Talking to Nguoi Dua Tin (NDT), Mr. Pham Anh Tuan - Director of the Payment Department of the State Bank of Vietnam (SBV) shared about the remarkable results of the banking industry, and mentioned important policy orientations to promote the digital transformation process in the future.

Completed cross-border payment system connection

Investor: Please sir Tell us about some of the digital transformation achievements of the banking industry since implementing Decision 810/QD-NHNN on the Digital Transformation Plan for the Banking Industry to 2025, with a vision to 2030?

Mr. Pham Anh Tuan: After 3 years of implementing Decision 810, the digital transformation activities of the banking industry have achieved encouraging results, contributing to the overall development of the economy .

Regarding the legal framework, The State Bank continues to research, review, amend, supplement, and promulgate regulations to promote digital banking transformation activities such as developing and advising the Government to submit to the National Assembly the Law on Credit Institutions 2024. At the same time, actively coordinate with ministries and branches in developing the Law on Electronic Transactions and the Law on Identification.

Submit to the Government for promulgation the Decree on Non-Cash Payment, the Decree on Controlled Testing Mechanism in the Banking Sector and participate in commenting on the development of the Decree on Personal Data Protection, the Decree on Electronic Identification and Authentication.

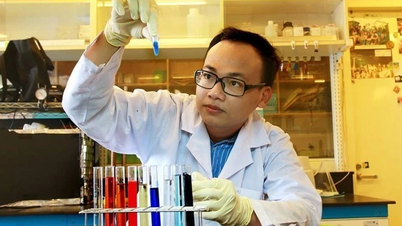

Mr. Pham Anh Tuan - Director of Payment Department of State Bank.

Regarding infrastructure serving digital transformation, the banking industry has always focused on investment, upgrading and development. The inter-bank electronic payment system operates stably and safely, processing an average of more than VND 830,000 billion in domestic currency payment transactions per day.

The financial switching and electronic clearing system is capable of processing instant payment transactions, operating continuously 24/7 throughout the year, processing an average of 20-25 million transactions/day. Up to now, the entire market has more than 21,000 ATMs and 671,000 POS; the payment acceptance network (POS/QR Code) covers most localities nationwide.

Currently, Vietnam has completed connecting the cross-border payment system via QR Code with Thailand, Cambodia, Laos and is continuing to deploy with Korea and Japan, allowing customers to pay for goods and services abroad via QR code right on the mobile application of Vietnamese banks and vice versa.

The national credit information infrastructure has been upgraded to increase the ability to process and update data automatically, while expanding the collection and updating of data inside and outside the industry with a successful data update rate from credit institutions reaching a high level of over 98%, credit information coverage on the total adult population has always been improved, bringing the total number of customers in the credit information database to nearly 55 million customers.

Many credit institutions in Vietnam have over 90% of transactions conducted on digital channels.

About banking products and services, Many basic operations have been 100% digitized. Many credit institutions in Vietnam have over 90% of transactions conducted on digital channels.

Credit institutions focusing on digital transformation of traditional business activities along with having more interactive channels have brought new, convenient and completely different products and services compared to before such as: developing deposit/withdrawal features on automatic transaction machines; depositing and withdrawing cash using chip-embedded citizen identification cards; online disbursement for small and medium enterprises...

April 24, 2023, The State Bank of Vietnam has coordinated with the Ministry of Public Security to sign Plan No. 01 on implementing the tasks in Project 06. Since then, the banking industry has been very active and made efforts to implement the tasks set out in Plan 01, especially those related to connecting and exploiting the national database on population to clean customer data and the business activities of the banking industry.

Applying chip-embedded CCCD cards and applying electronic identification and authentication accounts (VNeID) to verify customers when providing services, thereby contributing to enhancing security and safety in the process of popularizing digital payments.

With the view that population data, identification, identification and electronic authentication are the foundation, "original" data serving user identity verification and developing multiple digital utilities for people and businesses, the State Bank has continuously directed credit institutions, foreign bank branches, and payment intermediaries to research and apply data on population, chip-embedded citizen identification, identification accounts and electronic authentication (VNeID) to clean data, identify and accurately verify customers.

