Domestic consumers have to buy gold at a price 22.6% higher than the international price.

On January 11th, SJC gold bar prices fluctuated in the opposite direction to world prices, suddenly increasing by 800,000 VND/ounce. Saigon Jewelry Company (SJC) bought at 72.8 million VND/ounce and sold at 75.3 million VND/ounce. Doji Group bought at 72.75 million VND and sold at 75.25 million VND. Eximbank bought at 72.5 million VND/ounce and sold at 75 million VND/ounce… 9999 gold rings also increased by 150,000 VND per ounce, with SJC buying at 62 million VND/ounce and selling at 63.2 million VND/ounce…

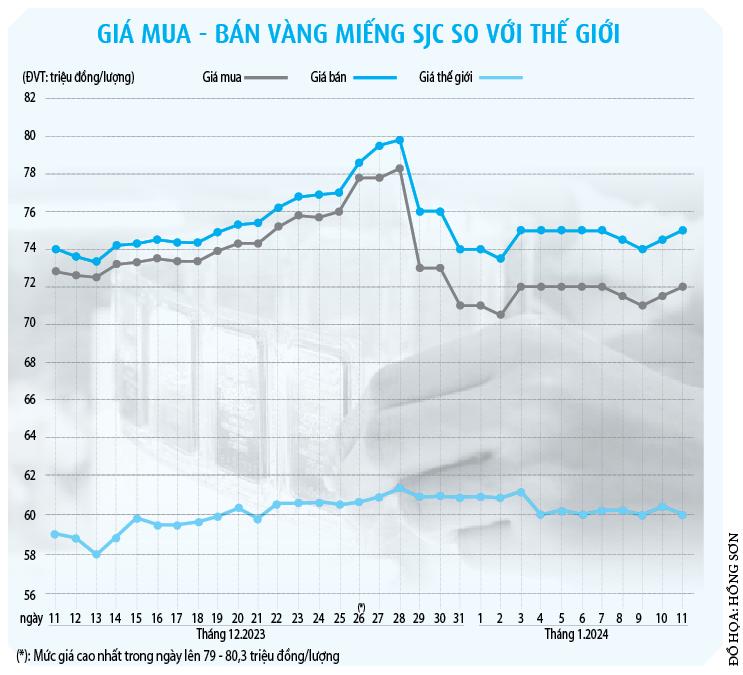

The difference between the buying and selling prices of SJC gold bars by trading units remains high, reaching 2.5 million VND/ounce, while the difference for gold rings is over 1 million VND/ounce. It can be seen that both gold rings and SJC gold bars are still pegged at very high levels. This is in stark contrast to the sharp decline at the end of December 2023 after the Prime Minister requested the State Bank of Vietnam (SBV) to urgently implement effective solutions to manage and regulate domestic gold bar prices according to market principles, preventing a high price difference between domestic and international gold bars that could negatively impact macroeconomic management, and to report the results of implementation in January 2024. This directive was issued when SJC gold bars reached a peak of over 80 million VND/ounce, 20 million VND/ounce higher than world gold prices.

SJC gold prices are 14 million VND/ounce higher than world prices.

Immediately afterwards, the price of SJC gold bars plummeted continuously. In just a few days, it dropped by tens of millions of VND per tael. However, the downward trend lasted for a few days before stopping completely, and the precious metal in the country gradually recovered. As mentioned above, SJC gold bars remain extremely expensive, being 14 million VND per tael higher than the international price. At this price, people in the country are paying up to 460 USD more for SJC gold bars, equivalent to a 22.6% increase. Even more absurd is that, with the same 9999 gold quality and brand, SJC gold bars are 11-12 million VND per tael more expensive than gold rings.

According to Mr. Dinh Nho Bang, Vice Chairman of the Vietnam Gold Business Association, in other countries, the price of gold is about 1-2 USD/ounce higher, with the highest being 4 USD. However, in Vietnam, the price of SJC gold bars is currently 14 million VND higher than the world price, while other types of jewelry such as gold rings are about 2-3 million VND higher per tael.

