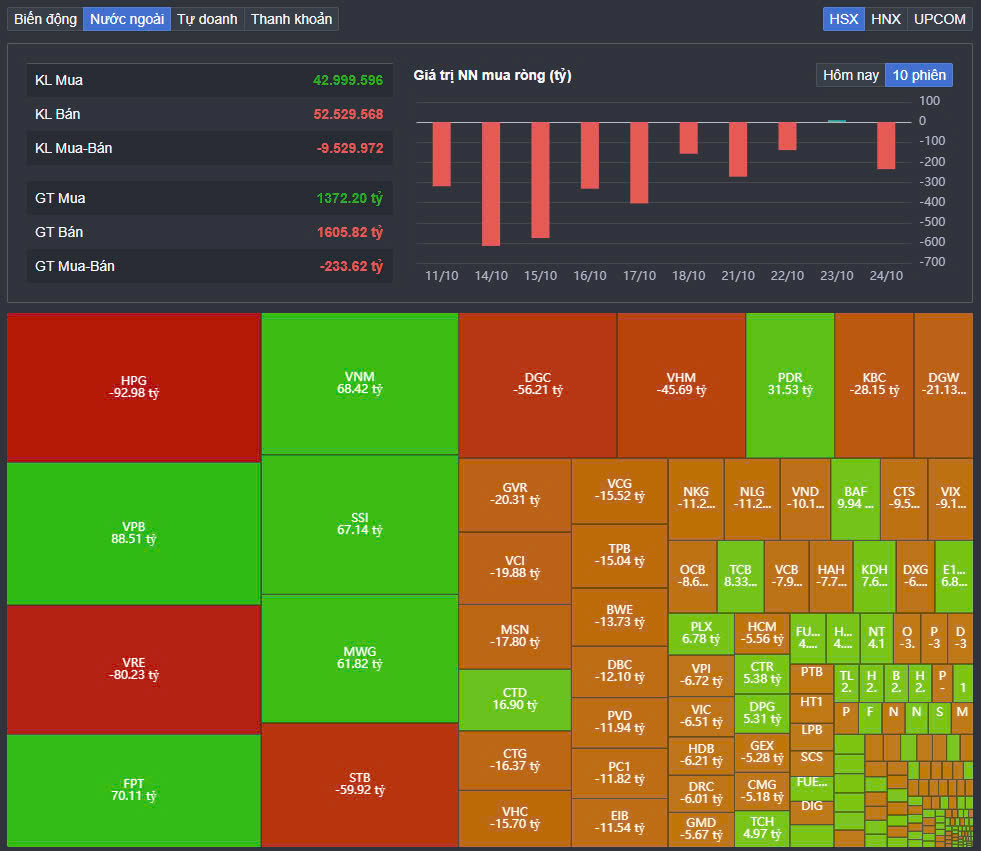

Strong selling pressure from STB and VHM triggered sell orders in many large stocks on the market in the session of October 24.

Strong selling of bank stocks and "Vin" family, VN-Index drops more than 13 points

Strong selling pressure from STB and VHM triggered sell orders in many large stocks on the market in the session of October 24.

|

| VHM was the stock that had the most negative impact on the VN-Index, taking away 3.31 points. |

After the session on October 23 increased by more than 1 point, investor sentiment remained cautious as the session on October 24 entered. This caused the market to fluctuate. After a few minutes of increasing points, the VN-Index reversed and fell below the reference level. The differentiation among stock groups is very strong.

Trading got worse in the afternoon session when a series of stock groups plummeted, with the focus being on the banking group and the "Vin" family.

During most of the trading session, stocks in the “Vin” family put pressure on the general market. This was also the second consecutive session that VHM fell sharply despite the fact that this company started buying treasury stocks since yesterday, October 23. During most of the trading session, the “Vin” group of stocks including VHM, VIC and VRE traded at red prices and had demand to “support prices”. However, due to strong selling pressure at the end of the session, all three stocks closed at the lowest level of the day. VHM fell 6.7% to VND43,850/share, VRE fell 2.7% to VND18,150/share and VIC fell 2.66% to VND42,050/share.

According to the latest update on the Ho Chi Minh City Stock Exchange (HoSE), Vinhomes has purchased a total of more than 19.1 million treasury shares, accounting for 5.17% of the total registered number. According to the plan, Vinhomes will buy back a maximum of 370 million treasury shares (accounting for 8.5% of the total outstanding shares) by order matching and/or negotiation from October 23 to November 21, 2024.

In addition, the market fell sharply under great pressure from banking stocks, of which STB was the "culprit" that triggered strong selling cash flow in this industry group. STB closed at the session's lowest level of 6.7% down to only VND33,400/share. In addition, banking stocks such as TPB, TCB, VPB, MBB, ACB ... also decreased by more than 1%. TPB decreased by 3.4%, TCB decreased by 2.3%, VPB decreased by 2.2%...

VHM was the stock that had the most negative impact on the VN-Index, taking away 3.31 points. Next, STB and VIC took away 1.09 points and 1.06 points, respectively.

|

| VHM is the stock that has the most negative impact on VN-Index. |

In the group of small and medium-cap stocks, a series of stocks in the securities group such as FTS, CTS, SHS, HCM, MBS or VCI all fell sharply. FTS decreased by 3.1%, CTS decreased by 2.8%, HCM decreased by 2.4%, MBS decreased by 2.4%... The retail group also recorded PET, DGW, MWG or FRT sinking in red. PET decreased by 4.6%, DGW continued to decrease by 1.4%...

On the other hand, VNM, VCB, GAS and FPT are stocks that have made important contributions to "balancing" the index, in which, VNM increased by 1.63% and contributed the most to the VN-Index with 0.56 points. VCB and KDH increased by 0.22% and 1.05% respectively with the contribution of 0.27 points and 0.08 points.

At the end of the trading session, VN-Index decreased by 13.49 points (-1.06%) to 1,257.41 points. The entire floor had 102 stocks increasing, 284 stocks decreasing and 52 stocks remaining unchanged. HNX-Index decreased by 1.81 points (-0.8%) to 224.69 points. The entire floor had 56 stocks increasing, 95 stocks decreasing and 57 stocks remaining unchanged. UPCoM-Index decreased by 0.06 points (-0.07%) to 92.06 points.

|

| Foreign investors returned to net selling after a light buying session yesterday. |

The total trading volume on HoSE reached 673 million shares, equivalent to a trading value of VND15,981 billion (up 14% compared to the previous session), of which negotiated transactions reached VND1,897 billion. The trading value on HNX and UPCoM reached VND650 billion and VND355 billion, respectively.

Foreign investors net sold again VND230 billion on HoSE, in which, this capital flow net sold the most HPG code with VND93 billion. VRE was also net sold VND80 billion. STB and DGC were net sold VND60 billion and VND56 billion respectively. In the opposite direction, VPB was net bought the most with VND89 billion. FPT and VNM were net bought VND70 billion and VND68 billion respectively.

Source: https://baodautu.vn/ban-manh-co-phieu-ngan-hang-va-ho-vin-vn-index-giam-hon-13-diem-d228267.html

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

Comment (0)