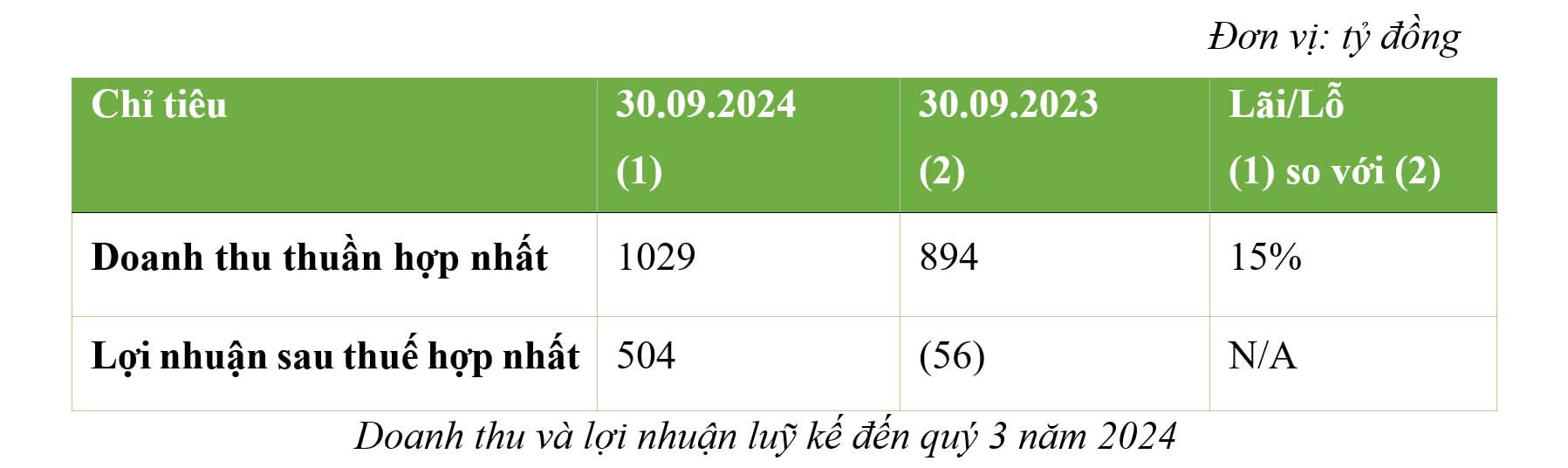

At the end of the first 9 months of the year, BCG Energy recorded consolidated net revenue of VND 1,029.5 billion, up 15% over the same period; consolidated profit after tax reached VND 504 billion, completing 98% of the yearly profit plan.

Positive financial indicators

In the first 9 months of the year, BCG Energy recorded consolidated net revenue of VND 1,029.5 billion and after-tax profit of VND 504 billion, impressive growth compared to the same period last year.

BCG Energy's operational solar power projects such as BCG Long An 1 (40.6 MW), BCG Long An 2 (100.5 MW), BCG Phu My (330 MW), BCG Vinh Long (49.3 MW) all achieved high efficiency. Revenue growth is mainly due to BCG Energy adding 114 MW of Phase 2 of Phu My Solar Power Plant, which will be commercially operated from June 2023.

In addition, about 75 MW of BCG Energy's operating rooftop solar power projects also achieved good performance, and rooftop solar power projects benefited from the electricity price adjustment of 4.8% in October 2024.

The company representative said that BCG Energy's profit grew strongly thanks to the efficiency in saving financial costs, especially the sharp decrease in interest expenses, and the business management costs were also optimized compared to the same period. With this result, BCG Energy has completed 98% of the 2024 profit plan.

