Life insurance is inherently good and humane, but some people have turned the industry into an obsession for customers.

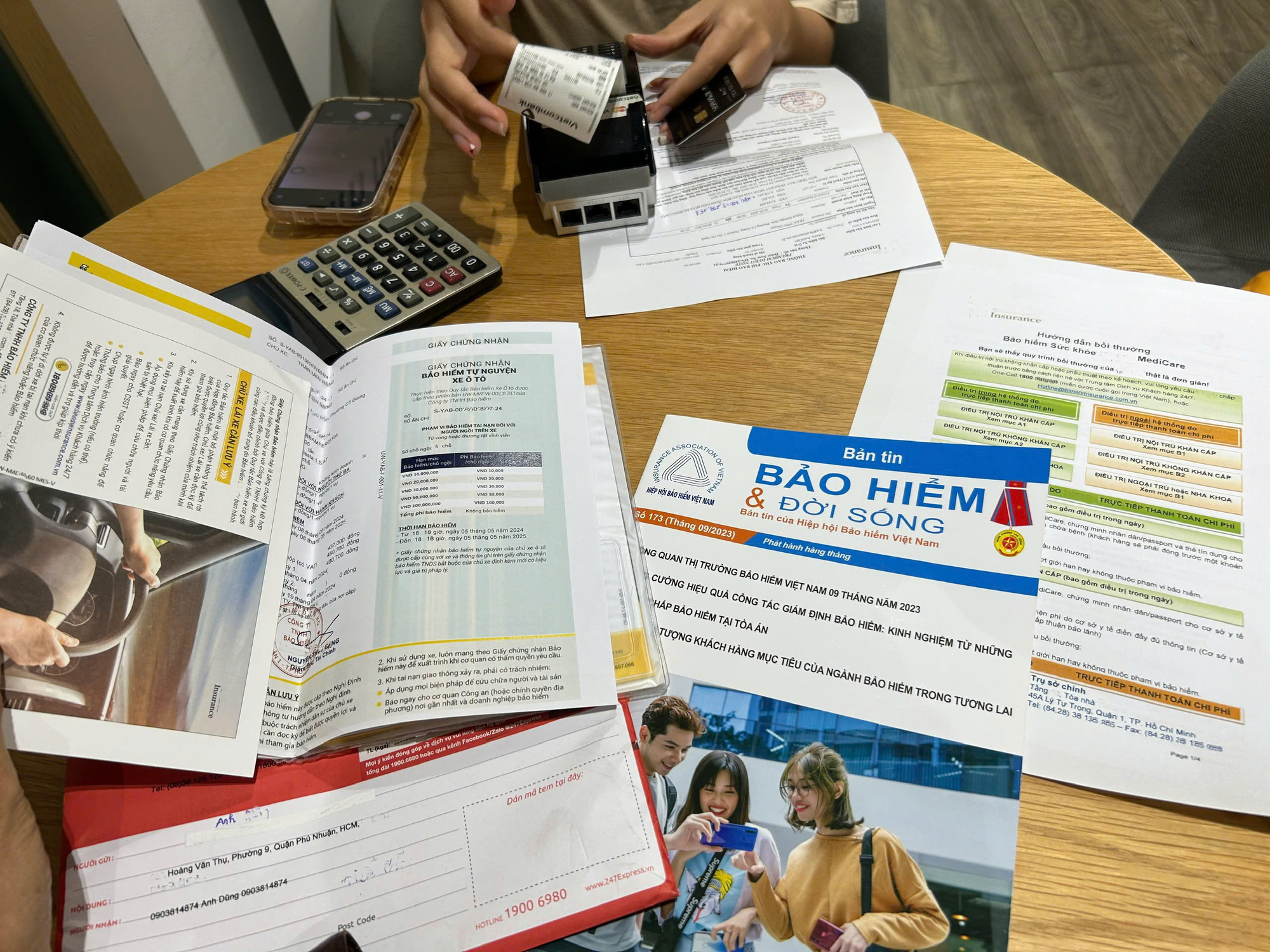

Customers should carefully read the terms and conditions before purchasing insurance - Photo: TTD

That's just one of many reader comments on the series "As Difficult as Claiming Insurance Benefits."

Overwhelmed by insurance contracts

"Before buying, the insurance agents praised the insurance company a lot. But when something happened, they went silent, ran away, and hardly anyone dared to stand up and defend the customer against the company," reader Diem My expressed.

Fed up with insurance companies, reader Hieu shared: "When I bought the policy, I was treated like a VIP, but when I tried to claim compensation, I was harassed with paperwork and still didn't get paid."

According to reader Anh Vu, the nature of life insurance is good and humane, but some people have turned this industry into a nightmare for customers.

A life insurance contract nearly 100 pages long, filled with complex and ambiguous financial terminology, is essentially designed to shift the burden onto the buyer.

"The meaning of insurance is always right. Only those who enforce it want it right or wrong," commented a reader with the username aq***@yahoo.com.

Meanwhile, reader Lao Vui argues that the purpose of insurance is not wrong; only people are at fault. This matter needs to be rectified so that those involved can receive their rightful benefits.

According to reader Chung Phuong: "The crime of insurance fraud, if applied only to customers, is extremely unfair in a fair business relationship between two parties."

Insurance companies found to be intentionally refusing to pay claims or making things difficult for customers should face criminal prosecution. Otherwise, people will lose faith in insurance."

Adding to the discussion, reader Huy wrote: "Life insurance is only sold to those who do not have underlying health conditions. Therefore, when purchasing insurance, it is necessary to truthfully declare one's health status. Customers have 21 days to read and consider the contract; no one forces them."

Another reader, Hoa Huong Duong, commented: "Many people buy insurance without knowing or carefully reading the insurance rules before deciding to purchase it."

This is an integral part of the insurance contract that clearly states the terms and conditions. Don't wait until a claim occurs to realize that the insurance agent didn't explain it clearly."

Solutions from those involved.

Confusing contracts and unclear terms, leading to differing interpretations, are the main causes of disputes between insurance buyers and sellers.

Therefore, reader Nguyen Ha suggests that contracts should be concise, clear, and unambiguous, avoiding ambiguous terminology that can be interpreted in various ways.

Reader Minh argues that insurance contracts must clearly state the exclusion clauses; otherwise, the insurance company is obligated to pay compensation.

"There should be sanctions against insurance companies if they are found to be deliberately making it difficult to pay out to policyholders."

"Insurance companies can't just pay whenever they want, or make things difficult if they don't want to," reader Hoang Hung commented.

Reader Phuc An asks: "I don't know how the agencies protecting the rights of insurance policyholders demonstrate their role in the above cases?"

Therefore, reader Van Long suggests that consumer protection agencies should also be stronger and more independent so that they can speak up when necessary.

"Simply establish a regulation that penalizes wrongful insurance refusals 30 times the amount. With a penalty mechanism in place, relevant authorities will be able to support customers," reader P suggested.

Another reader, Tuyendcc, commented: "The law should stipulate that insurance contracts cannot exceed 30 pages and 10,000 words. Let's see if they can still cram in misleading information."

Source: https://tuoitre.vn/bao-hiem-dung-chi-ngot-ngao-luc-ban-dau-20241130113802213.htm

Comment (0)