Tax bill must be put on hold

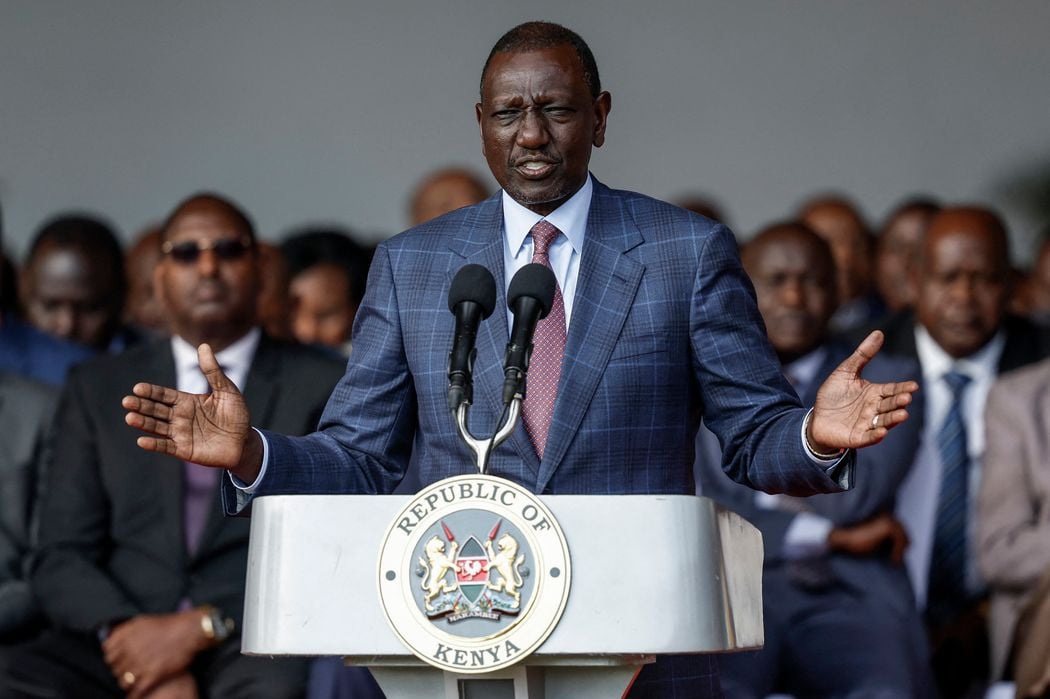

Kenyan President William Ruto said Wednesday he would withdraw a bill to hike taxes, a day after nationwide protests against the measures turned deadly, in a move that underscores the growing burden of near-record debt servicing in African countries.

Kenyan President William Ruto announced the withdrawal of the tax increase bill - Photo: AFP

Standing before a host of lawmakers, President Ruto said he would seek new austerity measures, including in his own office, to offset public opposition to the so-called finance bill, which aims to raise an additional 200 billion Kenyan shillings ($1.55 billion) in tax revenue.

The funds - including new taxes on everyday items such as imported nappies and toilet paper - are intended to help East Africa's most developed economy pay off its loans and bonds.

The surprise announcement came a day after a crowd of protesters, mostly young Kenyans, stormed the country's parliament minutes after lawmakers voted to pass the bill.

Police opened fire on protesters, a move that President Ruto and other members of the government defended as necessary to protect public infrastructure, but was widely criticised by many Western governments and human rights groups.

Mr Ruto said six people had been killed in the clashes and more than 200 injured. Earlier in the day, a group of Kenyan human rights groups said they had counted at least 23 dead.

Meanwhile, the Kenyan police agency said that 58 police officers were also injured and many of its vehicles were damaged by protesters who vandalized or set them on fire. President Ruto said: "It is clear that the public is still insisting that we make more concessions."

The remains of a burned-out car during a protest in Nairobi against a proposed tax hike. Photo: AFP

Like many other African countries, Kenya has seen its public debt rise sharply over the past decade, as the country has sold billions of dollars worth of bonds and taken out infrastructure loans from a variety of creditors, especially China.

According to President Ruto, his administration now spends 61 shillings out of every 100 shillings it collects in taxes on debt servicing. Across sub-Saharan Africa, debt servicing consumed an average of 47.5% of countries’ revenues last year, double the level of a decade ago.

Stuck in debt

Since being elected president last year, Mr Ruto has won plaudits from international investors for averting a default, including signing a bailout deal with the International Monetary Fund (IMF) and pledging to increase government revenue. In February, Kenya successfully tapped international debt markets, albeit at much higher interest rates than before.

But a growing number of Kenya's 54 million citizens — more than a third of whom still live in poverty, according to the World Bank — are opposed to the government's fiscal plans.

Thousands of people have marched through the streets of Nairobi and other Kenyan cities over the past week, calling for a nationwide strike, demanding that President Ruto and Parliament cancel the planned tax measures.

Protesters gather to protest against tax hikes in Kenya - Photo: AFP

President Ruto has called the invasion of Parliament an act of “treason” and pledged to act forcefully to quell further unrest. But he was forced to back down by withdrawing the tax increase bill.

Dr Shani Smit-Lengton, an economic analyst at Oxford Economics Africa, said the withdrawal of the finance bill would make it harder for Mr Ruto's government to cut the deficit to its target of 3.3% of GDP in the current financial year, from 5.7% in the current financial year.

“Withdrawing the finance bill is our least likely scenario, so we will need to reassess the significance of this decision to the economy,” Ms Smit-Lengton said. “The Kenyan government will also need to consult with the IMF, whose staffing level review was completed in early July.”

Razia Khan, head of Africa research at Standard Chartered Bank, said financial markets may welcome President Ruto’s reversal of the bill, after the Nairobi stock market and Kenya’s dollar bonds sold off amid the protests.

“In order to give in to protesters’ demands, spending will be addressed through a political compromise that meets both the need for fiscal consolidation and popular opinion,” Ms Khan said.

Meanwhile, President Ruto said his government would be forced to postpone plans to recruit more teachers and support coffee and sugarcane farmers, and he would seek dialogue with opposition parties and civil society on how to manage future spending.

“That is because Kenyans have been loud and clear in saying they want a leaner budget,” Mr Ruto said.

Source: https://www.congluan.vn/bao-loan-o-kenya-va-ganh-nang-no-nan-cua-cac-quoc-gia-chau-phi-post302116.html

Comment (0)