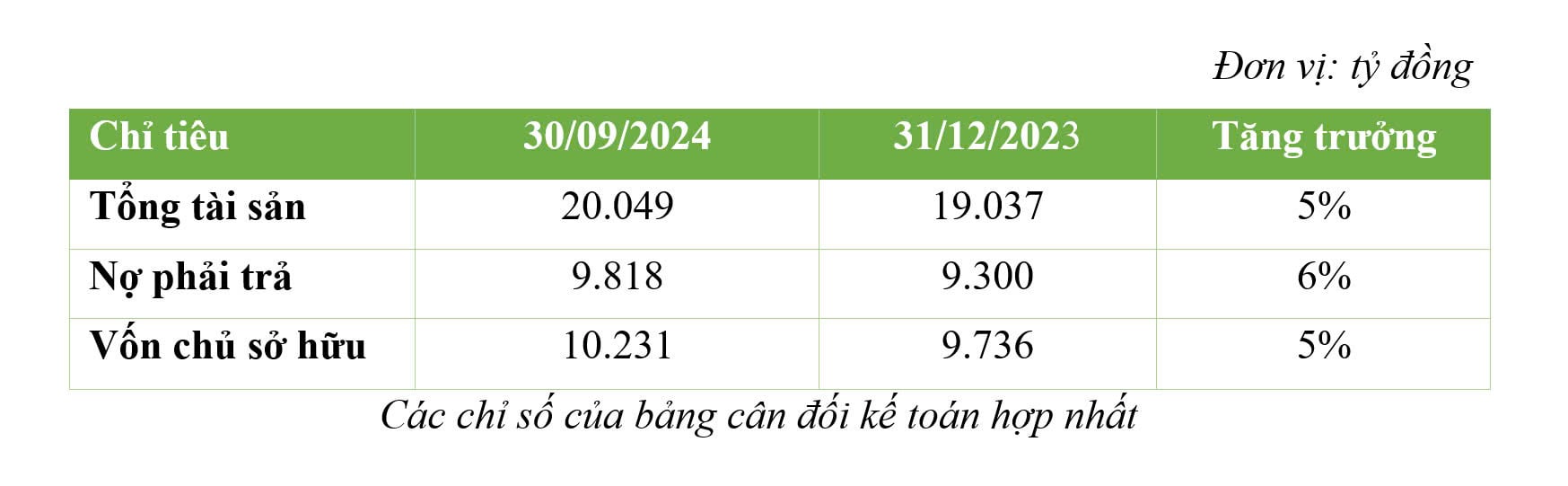

As of September 30, 2024, BCG Energy's total consolidated assets reached VND20,049 billion, up 5% compared to the beginning of the year. This increase was mainly due to new investments, most notably the investment in the Tam Sinh Nghia Waste-to-Energy Plant in Thai My Commune, Cu Chi District, Ho Chi Minh City.

The company's total liabilities also increased to VND9,818 billion, equivalent to a growth rate of 6%. This increase mainly came from liabilities related to the purchase of shares of Tam Sinh Nghia Investment and Development Joint Stock Company from old shareholders.

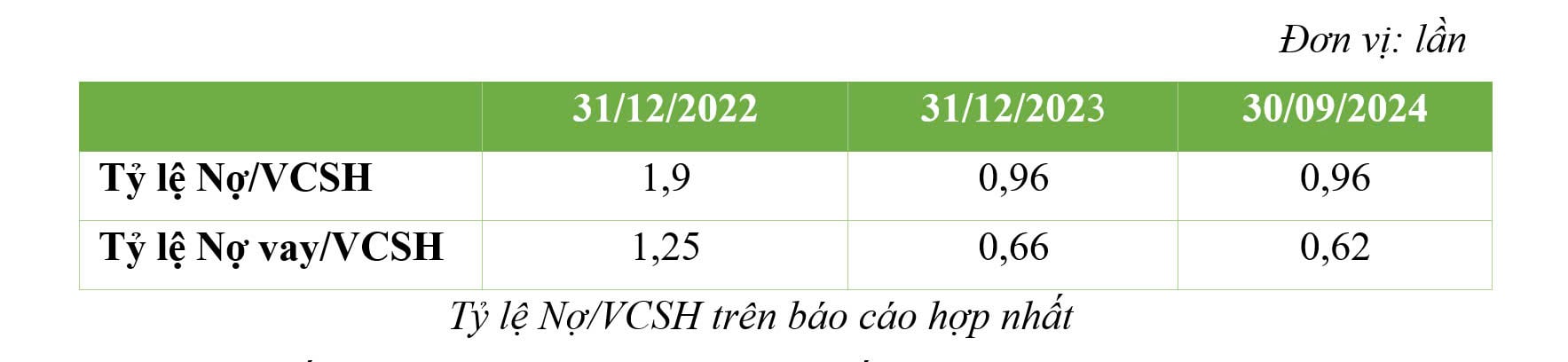

BCG Energy's debt-to-equity ratio continues to improve over the years, from 1.9x as of December 31, 2022 to 0.96x as of September 30, 2024. In addition, BCG Energy's debt-to-equity ratio also sharply decreased from 1.25x at the end of 2022 to 0.62x at the end of Q3/2024.

This improvement not only creates an advantage in financial capacity, but also helps the company minimize risks from the impact of the economy and the market. Strong financial capacity also enhances the ability to meet capital needs for M&A activities to expand the project portfolio.

Forecast to continue strong growth

BCG Energy is operating around 75 MW of rooftop solar and plans to deploy another 75 MW this year. BCG Energy’s solar customers are large enterprises. In the coming years, BCG Energy plans to develop an additional 150 MW of rooftop solar each year.

Currently, BCG Energy is installing new rooftop solar power projects at the Mobile World and Bach Hoa Xanh store systems, and is expected to complete installation for 115 stores in 2024. The rooftop solar power segment is expected to continue to grow strongly in the coming time after the Government issued the Direct Power Purchase Agreement (DPPA) and Decree 135 stipulating mechanisms and policies to encourage the development of self-produced and self-consumed rooftop solar power.

It is expected that in 2024, BCG Energy's net revenue will continue to grow positively thanks to the completion of the procedures to recognize the first commercial operation date of 21 MW (out of a total capacity of 49 MW) of the Krong Pa 2 solar power project in Gia Lai, along with contributions from rooftop solar power projects under construction. In addition, to increase the total power capacity, BCG Energy is implementing the M&A plan for solar power projects that have come into operation and enjoy FiT 2 price.

In the waste-to-energy sector, BCG Energy is urgently constructing phase 1 of the Tam Sinh Nghia Plant in Ho Chi Minh City and researching the implementation of additional waste-to-energy plants in Long An, Kien Giang and other provinces and cities.

According to Power Plan VIII, BCG Energy currently has a total of 8 wind power projects with a total capacity of up to 925 MW prioritized for implementation by 2030. The company's goal is to achieve a total capacity of 2 GW by 2026, while diversifying its renewable energy portfolio with low investment costs and an average annual return of 10% to 14%.

Vinh Phu

Source: https://vietnamnet.vn/bcg-energy-hoan-thanh-98-ke-hoach-loi-nhuan-nam-2024-2339779.html

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting on the implementation of the Lao Cai-Hanoi-Hai Phong railway project.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/0fa4c9864f63456ebc0eb504c09c7e26)

Comment (0)