Receiving the award for Best SME Bank in Vietnam for the 7th consecutive time is an affirmation of BIDV 's efforts in the journey of cooperation and development with the small and medium-sized customer community.

BIDV representative received the award "Best SME Bank in Vietnam" for the 7th consecutive time. (Photo: Vietnam+)

On July 4, 2024, in Singapore, Asian Banking and Finance (ABF) Magazine honored the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) with the award "SME Bank of the Year Vietnam - Best SME Bank in Vietnam".

Receiving this prestigious award for the 7th consecutive time is an affirmation of BIDV's efforts and outstanding results in the journey of cooperation and development with the small and medium-sized customer community in Vietnam.

Sharing at the award ceremony, Ms. Pham Thi Van Khanh - Director of BIDV Corporate Customer Department said: "BIDV identifies small and medium enterprises as an important customer segment in the bank's business strategy and prioritizes support resources, creating the most favorable conditions for small and medium-sized customers to develop..."

BIDV proposes to issue a total of more than 1.36 billion new shares to increase its charter capital from more than VND57,004 billion to over VND70,624 billion through two options.

With appropriate policies and great efforts, BIDV's SME banking activities have recently achieved outstanding results such as: Continuing to maintain the position of No. 1 SME Bank in Vietnam, leading the market in terms of customer base and outstanding SME loans...

To achieve that result, BIDV has actively accompanied the development of small and medium enterprises by continuing to fulfill its commitment to the business community. Since the beginning of 2024, BIDV has actively implemented credit packages with a total scale of nearly 500,000 billion VND with a competitive interest rate policy (reduction of up to 2%/year) to support businesses to develop and expand production and business activities.

Previously, BIDV was also the first bank in the market to provide comprehensive financial solutions in the field of supply chain financing, promptly meeting the needs of businesses in the fields of: animal feed, food, construction materials, telecommunications, chemicals, automobiles/electronics, pharmaceuticals, etc.

BIDV is currently a strategic partner of the Enterprise Development Agency ( Ministry of Planning and Investment ), the Vietnam Association of Small and Medium Enterprises, the Vietnam Federation of Commerce and Industry, the Vietnam Women Entrepreneurs Council... BIDV also actively participates in activities of international organizations for women-owned small and medium enterprises of the Economic and Social Commission for Asia and the Pacific (UN ESCAP), Facebook's SheMeansBusiness, ITC's SheTrades, the LinkSME project funded by USAID...

BIDV has promoted the development of the digital banking ecosystem: BIDV constantly strives to develop the digital banking system, improving customer experience. In particular, it has deployed the SMEasy digital platform (https://smeasy.bidv.com.vn) to provide maximum support for customers with financial and non-financial solutions; deployed the Open API system to help integrate banking services into customers' applications, software, and digital platforms; developed the BIDV iBank e-banking application to provide a diverse online banking service ecosystem,...

BIDV is also a pioneer in deploying non-cash payment services to small and medium-sized customers, especially public administrative services. To date, BIDV has relationships with more than 40,000 administrative and career customers, including cooperation with more than 1,000 public health units, 11,570 schools and electricity and water service providers, more than 8,600 trade unions at all levels...

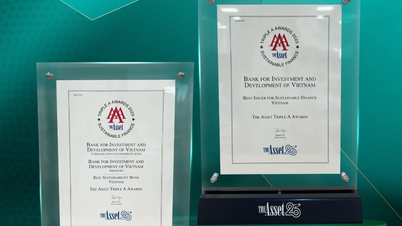

BIDV has long established the goal of “aiming towards sustainable development” throughout its banking operations, making green credit and green financing a priority in its development strategy. Currently, BIDV has issued 03 green financial frameworks including: Environmental and social risk management framework applied to loans from international capital sources; Sustainable loan framework; Green bond framework.

Thereby, BIDV established the basic foundations for credit granting, capital mobilization and risk management in sustainable finance activities at the bank. As of March 31, 2024, BIDV has financed nearly 1,700 customers with about 2,100 projects/plans in the green sector; outstanding green credit reached VND 73,400 billion, accounting for 11.5% of total outstanding green credit in the whole economy.

BIDV's outstanding achievements in SME banking have been recognized and honored by domestic and international organizations. In addition to the 7th consecutive "Best SME Bank in Vietnam" award from ABF, BIDV has also been awarded such awards as: Best SME Bank in Southeast Asia and Best Corporate Bank in Southeast Asia (Global Banking & Finance Review), "Best Bank Serving FDI Customers in Vietnam" (ABF), "Leading Digital Solution Bank in Vietnam" (Asiamoney), "Top 10 Sustainable Enterprises in the Trade - Services Sector"./.

Vietnam+

Source: https://www.vietnamplus.vn/bidv-lan-thu-7-duoc-vinh-danh-ngan-hang-sme-tot-nhat-viet-nam-post963091.vnp

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)