BCG Energy was established in 2017 and is the energy company of Bamboo Capital. On July 31, BCG Energy will trade 730 million shares on the Upcom floor, with the stock code BGE and a reference price of VND15,600/share.

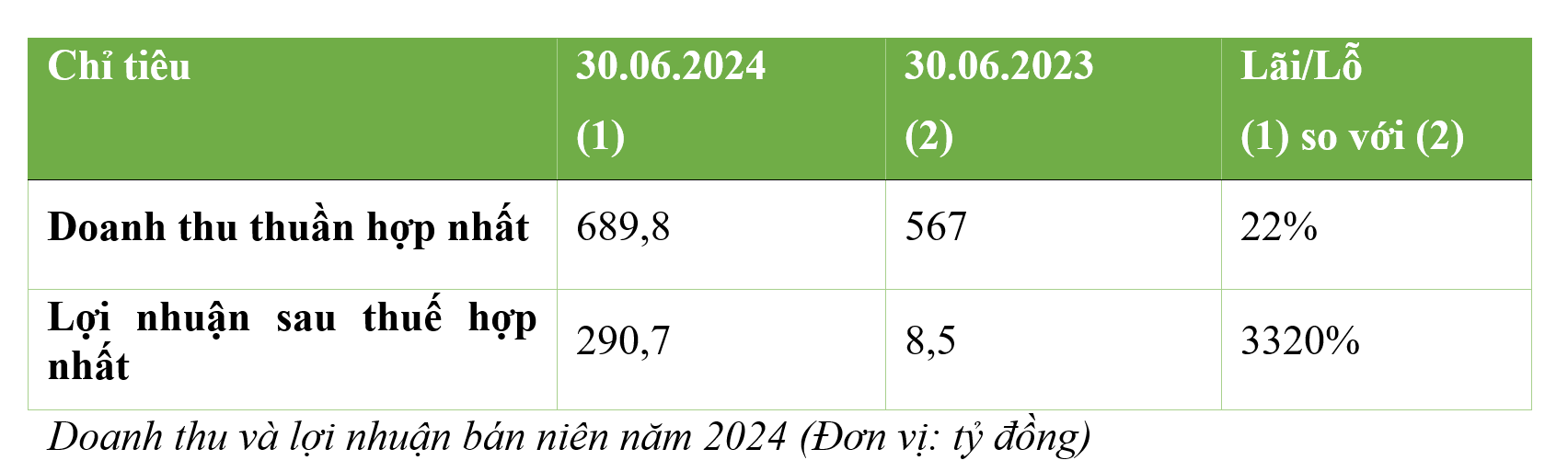

In the first half of 2024, BCG Energy recorded consolidated net revenue of VND 689.8 billion, up 22% over the same period in 2023. Revenue growth is mainly driven by the commercial operation of Phu My Phase 2 Plant with a capacity of 114 MW from June 2023.

In addition, solar power projects have been successfully put into operation with a total capacity of 594.4 MW, including solar power plants such as: BCG Long An 1 (40.6 MW), BCG Long An 2 (100.5 MW), BCG Phu My (330 MW), BCG Vinh Long (49.3 MW). Rooftop solar power projects with a total capacity of 74 MW also achieved good performance.

It is forecasted that in 2024, the company's net revenue will continue to grow thanks to the completion of procedures to recognize the commercial operation date for the Krong Pa 2 solar power project with a capacity of 21 MW/49 MW in Gia Lai , along with contributions from rooftop solar power projects under construction.

The 2024 semi-annual financial report shows that BCG Energy's consolidated profit after tax reached VND290.7 billion, an increase of 33 times compared to the same period in 2023. This impressive growth was mainly driven by the efficiency in saving financial costs, especially the sharp decrease in interest expenses. With this result, BCG Energy has completed 59% of the 2024 profit plan.

