(NLDO) - Today's interest rates at some specially controlled banks have a significant difference, with some banks mobilizing deposits exceeding 6.3%/year.

In the latest mobilization interest rate table applied from the beginning of December 2024, GPBank sharply increased interest rates for many terms.

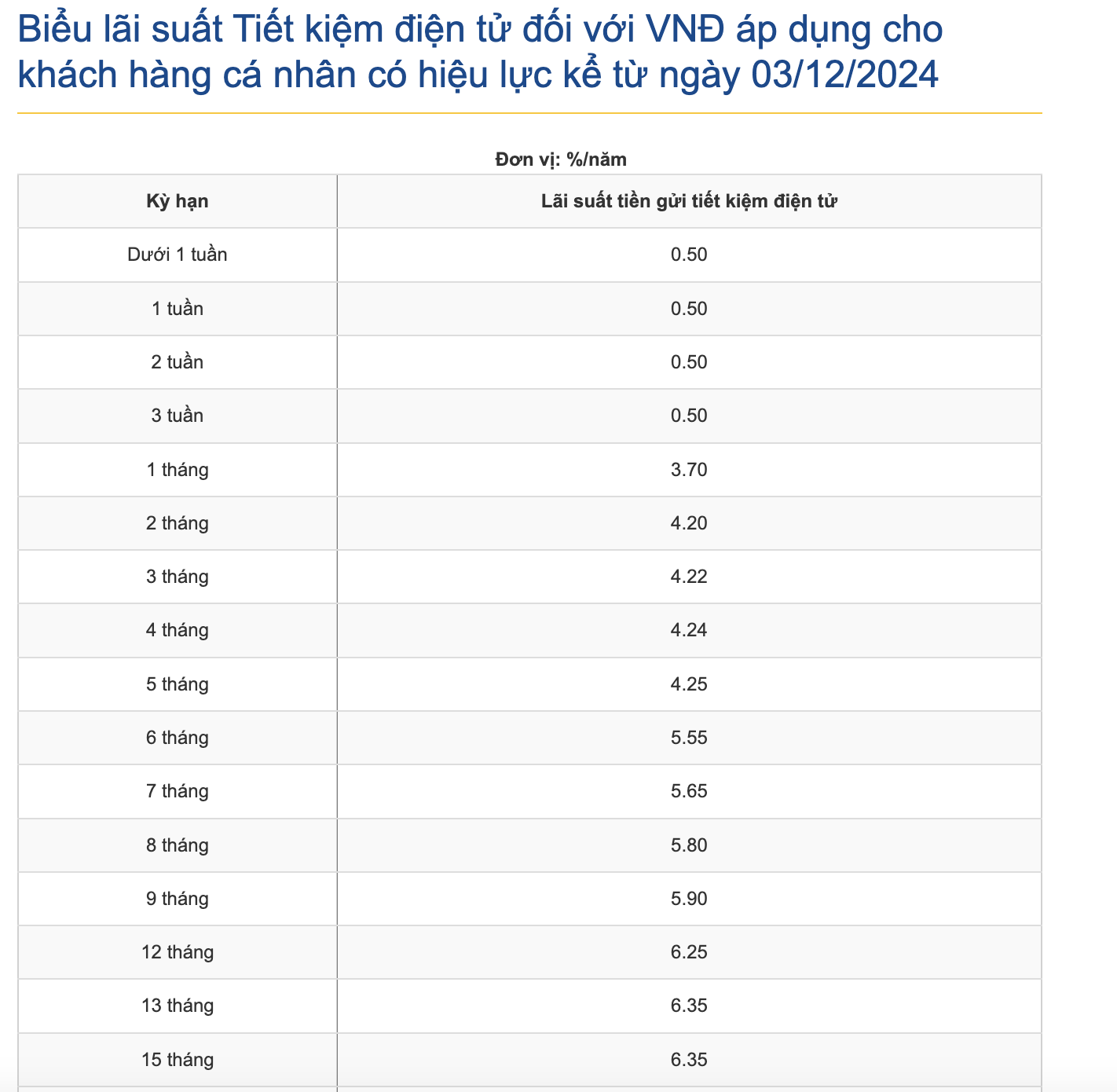

Currently, customers who deposit savings for a 1-month term at GPBank enjoy an interest rate of 3.7%/year; for a 5-month term, it is 4.25%/year; for a 6-month term, it has increased sharply to 5.55%/year. The highest interest rate is 6.35%/year when customers deposit savings for 13 months or more. These interest rates have increased by about 0.95 percentage points compared to the previous interest rate schedule.

GPBank is one of the banks under special control, in the process of restructuring, waiting to receive mandatory transfer.

Latest deposit interest rates at GPBank

According to the reporter's records, some banks under special control also have deposit interest rates exceeding 6%/year such as DongABank. In the latest deposit interest rate table, DongABank listed the 1-month term interest rate at 3.9%/year; the 6-month term is 5.55%/year and the highest interest rate is 6.1%/year when customers deposit savings for 18 months or more.

At Oceanbank, when customers deposit for a term of 1 month, the interest rate is 4%/year; 6 months is 5.3%/year and the highest interest rate is also 6.1%/year when customers deposit for more than 18 months.

Meanwhile, CBBank mobilizes deposit interest rates at a lower level. Customers depositing savings for a term of 1 month at this bank are 3.85%/year; 6 months are 5.45%/year and long-term deposits over 13 months are 5.7%/year.

The highest interest rate today at SCB is 3.9%/year for long term deposits.

A notable development at another bank that is also under special control is SCB, with very low deposit interest rates. According to the published interest rate table, SCB's deposit interest rate is 1.9%/year for 1 month; 2.9%/year for 6 months and the highest is 15 months with an interest rate of 3.9%/year.

Regarding the restructuring process of specially controlled banks, according to the announcement of the State Bank, CBBank is currently transferred to Vietcombank and OceanBank is transferred to MB.

The State Bank said it is directing the transferee banks to review and will have a plan to accept the compulsory transfer as soon as possible for the two other banks, GPBank and Dong A Bank. During this process, the interests of depositors before, during and after the compulsory transfer are guaranteed to be safe and in compliance with state regulations.

Source: https://nld.com.vn/lai-suat-hom-nay-5-12-bat-ngo-lai-tien-gui-o-mot-ngan-hang-196241205092814882.htm

![[Photo] Prime Minister Pham Minh Chinh chairs Government Standing Committee meeting on Gia Binh airport project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/6d3bef55258d417b9bca53fbefd4aeee)

Comment (0)