Just counting the direct ownership of shares at SHB, the three father and son of Mr. Do Quang Hien (Mr. Hien) hold 8.42% of the bank's charter capital (308.423 million shares), equivalent to nearly 3,300 billion VND.

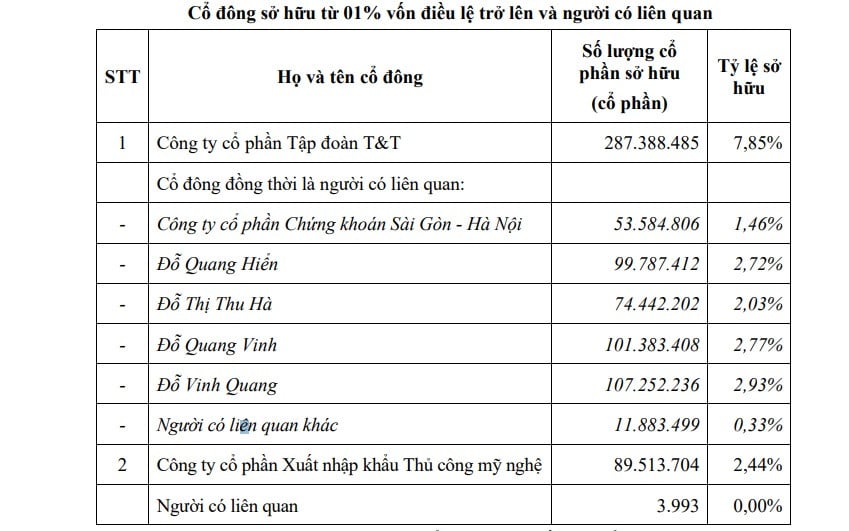

Saigon - Hanoi Commercial Joint Stock Bank (SHB) has just announced the list of shareholders owning 1% or more of charter capital according to the Law on Credit Institutions and based on information provided by shareholders.

Institutional shareholders include T&T Group Joint Stock Company owning 7.85%, Saigon - Hanoi Securities Joint Stock Company (SHS) owning 1.46%, Handicraft Import-Export Joint Stock Company and related persons owning 2.44%.

The list of individuals owning more than 1% of SHB's charter capital includes: Mr. Do Quang Hien (Mr. Hien) - Chairman of SHB's Board of Directors (2.72%), Ms. Do Thi Thu Ha - Mr. Hien's sister (2.03%). Mr. Hien's two sons, Do Quang Vinh and Do Vinh Quang, hold 2.77% and 2.93% of shares at SHB, respectively.

The list of individual shareholders mentioned above and SHS is also related to the largest shareholder of SHB, which is T&T Group founded by Mr. Do Quang Hien.

In addition, other related shareholders are holding 0.33% of charter capital at SHB.

Just by directly owning shares at SHB, Mr. Do Quang Hien and his three sons hold 8.42% of the bank's charter capital, equivalent to more than 308 million shares.

With the closing price of the trading session on October 23 being VND10,650/SHB share, the total value of shares held by Mr. Hien and his three sons is more than VND3,284 billion. Of which, the value of SHB shares directly held by Mr. Do Quang Hien is VND1,062 billion, Mr. Do Quang Vinh is VND1,079 billion and Mr. Do Vinh Quang is VND1,142 billion.

Meanwhile, the value of assets held by Ms. Do Thi Thu Ha is 793 billion VND according to the current market price of SHB shares.

Another sister of Mr. Hien, Ms. Do Thi Minh Nguyet, also owns more than 20 million SHB shares, worth a total of about VND215 billion. However, Ms. Nguyet is not on the list of shareholders that must be announced because she owns less than 1% of the bank's charter capital.

The disclosure of shareholder information is to comply with Article 49 of the Law on Credit Institutions on disclosure of information of shareholders owning 1% or more of charter capital.

According to the Law on Credit Institutions 2024, related persons for organizations and individuals are more expanded than before; at the same time, the ownership limit for shareholders who are organizations is reduced from 15% to 10%, and for shareholders and related persons is reduced from 20% to 15%. In case this group owns shares exceeding the limit according to the new regulations, it will still be maintained but not increased, except in the case of receiving dividends in shares.

SHB is a bank that has maintained annual stock dividend payments at a rate of 10-18% over the past 5 years (2023 dividends will be paid in cash and stocks).

Source: https://vietnamnet.vn/bau-hien-va-2-con-so-huu-8-42-von-dieu-le-shb-tri-gia-gan-3-300-ty-dong-2334904.html

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

Comment (0)