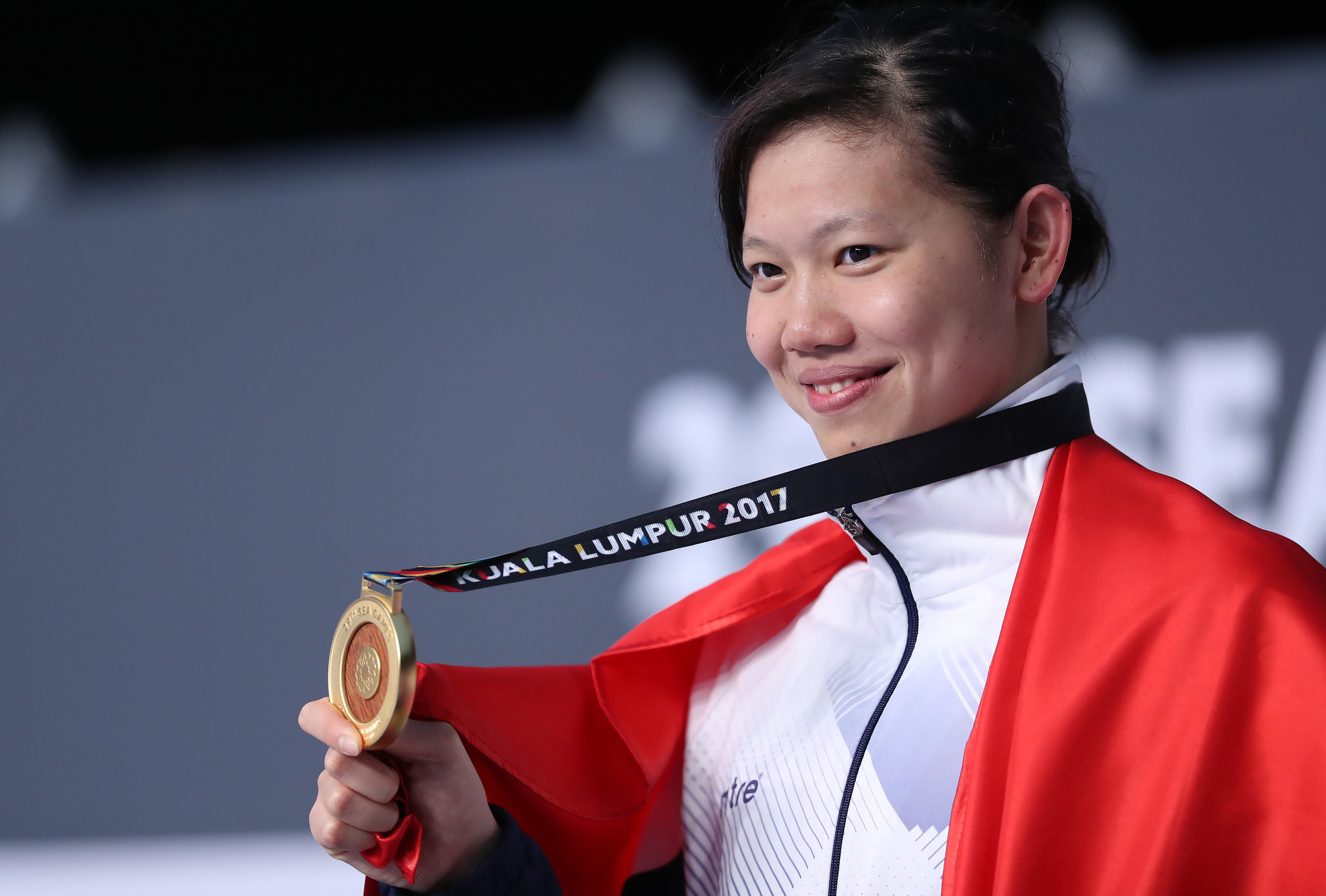

Mr. Masataka “Sam” Yoshida, CEO of RECOF Corporation: Despite fluctuations, Japanese investors still choose Vietnam

“There is no obstacle that hinders Vietnam's position in the business strategies of Japanese investors and the wave of Japanese investors entering Vietnam continues, focusing on mergers and acquisitions (M&A) activities, despite global geopolitical fluctuations,” said Mr. Masataka “Sam” Yoshida.

|

| Mr. Masataka “Sam” Yoshida |

Location of Vietnam investment location

A large Japanese corporation with a revenue of approximately 2.2 billion USD has just made a surprise visit to Vietnam. The Chairman of the Corporation personally came to work with relevant parties. The decision to relocate a large part of its production facilities to Vietnam within the next 2-3 years has been made.

