At the recent regular press conference of the third quarter of the Ministry of Finance, Mr. Doan Thanh Tuan - Deputy Director of the Department of Insurance Management and Supervision, Ministry of Finance - said that in 2023, the Ministry of Finance will continue to inspect 10 insurance enterprises.

To date, the Ministry of Finance has completed inspections of two life insurance companies, including AIA Life Insurance Company Limited (AIA Insurance) and Dai-ichi Life Insurance Company (Dai-ichi). At the same time, this unit is inspecting Manulife Life Insurance Company and one other company.

In addition, from now until the end of 2023, the Ministry of Finance will continue to inspect 6 insurance companies as planned.

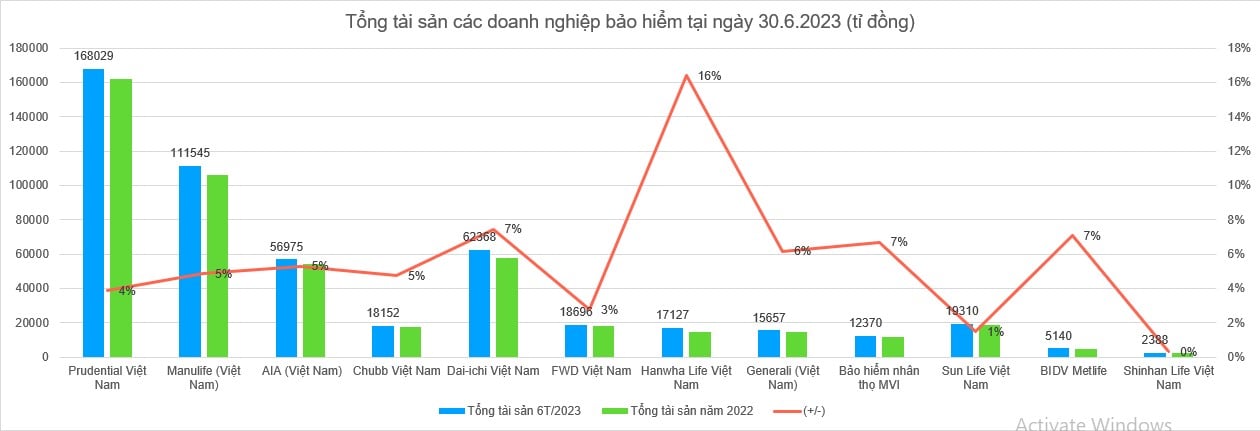

Regarding the two enterprises that the Ministry of Finance has completed inspections of, according to Lao Dong statistics, as of the end of June 2023, Dai-ichi's total assets reached VND 62,368 billion, and AIA Insurance's total assets reached VND 56,975 billion.

Thus, in terms of total assets, these two insurance companies are only behind Prudential Vietnam (VND 168,029 billion) and Manulife Vietnam (VND 111,545 billion), higher than most other insurance companies licensed to operate in Vietnam.

