On November 29, 2023, the National Assembly passed a Resolution on the application of additional corporate income tax under the provisions against global tax base erosion. This Resolution takes effect from January 1, 2024.

On that basis, on November 30, 2023, the Ministry of Finance issued a number of notable points in the Resolution on applying additional corporate income tax according to regulations against global tax base erosion.

Specifically, the minimum tax rate prescribed in the Resolution is 15%. The taxpayer is a constituent unit of a multinational corporation with revenue in the consolidated financial statements of the ultimate parent company for at least 2 years in the 4 consecutive years preceding the fiscal year equivalent to 750 million Euro (EUR) or more, except for some cases as prescribed.

The Resolution stipulates two contents on the application of additional corporate income tax. In particular, the regulation on additional minimum domestic standards applies to the constituent units or groups of constituent units of the above-mentioned multinational corporations, which have production and business activities in Vietnam during the fiscal year.

Along with that, the regulation on aggregate minimum taxable income (IIR) applies to the ultimate parent company, partially owned parent company, intermediate parent company in Vietnam which is a constituent unit of the above-mentioned multinational corporation, directly or indirectly holding ownership of a low-tax constituent unit abroad according to the Global Minimum Tax Regulation at any time during the fiscal year.

According to the Resolution, taxpayers must declare information declarations according to the Global Minimum Tax Regulations, supplementary corporate income tax declarations with an explanatory note explaining the differences due to differences between financial accounting standards.

Vietnam will collect an additional VND14,600 billion each year when applying the global minimum tax.

Regarding the deadline for submitting the Declaration and paying tax, for the regulation on the standard domestic minimum supplementary corporate income tax (QDMTT), it is 12 months after the end of the fiscal year.

For the provisions on minimum aggregate taxable income (IIR), it is 18 months after the end of the financial year for the first year the group is subject to the application; and 15 months after the end of the financial year for subsequent years.

According to the 2022 corporate income tax settlement data, the General Department of Taxation (Ministry of Finance) preliminarily calculated that about 122 foreign corporations investing in Vietnam are affected by the Regulation on supplementing the minimum domestic standard (QDMTT) and the estimated additional tax collected is about 14,600 billion VND.

Also according to preliminary calculations, based on 2022 corporate income tax settlement data, if Vietnam applies the minimum taxable income (IIR) regulation, there will be 6 Vietnamese corporations subject to the application and the additional corporate income tax that Vietnam can collect is expected to be about 73 billion VND (in case the investment recipient countries do not apply IIR).

Currently, the Ministry of Finance (General Department of Taxation) is urgently developing a Decree detailing the contents assigned in the Resolution to ensure full legal basis, consistency, and consistency with the provisions of the Resolution for implementation.

According to the Ministry of Finance, the global minimum tax is not an international treaty, not an international commitment, and does not require countries to apply it. However, if Vietnam does not apply it, it must still accept that other countries apply the global minimum tax, and have the right to collect additional taxes on enterprises in Vietnam (if applicable) that enjoy an actual tax rate in Vietnam lower than the global minimum rate of 15%, especially enterprises with foreign investment.

In the above context, to ensure legitimate rights and interests, Vietnam needs to affirm the application of global minimum tax. According to the guidance of the Organization for Economic Cooperation and Development (OECD) on regulations against global tax base erosion, global minimum tax is essentially an additional corporate income tax and countries need to regulate it in their legal systems accordingly .

Source

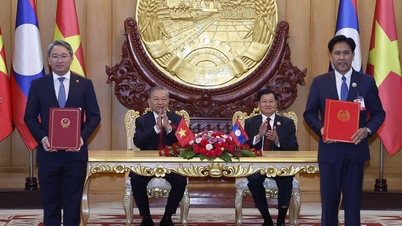

![[Photo] Prime Minister Pham Minh Chinh receives President of Cuba's Latin American News Agency](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F01%2F1764569497815_dsc-2890-jpg.webp&w=3840&q=75)

Comment (0)