At the meeting of the National Financial and Monetary Policy Advisory Council on the afternoon of March 28, chaired by Deputy Prime Minister Le Minh Khai, experts proposed removing the state monopoly on SJC gold bars and granting licenses to produce gold bars to a number of qualified enterprises.

Stabilize the market, reduce price differences

Speaking with Thanh Nien before the proposal to remove the monopoly on SJC gold bars, Mr. Huynh Trung Khanh, Vice President of the Vietnam Gold Business Association, acknowledged that if the monopoly on SJC gold bars is removed immediately, it will have certain impacts on the Vietnamese gold market.

Abolishing the monopoly of SJC gold bars, gold price may immediately decrease by several million VND per tael

"If there are more products and a more diversified market, the price of SJC gold will certainly decrease. Although it is still higher than the world price, the difference is at a moderate rate. Consumers will benefit and the market will be more stable," said Mr. Khanh.

Sharing the same view, gold expert Nguyen The Hung analyzed that the world gold market is still in an upward price cycle. If the State monopoly mechanism on gold bar production is not eliminated, it will be difficult to stabilize the market. "There is no need to allow imports, just eliminate the monopoly, the gold price will immediately drop by several million VND per tael," Mr. Hung said.

According to Mr. Khanh, removing the monopoly on gold bars is a prerequisite for allowing the import of raw gold in the future. For example, allowing PNJ and DOJI to produce gold bars to compete with SJC, these two businesses must also be allowed to import raw gold. Conversely, allowing PNJ and DOJI to import, SJC must also be allowed to import raw gold for further production.

Control gold imports by quota?

Mr. Khanh analyzed that the current domestic gold price is higher than the world gold price mainly due to lack of supply and psychology. People do not sell much after buying. The key issue is how to create supply.

"In addition to removing the SJC gold monopoly, if there is a change in the policy of importing raw gold, businesses will produce more, investors may also sell more gold bars... All of these factors will reduce the difference between Vietnam's gold price and the world gold price. The reduction depends on the supply to the market," Mr. Khanh shared his perspective and affirmed that the State Bank can also control the market, not "open it wide".

It is forecasted that from now until the end of the year, domestic gold prices will continue to increase following the trend of world gold prices.

He pointed out that the production of gold bars is controlled by production quotas, and the import of raw materials is also controlled by import quotas. For example, a business is allowed to stamp a certain number of gold bars a year, and is not allowed to freely import as much as it wants. When controlled like this, issues related to exchange rates and foreign exchange can also be controlled.

"The Vietnam Gold Business Association has proposed that, initially, 3 businesses (PNJ, SJC, DOJI) be allowed to import 1.5 tons of gold/year (each business imports 500 kg of gold/year). Businesses also only request to import within a controlled scope," Mr. Khanh informed.

Regarding the proposal to abolish the monopoly on SJC gold and move towards abolishing the monopoly on importing raw gold, some economic experts believe that when the monopoly on SJC gold is abolished, the price gap will decrease and businesses will no longer have many opportunities to make profits.

At this time, businesses that want to import must also calculate. Although gold is a special commodity, it still has to comply with market principles, from production to business and trading. Therefore, allowing gold imports under the management and supervision of the management agency will control foreign currency.

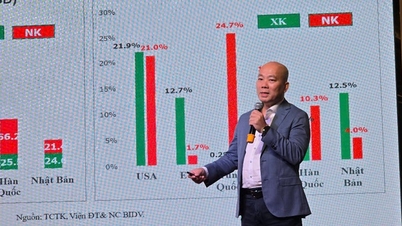

Speaking with Thanh Nien , Mr. Shaokai Fan, Director of Asia-Pacific region (excluding China) and Director of Global Central Bank at the World Gold Council, assessed that the recent policy of restricting gold imports is the main reason for the large difference in domestic gold prices with world gold prices.

Many experts and businesses now hope that the gold market will be more liberalized in the future. Any new regulations allowing gold imports will help reduce the gap between domestic and international gold prices, ensuring the interests of investors.

"Of course, gold imports will have a certain impact on the macro economy, but Vietnam's foreign exchange reserve position is much better than before. Most importantly, as we can see, even though Vietnam is strictly managing official gold imports, domestic gold demand is still very strong and is still being met by gold sources from somewhere, if not from official sources then it will be unofficial sources. Therefore, amending Decree 24 on gold trading management appropriately will help the Government manage official gold sources," said Mr. Shaokai Fan.

While waiting for the next specific moves in amending Decree 24, Mr. Khanh predicts that in the coming time, domestic gold prices will continue to increase following the developments in world gold prices.

By the end of the year, the world gold price may increase to 2,400 - 2,500 USD/ounce. At that time, the domestic gold bar price may increase to 85 - 87 million VND/tael and gold ring price may increase to 74 million VND/tael.

On the morning of March 30, the price of gold rings, after suddenly skyrocketing by a million VND per tael the day before, continued to stay high, despite the plummeting price of gold bars.

Specifically, SJC bought 4-number-9 gold rings for 69.2 million VND and sold for 70.4 million VND, down 50,000 VND compared to yesterday. PNJ kept the buying price unchanged at 69.3 million VND and selling price at 70.4 million VND...

Meanwhile, gold bars turned down by nearly a million VND per tael after 1 day. SJC bought 78.7 million VND and sold 81 million VND, down 800,000 VND in buying and 500,000 VND in selling. This development pushed the difference in buying and selling prices of SJC gold bars to 2.3 million VND/tael instead of only 2 million VND/tael as in previous days.

World gold price fluctuated around 2,234 USD/ounce.

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)