strategies of the Party and State, while not violating international commitments, going against the integration trend.

"To do so, it must be affirmed that our promulgation of new investment incentive and support policies is not a measure to compensate investors for losses due to them having to pay additional taxes, because this violates OECD principles.

"Investment support policies need to ensure the principle of fairness towards all enterprises that meet the specific criteria that our policies aim for, regardless of whether they are subject to additional taxes or not," Mr. Vu Tien Loc emphasized.

Delegate Tran Anh Tuan, National Assembly Delegation of Ho Chi Minh City expressed the necessity of the draft Resolution on applying additional corporate income tax according to regulations against global tax base erosion...

According to National Assembly delegate Tran Anh Tuan, this is a very important Resolution to adjust the new tax policy in the coming time, creating a basis for attracting equal investment. With a minimum regulation of 15%, we will have a basis, based on this tax rate to negotiate the tax exemption and reduction threshold.

To complete the contents of the draft Resolution, delegate Tuan suggested that it is necessary to adjust some contents such as not needing to include the regulation that every year companies can choose to pay taxes or not pay taxes... in the draft Resolution, because there are already regulations on tax payment conditions above, if this regulation is included it will become redundant.

Continue to consider reducing VAT by 2%

Presenting the Summary Report on the National Assembly's draft resolution on value-added tax (VAT) reduction, Minister of Finance Ho Duc Phoc emphasized that the focus on drastic and synchronous implementation of financial policy solutions in recent times has had a positive impact in supporting businesses and people to stabilize production and business, contributing to stabilizing the macro-economy, creating favorable conditions to promote economic recovery and growth.

In 2022, the National Assembly issued Resolution No. 43/2022/QH15 dated January 11, 2022 on fiscal and monetary policies to support the Socio-Economic Recovery and Development Program, which proposed a solution to reduce VAT by 2% for a number of groups of goods and services subject to a VAT rate of 10% from February 1, 2022 to December 31, 2022.

In 2023, facing economic difficulties, the National Assembly will continue to implement the VAT reduction policy according to Resolution No. 43/2022/QH15 from July 1, 2023 to December 31, 2023 in Resolution No. 101/2023/QH15 dated June 24, 2023 of the National Assembly on the 5th Session, 15th National Assembly.

The solution to reduce VAT along with other support solutions on taxes, fees, and charges is creating great conditions to help businesses reduce production costs, increase profits, and increase the ability to stimulate demand.

The Minister of Finance said that after 4 months of implementation (July, August, September and October 2023), the VAT reduction policy under Resolution No. 101/2023/QH15 has supported businesses and people with a total of about 15.6 trillion VND, contributing to reducing the cost of goods and services, thereby promoting production and business and creating more jobs for workers, stimulating consumption, and promoting production and business development.

In order to promptly respond to developments in the socio-economic situation, and at the same time consider and calculate appropriately with actual conditions, Minister of Finance Ho Duc Phoc proposed to resolutely and effectively implement support solutions on taxes, fees, charges and land rents issued in 2023 and study and propose a number of solutions to reduce taxes, fees and charges for 2024.

For example: Continue to consider reducing VAT by 2% and consider reducing environmental protection tax on gasoline and oil as applied in 2023; continue to review and reduce export tax and import tax rates to support domestic production and business; reduce the collection of some fees and charges.

Source

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

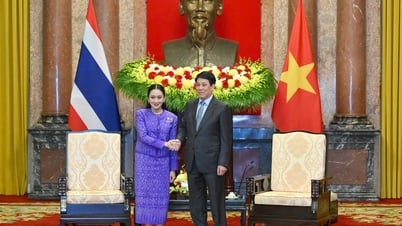

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)