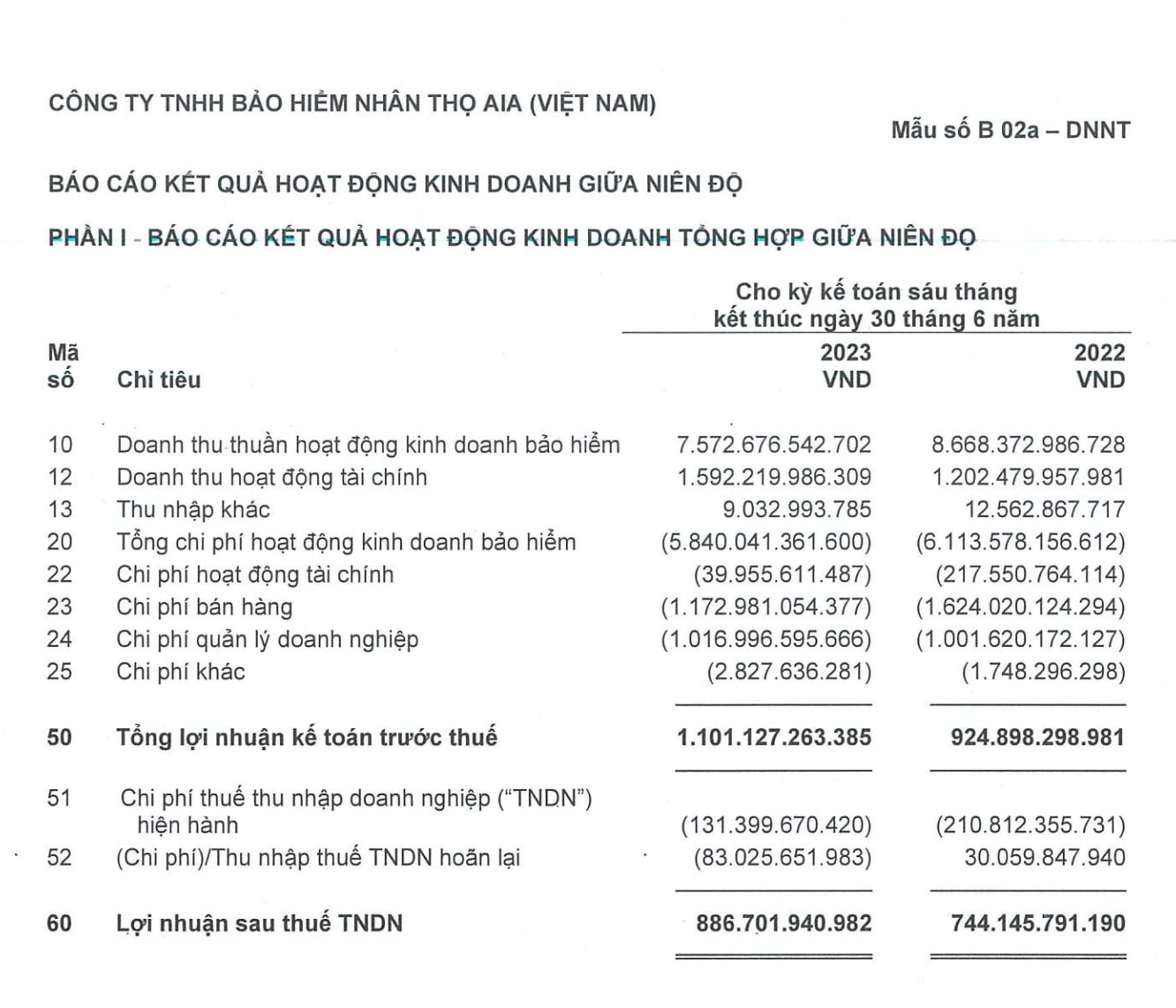

Recently, AIA Insurance announced its interim financial report for the 6-month accounting period ending June 30, 2023.

Accordingly, at the end of the first 6 months of the year, AIA Insurance recorded net revenue from insurance business activities reaching VND 7,573 billion, down 13% over the same period. Revenue from financial activities reached VND 1,592 billion, up 32%.

At the same time, AIA's total insurance operating expenses reached VND5,840 billion, down 4% compared to the first half of 2022. Financial operating expenses decreased sharply by 82%, to VND40 billion; sales expenses decreased by 28%, to VND1,173 billion; business management expenses reached VND1,017 billion, up 2% over the same period.

As a result, despite the decrease in revenue, thanks to "moderation" in expenses, AIA Insurance reported a profit after tax of approximately VND 887 billion, an increase of 19% compared to the first half of 2022. This profit contributed to bringing AIA's accumulated profit as of June 30, 2023 to more than VND 5,585 billion.

At the end of the first half of this year, AIA Insurance's total assets reached VND56,975 billion, an increase of about VND2,866 billion after 6 months. Of which, cash at the company was VND563 million; bank deposits were over VND859 billion; and cash equivalents were over VND35 billion.

In addition, AIA Insurance also spent VND2,159 billion to invest in trading securities; VND10,021 billion to hold until maturity, but the company is having to set aside a short-term investment devaluation reserve of more than VND82 billion.

Not to mention, AIA Insurance is also spending more than 22,758 billion VND to invest in bonds; term deposits at banks are about 10,045 billion VND; certificates of deposit are 230 billion VND... At the same time, in the other short-term receivables item, this insurance company has 737 billion VND of expected interest from bond investment, 472 billion VND of expected interest from bank deposits.

Notably, as of June 30, 2023, AIA Insurance still had more than VND 99 billion in bad debt, but the recoverable value was only about VND 6 billion, with a provision of nearly VND 93 billion.

On the other side of the balance sheet, AIA Insurance's liabilities are about VND42,324 billion, an increase of nearly VND2,000 billion compared to the beginning of the year. The majority is technical reserves with VND29,557 billion.

The debt structure of AIA Insurance shows that this company owes its employees nearly 25 billion VND. According to AIA's financial report, despite large profits and tens of thousands of billions of VND spent on financial investment, AIA's employee debt has tended to increase sharply in recent years.

Accordingly, in 2019, AIA's payable to employees was just over 1 billion VND, in 2020 it was 5 billion VND, in 2021 it was nearly 10 billion VND, in 2022 it was approximately 24 billion VND and in the first 6 months of 2023 it was up to 25 billion VND.

Source

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

Comment (0)