Continue to pay principal and interest of bonds with other assets

According to the Ministry of Finance , after the incident of Saigon Joint Stock Commercial Bank (SCB) and Van Thinh Phat Group, the corporate bond market has fluctuated strongly. Investors have lost confidence and asked businesses to buy back bonds before maturity, and businesses have encountered difficulties in issuing new bonds...

From March 5 to November 3, 68 enterprises issued private bonds with a volume of 189,700 billion VND.

Faced with that situation, the Government issued Decree No. 08/2023/ND-CP amending, supplementing and suspending the implementation of a number of articles in the decrees regulating the offering and trading of individual corporate bonds in the domestic market and the offering of corporate bonds to the international market (Decree 08).

Decree 08 has postponed a number of provisions in Decree 65/2022/ND-CP amending and supplementing a number of articles of Decree 153/2020/ND-CP regulating the offering and trading of individual corporate bonds in the domestic market and the offering of corporate bonds to the international market (Decree 65) until December 31.

This is to balance the legitimate interests of the issuing enterprise and investors buying bonds in the spirit of "harmonizing interests and sharing difficulties"; supporting bond-issuing enterprises to raise capital, pay due debt obligations to investors and continue production and business activities.

Decree 08 stipulates that enterprises can negotiate with bondholders to pay principal and interest on maturing bonds with other assets; bonds issued before Decree 65 took effect can be negotiated to extend the maximum term to no more than 2 years; suspend the enforcement until December 31 for 3 contents of Decree 65 on determining professional securities investors as individuals buying individual corporate bonds, mandatory credit rating and reducing the time for distributing bonds.

At the meeting of the Ministry of Finance to assess the implementation of Decree 08 held on the afternoon of November 28, Mr. Nguyen Hoang Duong, Deputy Director of the Department of Finance of Banks and Financial Institutions (Ministry of Finance), said that since the second quarter, the corporate bond market has gradually stabilized.

Discussing the provisions of Decree 08 on payment of principal and interest of bonds with other assets and the bonds issued before Decree 65 took effect were negotiated to extend the maximum term to no more than 2 years, representatives of the Finance Department of banks and financial institutions said that according to the provisions of Decree 08, these policies will continue to be implemented in the coming time.

Proposal not to extend the suspension period of 3 contents

Notably, with some other contents stipulated in Decree 65, the Ministry of Finance proposed that it is not necessary to extend the suspension period.

Specifically, with the proposal to unnecessarily extend the suspension of the implementation of the regulation defining professional securities investors as individuals who purchase individual corporate bonds, the ministry explained that Decree 65 stipulates that professional securities investors are individuals who must ensure that their portfolio holdings have an average value of at least VND 2 billion within 180 days using the investor's assets, excluding loans.

To maintain the demand for corporate bond purchases by individual investors with financial potential but who have not accumulated enough time for 180 days as prescribed in Decree 65 and to give the market more time to adjust, Decree 08 stipulates the suspension of the above provisions in Decree 65 until December 31.

Up to now, after more than 8 months of implementing Decree 08, professional securities investors who are individuals have accumulated enough time of 180 days to meet the regulations on professional securities investors in Decree 65, so there is no need to extend the suspension of the implementation of this regulation.

In addition to the above content, the Ministry of Finance proposed not to extend the suspension of mandatory credit rating regulations for individual corporate bonds.

The Ministry also believes that it is not necessary to extend the suspension of the regulation on reducing the time for bond distribution.

Decree 65 stipulates that the bond distribution period for each offering shall not exceed 30 days (previously stipulated in Decree 153 as 90 days, similar to public offering of corporate bonds). The purpose of this regulation is to limit enterprises from taking advantage of the long bond distribution period to invite small individual investors who are not professional securities investors to buy bonds.

To help businesses balance and mobilize resources to pay off debt obligations due, Decree 08 stipulates the suspension of implementing regulations on reducing bond distribution time until December 31.

"Up to now, market liquidity has stabilized. To limit risks to the corporate bond market and limit the situation where businesses take advantage of distribution and invite small individual investors who are not professional securities investors to buy bonds, it is not necessary to extend the suspension of this regulation," the Ministry of Finance explained.

According to Deputy Minister of Finance Nguyen Duc Chi, to continue stabilizing and developing the corporate bond market, the Ministry of Finance has reported to the Government leaders a series of overall solutions.

Regarding medium and long-term solutions on mechanisms and policies, the Ministry of Finance has reported for a comprehensive review, researched and reported to competent authorities to amend regulations on the issuance of individual corporate bonds and related persons (in the Securities Law, Enterprise Law and related laws). If necessary, it is recommended that competent authorities issue laws amending and supplementing a number of laws to promptly handle legal problems in the corporate bond market...

Since Decree 08 took effect (March 5 - PV) to November 3, according to the monitoring data of the Hanoi Stock Exchange, there were 68 enterprises issuing private bonds with a volume of 189,700 billion VND. The outstanding debt of individual corporate bonds at the end of October was about 1 million billion VND, accounting for 10.5% of GDP in 2022, equal to 8% of the total outstanding credit of the economy .

Source link

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

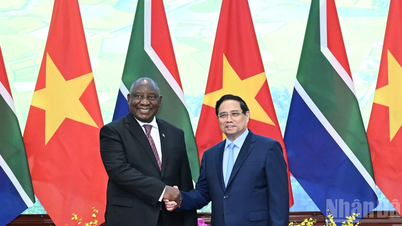

![[Photo] Prime Minister Pham Minh Chinh meets with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761226081024_dsc-9845-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

Comment (0)