"Vietnam is a gold importer, consuming about 20 tons annually. However, for the past 12 years, no additional SJC gold bars have been produced and released onto the market, while demand remains constant. The imbalance between supply and demand for gold leads to high market prices. The Association has also reported to the Government that there is no price manipulation in the market; businesses buy high and sell high to avoid losses. Most gold trading companies are private, so they need to protect their capital. This also leads to a situation where the buying and selling prices increase by 1-3 million VND/ounce, sometimes even up to 5 million VND/ounce, to mitigate risks. Because of this imbalance between supply and demand, on peak days, some companies sell 2,200 ounces of gold but only buy 600 ounces, making it impossible to balance the supply," Mr. Bang informed.

Associate Professor Nguyen Huu Huan (Ho Chi Minh City University of Economics) argues that domestic gold prices are not linked to international prices, operating as a monopoly for many years, leading to highly unpredictable and volatile fluctuations.

"Currently, the State Bank of Vietnam is the sole importer of gold in the market, and through SJC, it also has a monopoly on the production of gold bars. The supply is not abundant enough to meet domestic demand, leading to gold prices being pushed much higher than world prices. This also explains why only SJC gold bars experience such unstable price surges, while gold rings have abundant supply due to more suppliers, resulting in more competitive prices and closer alignment with world prices. Unlike stocks – where investors can buy and sell directly – the gold market has intermediary businesses and gold shops. Therefore, gold businesses maintain a large gap between buying and selling prices to mitigate risks during market fluctuations and to maximize profits. Not to mention, imported gold bars are subject to additional taxes and fees…," Mr. Huan added.

A domestic gold price that is 1-2 million VND/ounce higher is appropriate.

So, what is a reasonable price difference between domestic and international gold prices? Associate Professor Dr. Nguyen Huu Huan suggests that domestic gold prices should equal the converted world gold price (including taxes and fees) or only be about 1-2 million VND/ounce higher. A difference exceeding this level would create inconsistencies and market failures. In principle, any price difference will lead to speculation…

"The scarcer the supply, the more people crave gold, using all resources to search for it instead of investing in production and business. The rush to hoard and trade gold will cause the economy to freeze, with no business or production activities," warned Associate Professor Dr. Nguyen Huu Huan.

Sharing the same view, Mr. Nguyen Ngoc Trong, Director of New Partner Gold Company, also believes that a price difference of 1-2 million VND/ounce between domestic and international gold prices (after deducting taxes and fees) is acceptable. However, Mr. Trong is concerned that if gold prices are lowered, it will stimulate demand among the population, and gold imports will affect the exchange rate.

According to him, to avoid using foreign currency to import gold, the authorities could purchase domestic gold raw materials to produce gold bars for the market. The current market size is much smaller than before, so even a small amount could cause domestic prices to fall sharply, narrowing the gap with world prices. When the government intervenes in the supply, leading to a price drop, many previous buyers will take profits, and the supply will increase accordingly. Market intervention sales need to be consistent to bring prices closer to world prices; otherwise, a significant price difference will persist.

Concurring, Associate Professor Vo Dai Luoc, former Director of the Institute of World Economics and Politics, also emphasized: Domestic gold prices should use world gold prices as a benchmark for adjustment. Currently, Vietnam has opened up trade with the world, with 16 free trade agreements. Goods circulate freely, and gold is just another commodity, so there is no reason why it cannot be on par with world gold prices. Frankly stating that Vietnam currently lacks a gold market, Mr. Vo Dai Luoc asserted that if there were free buying and selling, there would not be such a large difference between domestic and world gold prices.

"The biggest reason for the instability in gold prices is the monopoly. A monopoly naturally leads to monopolistic pricing. Gold price adjustments are always made to benefit one company, not according to market developments. A market needs many buyers and many sellers. No country in the world implements a policy where only one entity imports and produces gold bars like Vietnam," this person stated.

It's time to abolish the gold bullion monopoly.