Mr. Masataka “Sam” Yoshida, Global Director of Cross-border M&A Services at RECOF Corporation, shared information when the story about Japanese investors' interest in Southeast Asia, including Vietnam, is seeing a new factor - India.

In recent years, India has emerged as the leading destination for FDI inflows in the world, including FDI from Japan. Like China in the 1990s, India is considered a market with great potential and low production costs.

However, Japanese investors' penetration of the Indian market is facing many challenges, such as provincial licensing requirements, development orientation "towards the West and the Middle East", cultural diversity... requiring different approach strategies.

However, according to Mr. Yoshida, although the investment space in India by Japanese investors is very large, Vietnam and India do not compete directly in terms of production and manufacturing strategy, so each market has its own advantages and serves different roles in the strategies of multinational companies.

“Many Japanese investors recognize the need for a factory in Southeast Asia. Like the above corporation, they are maintaining a distribution network in most Southeast Asian countries and a sourcing base in China. Their strategy is to turn the factory in Vietnam into a major production and distribution center for the region. At the same time, they are expanding their investment in India, with an India and Middle East strategy,” Mr. Yoshida shared.

For Mr. “Sam”, this is the most vivid and fresh example of the business relationship between Vietnam and Japan, after the leaders of the two countries agreed to upgrade the relationship to “Comprehensive Strategic Partnership” in November 2023, on the occasion of the 50th anniversary of the establishment of diplomatic relations between the two countries.

“We hold a very optimistic view on the business relationship between Vietnam and Japan, especially in the next decade,” said Mr. Sam.

Opportunities from the growth of Vietnamese enterprises

Having been present in Vietnam since 2011, witnessing the significant growth and changes in diplomatic and economic relations between the two countries, Mr. Masataka “Sam” Yoshida believes that there is no obstacle that can hinder Vietnam’s position in the business strategies of Japanese investors.

This year is the year of the Dragon in both Vietnam and Japan. This zodiac animal symbolizes strength and optimism. Therefore, this year will be a year of hope for us in the bilateral relationship between Vietnam and Japan.

This year is the year of the Dragon in both Vietnam and Japan. This zodiac animal symbolizes strength and optimism. Therefore, this year will be a year of hope for us in the bilateral relationship between Vietnam and Japan.

Before the pandemic, Japanese investment in Vietnam increased steadily. Despite the challenges during the pandemic, interest from Japanese investors continued. In the M&A sector, the number of M&A deals between Vietnam and Japan decreased, due to the impact of global economic trends and Vietnam's economic challenges in 2023, however, this decrease was less severe than that of other countries.

“Recently, we have supported about 5 large Japanese corporations in M&A activities in Vietnam,” Mr. Sam revealed.

However, what he feels excited about is that many Vietnamese companies are interested in the opportunity to expand to Japan.

“We receive more requests from Vietnamese businesses to find suitable Japanese investors,” said Mr. Sam.

With Recof’s position in Vietnam, it is understandable that the company has a unique position in supporting Vietnamese enterprises in implementing expansion plans to Japan. Therefore, he said, there is an opportunity to provide appropriate consulting services to narrow the gap between Vietnamese enterprises and potential Japanese investors, ensuring a mutually beneficial cooperation relationship.

Mr. Sam started his career in M&A consulting in the late 1980s, so he understands the importance of this work in connecting countries and businesses. He once shared that as a Japanese, he has the responsibility to introduce suitable buyers and sellers, because the deal will affect the future of the business.

Therefore, in the new context, with the complex developments and challenges of global geopolitics, he is seeing a new attractiveness of Vietnam, according to the assessment of global investors.

“I know that there are Vietnamese enterprises that have successfully listed on the Nasdaq Stock Exchange. This shows the growing global presence of Vietnamese enterprises and their ability to meet the strict requirements of stock exchanges,” said Mr. Sam.

Of course, these are just the first steps, but the efforts of Vietnamese enterprises are very encouraging. In particular, in the eyes of experienced investors, the maturity of Vietnamese enterprises is creating new appeal.

Source

Comment (0)