Population data, identity, identification and electronic authentication are the foundation, "original" data serving to verify user identity.

In addition, it prevents and stops criminals from impersonating and using fake identity documents to register for banking services for illegal purposes.

At the same time, research the application of population data in deploying the most convenient and safe banking products and services to people and customers.

Ensuring security and safety is always a priority. The State Bank also regularly coordinates closely with ministries, branches and agencies to deploy measures to ensure security and safety of banking activities, strengthen communication and financial education through many activities and diverse approaches to prevent and minimize the use of payment services for illegal activities, helping people and businesses to exploit the maximum potential and benefits of digital payments.

To date, more than 87% of Vietnamese adults have payment accounts at credit institutions, with the annual growth rate of mobile payments reaching over 90% in the past 6 years. In the first 7 months of 2024, non-cash payment transactions reached 9.31 billion transactions with a value of VND 160 million billion (up 58.44% in quantity and 35.13% in value) over the same period last year.

3 big challenges

Investor : The digital transformation of the banking industry has been going on for many years. Can you tell us about the challenges that have arisen in the digital transformation process of the banking industry in Vietnam?

Mr. Pham Anh Tuan: In the context of the 4.0 industrial revolution, digital transformation has opened up many opportunities for all industries and fields, but it also comes with significant challenges. Digital transformation in Vietnam in the banking sector has been facing some major challenges.

Firstly, That is the challenge of synchronization and conformity of current legal regulations related to electronic transactions, electronic signatures, electronic identification and authentication, data sharing connection mechanism with personal data protection... with the practical application of digital technology in banking activities.

Digital banking transformation faces challenges in the face of rising high-tech crime trends.

Second, the challenge of synchronizing and standardizing technical infrastructure to facilitate seamless connectivity and integration between the banking industry and other industries and fields to form a digital ecosystem, providing multi-utility services to customers.

Third, the challenge of facing the increasing trend of high-tech crime along with ensuring security, safety, data confidentiality and customers using digital banking products and services conveniently and safely.

Investor: Can you share about the State Bank's plans and policies on managing and promoting digital transformation of banks in the coming time?

Mr. Pham Anh Tuan : Digital transformation of the banking industry has achieved encouraging results but there are still many challenges ahead. Promoting the achieved results, it is expected that in the coming time, the State Bank will prioritize focusing on a number of work contents.

Firstly , review and evaluate the results and continue to direct and guide credit institutions and payment intermediaries to promote the implementation of tasks in the Digital Transformation Plan for the banking industry to 2025, with a vision to 2030, to soon achieve the goals set for the entire industry.

Second, focus on perfecting institutions, closely coordinating with relevant ministries and branches to accelerate the review, amendment and promulgation of legal documents to promote digital transformation in the banking sector.

This includes completing and proposing the Government to issue a Decree on a controlled testing mechanism in the banking sector to facilitate the application of technology and data solutions in banking activities.

Third, continue to closely coordinate with the Ministry of Public Security to effectively implement Project 06 of the Prime Minister.

Fourth, promote upgrading and developing technology infrastructure, ensuring safety and security, and information confidentiality during the process of digital banking transformation.

Fifth, increase resources for digital transformation, promote the application of innovative technology to provide a variety of convenient products and services at reasonable costs for people and businesses.

Sixth, continue to promote communication and financial education for people and businesses to use banking services on digital channels safely and effectively.

Investor : Thank you for sharing!

Source: https://www.nguoiduatin.vn/buoc-chuyen-minh-nhanh-chong-cua-nganh-ngan-hang-viet-nam-204241009105829275.htm

![[Photo] Closing of the 1st Congress of Party Delegates of Central Party Agencies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/24/b419f67738854f85bad6dbefa40f3040)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh received the working delegation of Pasaxon Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/23/da79369d8d2849318c3fe8e792f4ce16)

![[Photo] Solemn opening of the 1st Congress of Party Delegates of Central Party Agencies](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/24/82a89e250d4d43cbb6fcb312f21c5dd4)

Comment (0)