Mr. Dinh Nho Bang commented: For more than 10 years, the State Bank of Vietnam has not imported gold, and people have not used gold for payment purposes as before. Therefore, fluctuations in gold prices do not affect monetary policy or exchange rate policy. Consequently, some argue that importing gold to increase supply, intervene in the market, and stabilize prices would lead to the expenditure of foreign currency, an increase in the amount of gold held by the public, and would not be able to channel this capital into production and business activities…

"These issues need to be considered by the authorities when re-evaluating Decree 24/2012 on the management of the gold market and finding appropriate solutions in the future. However, the State Bank of Vietnam (SBV) is the producer of gold bars, and SJC is only allowed to process them with the approval of the SBV. My view is that the monopoly on gold bars should be abolished, and gold should be treated as a commodity. At the same time, the domestic gold market must be interconnected with the world market to help narrow the price gap. A price difference of 2-3 million VND/ounce higher for gold bars or jewelry compared to the world market is reasonable," Mr. Bang stated.

With just a few more participating entities, the market's competitiveness will clearly increase, and supply will also rise. At that point, the price of gold will be brought back to its true value. Stabilizing the gold market is necessary in a way that benefits many players. That's what makes a market sustainable and long-lasting.

Associate Professor Dr. Nguyen Huu Huan

According to data from CEIC, Vietnam's gold reserves were approximately US$649.45 million as of October 2023, an increase of US$42.08 million compared to September. The average from January 1995 to October 2023 was US$348.215 million. The all-time high was US$649.450 million in October 2023, and the record low was US$34.79 million in January 1995. Therefore, with a level close to US$650 million, the amount of gold reserves is approximately 9-11 tons.

To bring domestic gold prices closer to world gold prices, Associate Professor and Doctor of Science Vo Dai Luoc proposed building an "open" gold buying/selling mechanism with multiple sellers and supply sources. This would allow multiple entities to participate in importing and producing gold bars, and potentially establish a gold exchange to allow people to freely buy and sell gold in a transparent and competitive manner. The gold exchange, similar to real estate or stock exchanges, must operate under clear, transparent management mechanisms and policies, following international practices and building upon the experience of developed countries like Singapore and South Korea in managing their gold markets.

"Only genuine market relations can regulate the supply and price of goods. Gold is important, but it is essentially just a commodity, and not an essential one. We need a mechanism to build a real gold market, eliminating monopolies, allowing competition, and ensuring transparency to stabilize this commodity," said Mr. Vo Dai Luoc.

While acknowledging the timely efforts of the Government and the State Bank of Vietnam (SBV) to "cool down" the Vietnamese gold market in the recent period, Associate Professor Dr. Nguyen Huu Huan believes that determination must be concretized through clear policies. The first concrete step should be to increase supply. Theoretically, the SBV would have to import gold to mint more SJC gold. However, importing gold would lead to a risk of depleting foreign exchange reserves. Meanwhile, domestic gold reserves are still abundant, and it is entirely possible to "gather" gold rings, jewelry, and other raw materials to mint SJC gold. But the SBV does not have the function of purchasing gold circulating among the people. Therefore, the Government could provide a mechanism for the SBV to purchase raw gold from other gold production and trading units, utilizing the large domestic supply of gold rings to mint gold bars. In that case, the price of gold bars would decrease, partially resolving the shortage of SJC gold supply while also avoiding concerns about gold hoarding and its impact on the macroeconomic economy.

In the long term, Dr. Nguyen Huu Huan recommends quickly breaking SJC's monopoly on gold imports and gold bar production by allowing other entities to participate in the gold bar market. The current economic context in Vietnam is already conducive to "opening the game" with gold. Gold is not an essential product, so its market-based nature should be restored. Monopoly brings no benefit to the economy or the government.

"The key is management. We're opening up the playing field to many players, but not everyone is allowed to participate. Only large entities and organizations should be allowed to enter the gold bullion market. Small, independent gold shops will only function as distributors, not as producers," Mr. Huan emphasized.

The market is awaiting the amendment of Decree 24 to bring gold prices down closer to world gold prices, as directed by the Government and in line with the State Bank of Vietnam's leadership's view that "excessively high gold prices are unacceptable".

Source link

![[Photo] President Luong Cuong visits and extends New Year greetings to the Party Committee, government and people of Phu Tho province.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F02%2F05%2F1770275472255_ndo_br_1-jpg.webp&w=3840&q=75)

![[Photo] President Luong Cuong visits and extends New Year greetings to the armed forces of Military Region 2.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F02%2F05%2F1770277268147_ndo_br_1-4239-jpg.webp&w=3840&q=75)

Comment (0)