The virtual assistant integrates data from more than 100 specialized laws and has answered more than 30,000 taxpayers' questions in about 1 month; integrates tools and tables, making it easy to declare taxes, and can also support tax payments.

Urgent application of AI

Speaking at the conference "Summary of tax work in 2024, deployment of tasks in 2025" on December 19 in Hanoi, Minister of Finance Nguyen Van Thang affirmed: "Application of information technology, digital transformation, application of AI (artificial intelligence) is extremely important and urgent content of the tax industry today".

According to the Minister, the rapid changes and development of science and technology have created many modern forms of business. However, there are also many risks of fraud, and detection and combating them are increasingly difficult.

For example, human resources are limited, making it difficult to control invoice fraud by sitting and checking each invoice as before. Using AI will quickly identify and warn of fraudulent invoices, even invoices issued at night.

“Without technology and AI application, it will be very difficult to prevent tax fraud and complete tax management tasks,” said the Minister.

Director General of the General Department of Taxation Mai Xuan Thang said that the Tax sector will comprehensively apply digital transformation and AI to shorten procedures, simplify and improve taxpayer experience at the lowest cost and highest efficiency.

Great benefits for people, businesses and the tax industry

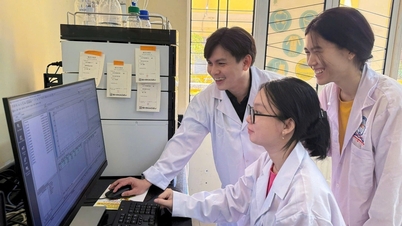

After 8 months of research, the Virtual Assistant application to support taxpayers (a subsystem in the overall AI application project) was officially launched at the Hanoi Tax Department on November 21.

Mr. Vu Manh Cuong, Deputy Director General of the General Department of Taxation, Director of the Hanoi Tax Department, said: From synthesizing and re-analyzing the entire database of regulations and legal policies including more than 100 specialized laws and guiding documents, integrating with the set of administrative procedures (TTHC) including 26 TTHC at the General Department level, 186 TTHC at the department level and 150 TTHC at the tax branch level, the Hanoi Tax Department has edited and rebuilt more than 15,000 contents for the Virtual Assistant.

“The virtual assistant can quickly answer questions about administrative procedures and policies; integrate tables, tools, and declarations, helping taxpayers easily look up, declare taxes, and even support tax payments. As of December 16, 2024, after about 1 month of implementation, the application has successfully answered more than 30,000 questions,” Mr. Cuong emphasized the benefits it brings to people and businesses.

According to Deputy General Director Vu Manh Cuong, the tax sector has been focusing on building a large database, currently having a data warehouse of more than 80 million taxpayers who are enterprises, organizations, individual households, and business individuals with the obligation to pay the state budget (about 100 billion records, capacity of more than 530 TB).

According to the plan, in 2025, the Virtual Assistant model will be deployed by the Tax sector nationwide. The automatic management feature in the Virtual Assistant will help tax authorities assess taxpayers' areas of interest, promptly identify difficulties and problems to provide timely support.

In addition, the tax authority will connect GPS positioning data of the Vietnam Road Administration to determine the routes of cargo trucks and determine the volume of goods corresponding to the refunded tax amount.

On the other hand, the Tax sector will step up coordination and information exchange with the State Bank, Social Insurance and relevant agencies to continue collecting data on cash flow, bank accounts, insurance, etc., combining these specialized databases with declaration data, electronic invoice data, financial reports, reviewing revenue, cash flow, and taxes paid to monitor and evaluate the "health" of businesses, serving to prevent illegal invoices.

Source: https://vietnamnet.vn/bo-truong-tai-chinh-nganh-thue-cap-thiet-ung-dung-ai-de-chong-gian-lan-2354232.html

![[Photo] Flooding on the right side of the gate, entrance to Hue Citadel](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761660788143_ndo_br_gen-h-z7165069467254-74c71c36d0cb396744b678cec80552f0-2-jpg.webp)

![[Photo] Draft documents of the 14th Party Congress reach people at the Commune Cultural Post Offices](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761642182616_du-thao-tai-tinh-hung-yen-4070-5235-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man received a delegation of the Social Democratic Party of Germany](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761652150406_ndo_br_cover-3345-jpg.webp)

![[Photo] President Luong Cuong attends the 80th Anniversary of the Traditional Day of the Armed Forces of Military Region 3](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761635584312_ndo_br_1-jpg.webp)

Comment (0)