| Announcement regarding the acceptance of applications for exemption from trade safeguard measures in September 2023. The Ministry of Industry and Trade publishes a list of products at risk of being investigated for trade safeguard measures. |

The Ministry of Industry and Trade is drafting a Circular amending and supplementing several articles of Circular No. 37/2019/TT-BCT dated November 29, 2019, issued by the Minister of Industry and Trade, which details certain aspects of trade defense measures.

|

| Photo: VNA |

According to the Ministry of Industry and Trade, after nearly four years of implementing Circular 37/2019/TT-BCT, this legal document provides the Trade Remedies Department and the Ministry of Industry and Trade with a clear legal basis for handling applications and making timely, reasonable, and legally sound decisions on exemptions from trade defense measures, ensuring the effectiveness of these measures in practice.

However, during the review process aimed at improving the legal system for trade defense in general and Circular 37/2019/TT-BCT in particular, some issues need to be amended in the regulations on deciding exemptions from the application of trade defense measures in Circular 37/2019/TT-BCT to suit practical requirements.

Specifically:

Regarding the scope of exemptions from trade safeguard measures: According to Article 10 of Circular 37/2019/TT-BCT, the Ministry of Industry and Trade considers exemptions from trade safeguard measures in six cases, including the case of: "Similar goods or directly competing goods produced domestically that do not meet the domestic consumption needs."

In fact, according to the Ministry of Industry and Trade, some businesses have cited this regulation to submit applications for exemption. Meanwhile, in most cases of investigation and application of trade defense measures, domestic production cannot meet 100% of domestic demand. This shortfall can still be compensated from imports not subject to trade defense measures. However, if exemptions are refused, businesses applying for exemptions may raise concerns. Therefore, the regulation allowing consideration of exemptions in cases where similar or directly competing goods produced domestically do not meet domestic consumption needs should be removed.

Regarding the components of the application for exemption from trade safeguard measures: The components of the exemption application are stipulated in Article 14 of Circular 37/2019/TT-BCT. This serves as the basis for the investigating authority to assess, calculate, and determine the quantity of imported goods eligible for exemption based on the production capacity and material usage norms provided by the enterprise, using a unified method.

In practice, for the investigating authority to accurately assess and verify the quantity of exempted imports according to its needs, it requires additional information such as inventory reports, land lease contracts, factory lease contracts, and tax reports. This information is not specifically listed in the application dossier. These specific dossier components are practical requirements that have been observed during inspections and audits of businesses after exemption, serving as the basis for conclusions. Therefore, the dossier components for requesting exemption from trade safeguard measures need to be more detailed so that businesses can easily comply.

Furthermore, Circular 37/2019/TT-BCT currently stipulates the components of the application dossier for exemption from trade protection measures in a way that lacks specificity and clarity, preventing individuals and organizations requesting exemption from fully understanding their obligations to provide all necessary documents and information. In practice, the submission of exemption applications often results in incomplete dossiers due to misunderstandings regarding the required documents. The proposed amendment aims to clarify and detail the required documents, including mandatory and readily available documents related to the business's production and business activities and the exemption procedure, thus saving businesses time and avoiding unnecessary administrative procedures.

Regarding post-exemption inspections : Post-exemption inspections need to be carried out regularly and rigorously. Experience in inspection and auditing in most advanced countries shows that post-exemption inspections maximize compliance with the law, increase strictness, and eliminate fraudulent behavior by inspected entities. The declarations made by entities seeking exemptions serve as a basis for assessing compliance with the law, verifying the integrity of the entity, and providing grounds for the inspection agency to conduct post-exemption inspections. Regulations stipulate that the investigating agency, during the inspection process, has the authority to evaluate and calculate the actual consumption rates of materials and the percentage of material loss in production and processing, as well as measures for handling scrap, waste, defective products, and surplus raw materials, auxiliary materials, and supplies after production and processing.

Regarding post-exemption inspection procedures and penalties for violations : Practical experience in post-exemption inspections over the past period has shown that many businesses do not fully comply with the obligations stipulated in Circular 37/2019/TT-BCT. However, the post-exemption inspection procedures and penalties for violations under this Circular are not specific enough and lack sufficient educational and deterrent effect. Therefore, it is necessary to supplement corresponding penalties for non-compliance/incomplete compliance with the stipulated obligations. These penalties could include: revoking the exemption decision, not considering further exemption for a specific period or until the applied trade protection measure is terminated, and requiring the customs authority to collect taxes on part/all of the goods that were exempted.

Regarding the duration of exemptions from trade safeguard measures , the Ministry of Industry and Trade clarifies that the current regulations on exemption duration in Circular 37/2019/TT-BCT may cause misunderstandings in some cases due to the wording.

The Ministry of Industry and Trade annually reviews the exemption period for applications requesting exemption from trade safeguard measures to effectively monitor the overall effectiveness of these measures. The principle and purpose of trade safeguard measures is to protect and encourage the development of domestic industries and reduce dependence on imported goods. Exemptions from trade safeguard measures are valid for 12 months, with no limit on the number of additional exemption requests, while the total exemption period remains unchanged.

This raises the need to clarify the regulations on the exemption period, in which a unified maximum period for one (1) exemption granted based on the enterprise's exemption application file and no limit on the number of additional exemptions granted to ensure the legitimate rights and interests of enterprises as well as to ensure the effectiveness of trade defense measures in practice.

In addition to the aforementioned amendments and additions, the Circular amending and supplementing Circular 37/2019/TT-BCT also adjusts and supplements some terminology to standardize the way regulations are made regarding a common issue or subject within a single clause, without changing the nature or creating corresponding rights and obligations.

The Ministry of Industry and Trade stated that the purpose of drafting the Circular amending and supplementing Circular 37/2019/TT-BCT is to ensure the implementation of the regulations in Decree 10 and to address the shortcomings and limitations of the current regulations. It inherits the relevant, advanced, and effectively applied provisions of Circular 37/2019/TT-BCT, ensuring that it meets the practical requirements of exemptions from trade defense measures and overcomes difficulties and obstacles in the implementation of Circular 37/2019/TT-BCT. It aims to create a comprehensive, rational, and feasible legal framework to ensure that exemptions from trade defense measures are carried out legally, effectively, and with quality, contributing effectively to the fight against and handling of violations of trade defense laws in the current context.

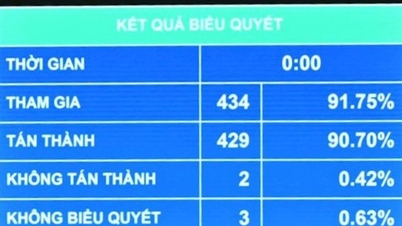

| To date, the Ministry of Industry and Trade has conducted investigations into a total of 25 trade defense cases, of which trade defense measures have been applied in 23 cases (including 14 anti-dumping cases, 1 anti-subsidy case, 6 safeguard cases, and 2 anti-circumvention cases). Between 2016 and 2023, regarding the granting of exemptions from trade defense measures, the Ministry of Industry and Trade issued a total of 318 exemption decisions and 50 decisions supplementing exemptions for importing enterprises related to 10 trade defense cases. |

The draft Circular amending and supplementing a number of articles of Circular No. 37/2019/TT-BCT can be viewed here.

Source link

![[Photo] Explore the US Navy's USS Robert Smalls warship](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F10%2F1765341533272_11212121-8303-jpg.webp&w=3840&q=75)

![[Video] The craft of making Dong Ho folk paintings has been inscribed by UNESCO on the List of Crafts in Need of Urgent Safeguarding.](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765350246533_tranh-dong-ho-734-jpg.webp)

Comment (0)