Observing the market, Mr. Tran Phuong, an investor in Hanoi, saw that there is currently a lot of information about selling "loss-cutting" villas and hotel apartments (condotels) in some localities such as Da Nang, Nha Trang (Khanh Hoa), Phu Quoc (Kien Giang), Quang Ninh... Villas worth tens of billions are being cut at a loss of 2-3 billion VND.

Not having much money to buy, Mr. Phuong "aimed" at condotel apartments priced at 2 - 4 billion VND, which are being sold at a loss of several hundred million VND. With 3 billion VND in the bank, Mr. Phuong considered whether to withdraw the money to invest in condotels for rent.

What Mr. Phuong is concerned about is whether condotel apartments without “pink books” will lose value? Is leasing more effective than bank interest rates?

Evaluating the resort real estate segment, sharing with VietNamNet reporter, Mr. Nguyen Vu Cao, General Director of Van Khang Phat Investment JSC, said that the recovery signal of resort real estate is still weak.

“This segment is currently not attractive to investors. The overall investment power of the market is very weak, with few transactions. In the past, when the cash flow in the market was high and it was easy to mobilize financial leverage, many people invested in resort real estate. After a period of witnessing the efficiency of the investment not being as high as expected, the investment cash flow in the future will change, they will not invest too much in resort real estate,” said Mr. Cao.

Regarding resort real estate products being sold at a loss, Mr. Cao said that even though they say 'cut losses', they still have not returned to their real price range.

“Cut losses compared to when prices were at their “peak”, but compared to real value and the health of the economy , prices are still high. Real estate prices in general are too high compared to per capita income. This is unreasonable. Real estate prices are decreasing but compared to 2019-2020, they are still high.

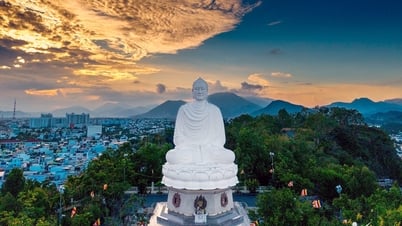

Resort real estate in Da Nang , Nha Trang, Ha Long (Quang Ninh), Phu Quoc, Quy Nhon… all have high prices. Prices have been “inflated” to 5-6 times, even in some places 10 times higher than a decade ago,” Mr. Cao assessed.

This person also commented that the resort real estate segment can recover by 2026 at the earliest, otherwise it will have to wait longer.

For investors with a few billion dong, should they invest in resort real estate at this time or not?

Answering this question, Mr. Cao said that depending on the area, project and location to consider investment. When investing, it is necessary to see whether the number of visitors to the area to be invested is large or not, if large, then the potential for tourism and resort exploitation is high.

“If you invest in resort real estate and wait for the price to increase, it will be difficult to bring expected profits to investors in the short term.

If investing in resort real estate and then renting it out at this stage is not feasible compared to the profit margin on total cost performance. Investing and then renting out, the profit is not necessarily as high as depositing money in the bank. In the long term, investing in residential real estate is still safer than other segments," Mr. Cao advised.

A figure related to hotel business activities in Vietnam from Savills Hotels shows that, as of the first 8 months of this year, the average room occupancy rate of the Vietnamese market only fluctuated at 40%. Meanwhile, Thailand, the Philippines, Indonesia and Malaysia have all surpassed the 50% mark and even Singapore is close to reaching 75%.

The recovery of business activities has been uneven, with Nha Trang - Cam Ranh and Phu Quoc facing more challenges in improving room occupancy.

In Phu Quoc, the average occupancy rate is only 30%, making it one of the least efficient markets in Southeast Asia. The Nha Trang - Cam Ranh area has a similar occupancy rate, but the average room rate is lower than 100 USD/night.

With this information, hopefully investors like Mr. Phuong will have more basis to make their investment decisions.

Proposal to establish a provincial real estate and land use rights transaction center

The Ministry of Construction is seeking opinions from ministries and branches on integrating land use rights trading floors with real estate trading floors into public service centers under the People's Committees of provinces and cities.

Why is the real estate market difficult but apartment prices do not decrease?

In the first 9 months of this year, the volume of real estate transactions in the market was only about 50% compared to the same period last year. However, real estate prices did not decrease, especially in the apartment segment.

Should you invest in real estate at the end of the year?

Interest rates are down, real estate prices are falling sharply in some places. So, is the last quarter of this year a good time to make a decision to invest in real estate?

Source

![[Photo] Award ceremony for works on studying and following President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/a08ce9374fa544c292cca22d4424e6c0)

![[Photo] Vietnamese shipbuilding with the aspiration to reach out to the ocean](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/24ecf0ba837b4c2a8b73853b45e40aa7)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)