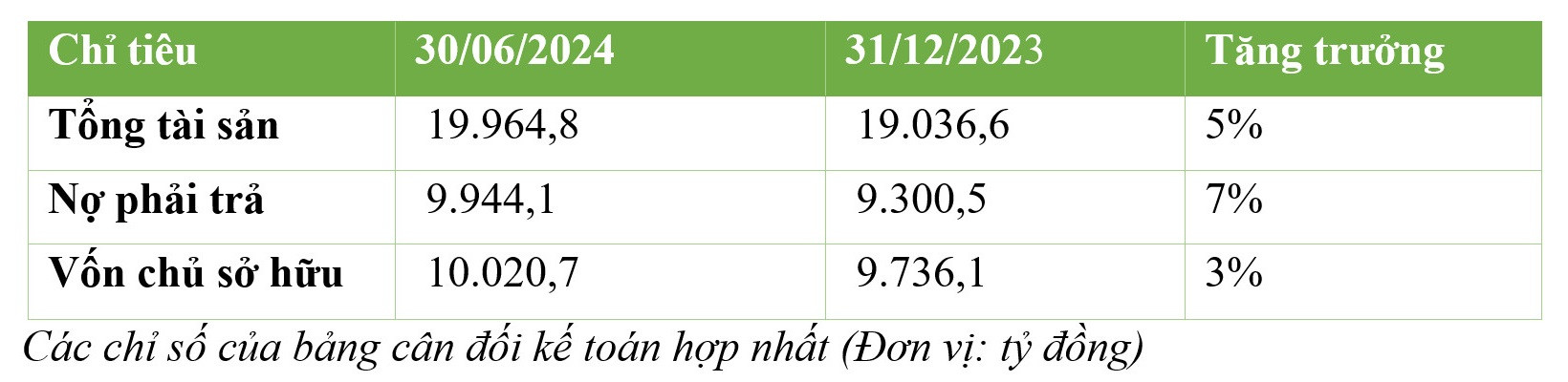

As of June 30, 2024, BCG Energy's total consolidated assets reached VND19,964.8 billion, up 5% compared to the beginning of the year. This increase was mainly due to new investments, most notably the investment in the Tam Sinh Nghia Waste-to-Energy Plant in Thai My Commune, Cu Chi District, Ho Chi Minh City.

According to the report, total liabilities also increased to VND9,944.1 billion, equivalent to a growth rate of 7%. This increase mainly came from liabilities related to the purchase of BCG Energy shares from Tam Sinh Nghia Investment and Development Joint Stock Company for former shareholders.

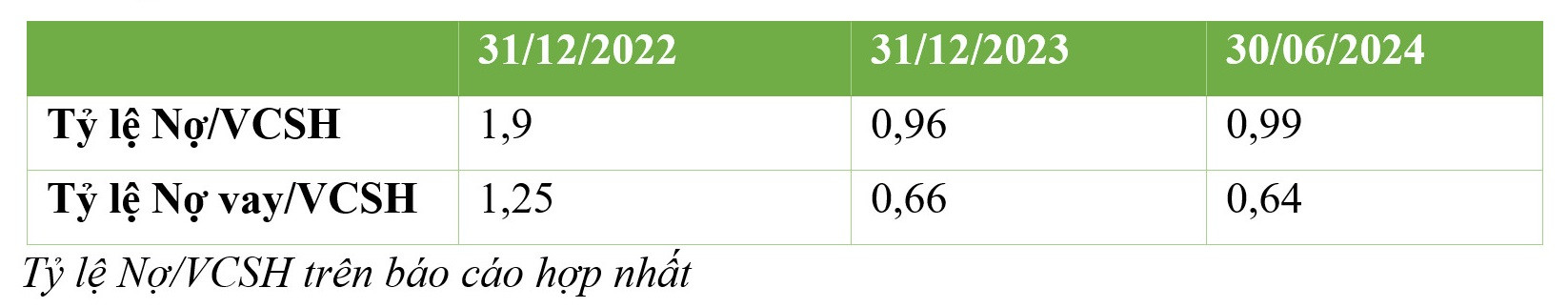

BCG Energy's debt-to-equity ratio has improved significantly and remained stable over the years; with a ratio of 1.9 as of December 31, 2022, decreasing to 0.96 as of December 31, 2023 and reaching 0.99 as of June 30, 2024. At the same time, the debt-to-equity ratio has shown a clear downward trend with a ratio of 1.25 as of December 31, 2022, decreasing to 0.66 as of December 31, 2023 and remaining at 0.64 as of June 30, 2024. This improvement not only creates an advantage in financial capacity but also helps the company minimize risks from the impact of the economy and the market. Strong financial capacity also enhances the ability to meet capital needs for M&A activities to expand the project portfolio.

The separate financial statements of the parent company BCG Energy recorded a decrease in revenue and net profit compared to the same period in 2023. The reason is that in the first 6 months of 2024, the company did not have any financial revenue from dividends distributed from subsidiaries. With strong revenue growth from renewable energy projects and the fact that these projects are expected to operate effectively in the near future, it is expected that the dividend stream distributed to the parent company will continue to grow, bringing great profits to shareholders.

Over the past time, BCG Energy has been built on three solid core competencies. These are the ability to develop, manage, and operate projects; the ability to M&A potential projects and successfully restructure after M&A; and finally the ability to mobilize capital to implement projects. In February 2024, BCG Energy signed a cooperation agreement with SUS Vietnam Holding Pte. Ltd., in implementing projects of Tam Sinh Nghia Investment - Development Joint Stock Company.

Looking ahead, BCG Energy’s revenue and earnings are expected to continue to grow strongly, driven by a portfolio of 229 MW of ongoing projects and 670 MW of future projects. The company’s goal is to reach a total capacity of 2 GW by 2026, while diversifying its renewable energy portfolio with low investment costs and an average IRR of 10-14%.

BCG Energy has strengths in mobilizing domestic and international capital, which helps the company promptly meet capital needs in the early stages of project implementation as well as refinancing at reasonable costs when projects come into operation. Listing on the Upcom exchange is an important step in the development journey of BCG Energy, making it easier for the company to mobilize capital to develop new energy projects.

(Source: BCG Energy)

![[Photo] Prime Ministers of Vietnam and Thailand visit the Exhibition of traditional handicraft products](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/6cfcd1c23b3e4a238b7fcf93c91a65dd)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

Comment (0)