Vietnam Social Security cited three reasons why individual business owners were illegally charged insurance, including "the owner would not register the entire household if he or she were not allowed to participate."

By September 2016, 4,240 individual business owners in 54 localities paid compulsory social insurance (SI) even though they were not eligible. There was a case where a person paid for 20 years but was not eligible for pension, so he filed a lawsuit against the provincial social insurance agency in court.

Explaining this situation, in a statement issued on the afternoon of May 16, Vietnam Social Security pointed out three main reasons. First, in the spirit of the 1994 Labor Code, the state encourages economic development, creating conditions for all activities that create jobs or self-employment. The fact that household heads create jobs "is highly encouraged and one of the conditions is that the household heads must have their legal rights and interests protected as workers (with compulsory social insurance)". At this time, there is no policy for voluntary social insurance participants.

The second is due to the need of workers to participate in and enjoy social insurance and health insurance (HI). The majority of household heads participating in compulsory social insurance are those who directly produce and do business. Household heads are both employers and employees, and through production and business they have income and salary. "This can be considered a form of self-negotiated and self-signed labor contract, so they participate in and enjoy social insurance and health insurance like employees," the announcement stated.

The final reason, according to Vietnam Social Security, is that "individual business owners will not register for the entire household if they themselves are not eligible for social insurance."

In all three cases, the Vietnam Social Security did not point out the responsibility of this agency as well as the social security staff. Meanwhile, the Petition Committee of the National Assembly Standing Committee pointed out that the collection of compulsory social security was not for the right subjects under the responsibility of the social security sector, affecting the legitimate rights of individual business owners.

The business owners are not wrong because they have the spirit of paying insurance. "The mistake lies with the local insurance collectors. However, many problems have not been resolved, such as how to pay the money that has been collected into the fund to the people, where to get the money to pay, how to calculate the payment, and what to do if they do not accept it?", the representative of the People's Petition Committee raised the issue.

Regarding the solution for business owners who have been wrongly collected, Vietnam Social Security assessed that "withdrawing social insurance and payment time from business owners will be very complicated because they do not agree, affecting their benefits due to long-term participation".

This agency proposed that the Petition Committee agree on the policy of including individual business owners in the compulsory social insurance payment category and allowing the calculation of the payment period so that they can enjoy the regime according to the payment-benefit principle. The Ministry of Labor, War Invalids and Social Affairs in coordination with the Vietnam Social Security submitted to the Government a resolution to calculate the mandatory and voluntary payment period (if any) for business owners.

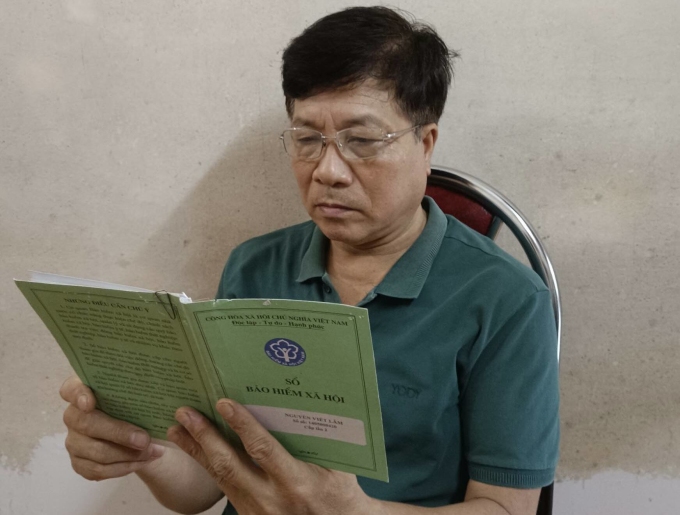

Mr. Nguyen Viet Lam (Tuyen Quang City), one of the household owners, sued Tuyen Quang Provincial Social Insurance in a local court in February 2022 for being wrongly collected social insurance for 20 years. Photo: NVCC

The current social insurance policy is divided into two types: compulsory and voluntary. Compulsory social insurance is for areas with contracts and agreements that both employees and employers must participate in. Employees are entitled to benefits including retirement, death, maternity, accident, illness, occupational disease, and unemployment benefits.

Voluntary social insurance is for workers of working age in the informal sector, without any relationship or labor contract. Workers can choose the contribution level according to regulations, receive partial support from the state, and only receive retirement and death benefits.

According to current regulations, individual business owners are not subject to compulsory social insurance, they can only pay voluntary social insurance. Because they are individuals or a person in the household authorized by other members to represent the business household, without a labor contract or agreement with anyone.

Hong Chieu

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)