Vietnam's livestock industry is showing positive signs of recovery after the difficulties of the past few years. To maintain this growth momentum in 2024, the industry needs to focus on three key solutions to address challenges and seize development opportunities.

| Four livestock associations have petitioned for the abolition of several wasteful regulations. Rising pork prices are driving credit flow into the livestock sector. |

|

The livestock industry is expected to recover.

According to the Ministry of Agriculture and Rural Development , the livestock industry recorded fairly stable growth figures in the first quarter of 2024. Total output of all types of meat during this period is estimated at over 2 million tons, an increase of 4.5% compared to the same period in 2023. Of this, pig farming remains the main activity, accounting for 64% of the total domestic livestock production.

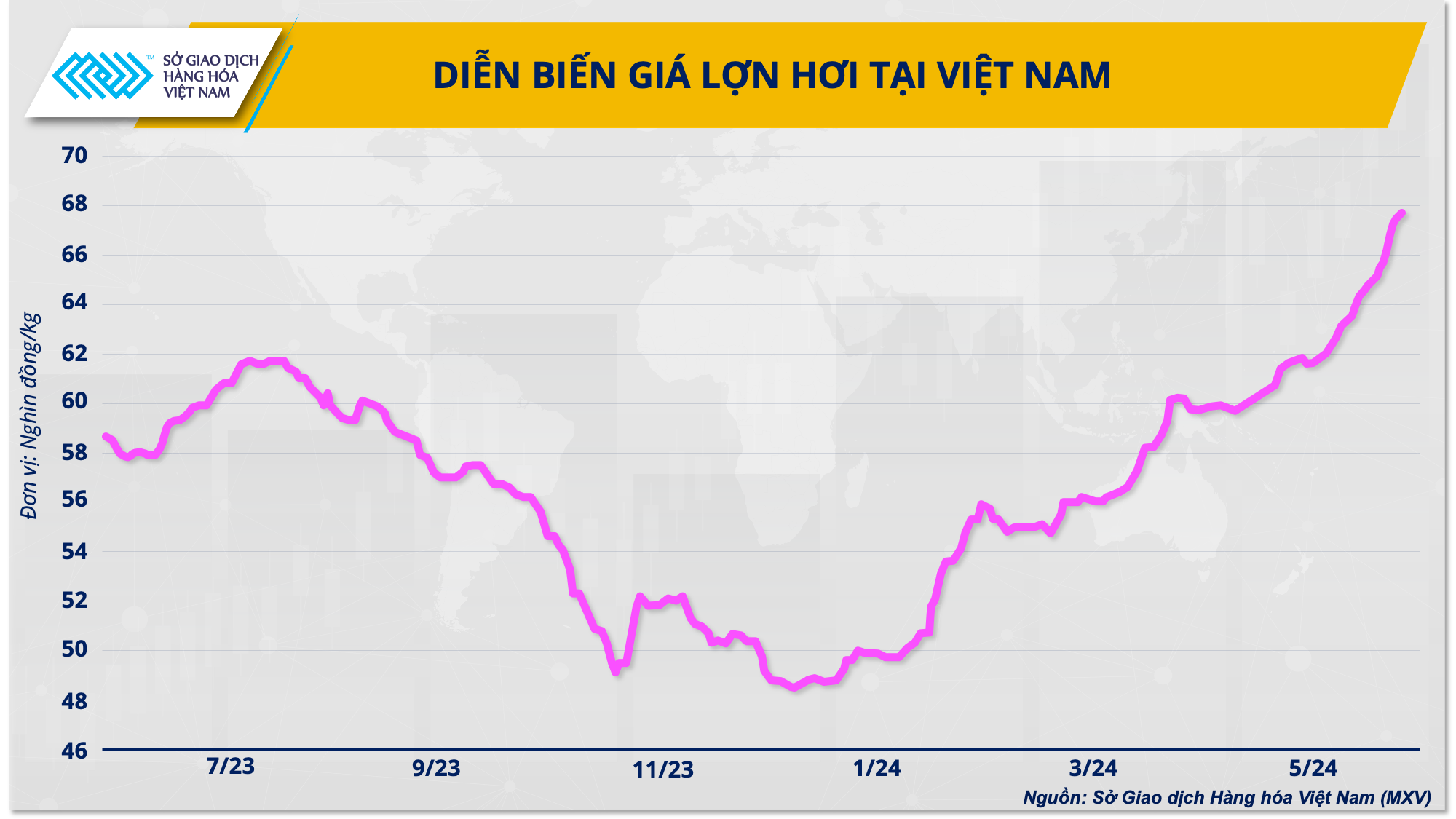

Not only production, but output prices also recovered strongly in the first four months of the year. As of this morning (May 29th), the price of live pigs ready for slaughter reached 70,000 VND/kg, the highest level in the past five years. This sharp price increase, especially in April each year, is a rare phenomenon because consumer demand usually decreases in the summer.

|

According to the Vietnam Commodity Exchange (MXV), domestic live pig supply remains low following the African Swine Fever (ASF) outbreak and reduced imports due to the narrowing price gap with pigs from Cambodia and Thailand. Meanwhile, businesses and farmers are still in the restocking phase and will have to wait at least until the end of this year before they can bring their pigs to market. Therefore, live pig prices are expected to remain high in the medium term, reinforcing the optimistic outlook for the livestock industry in 2024.

Foreign businesses still hold the advantage.

The stable growth trend demonstrates that the livestock industry still has considerable development potential and reflects shifts in the market structure following policies aimed at supporting the development of large-scale enterprises rather than small-scale household farms.

According to the Ministry of Agriculture and Rural Development, over the past five years, the number of small-scale household livestock farms has decreased by 15-20%. Professional household and farm-based livestock production now accounts for 60-65%. This is a natural consequence of the livestock industry's need to adapt and change after numerous events since the Covid-19 pandemic. Closed-loop pig farming is the core solution for sustainable development.

|

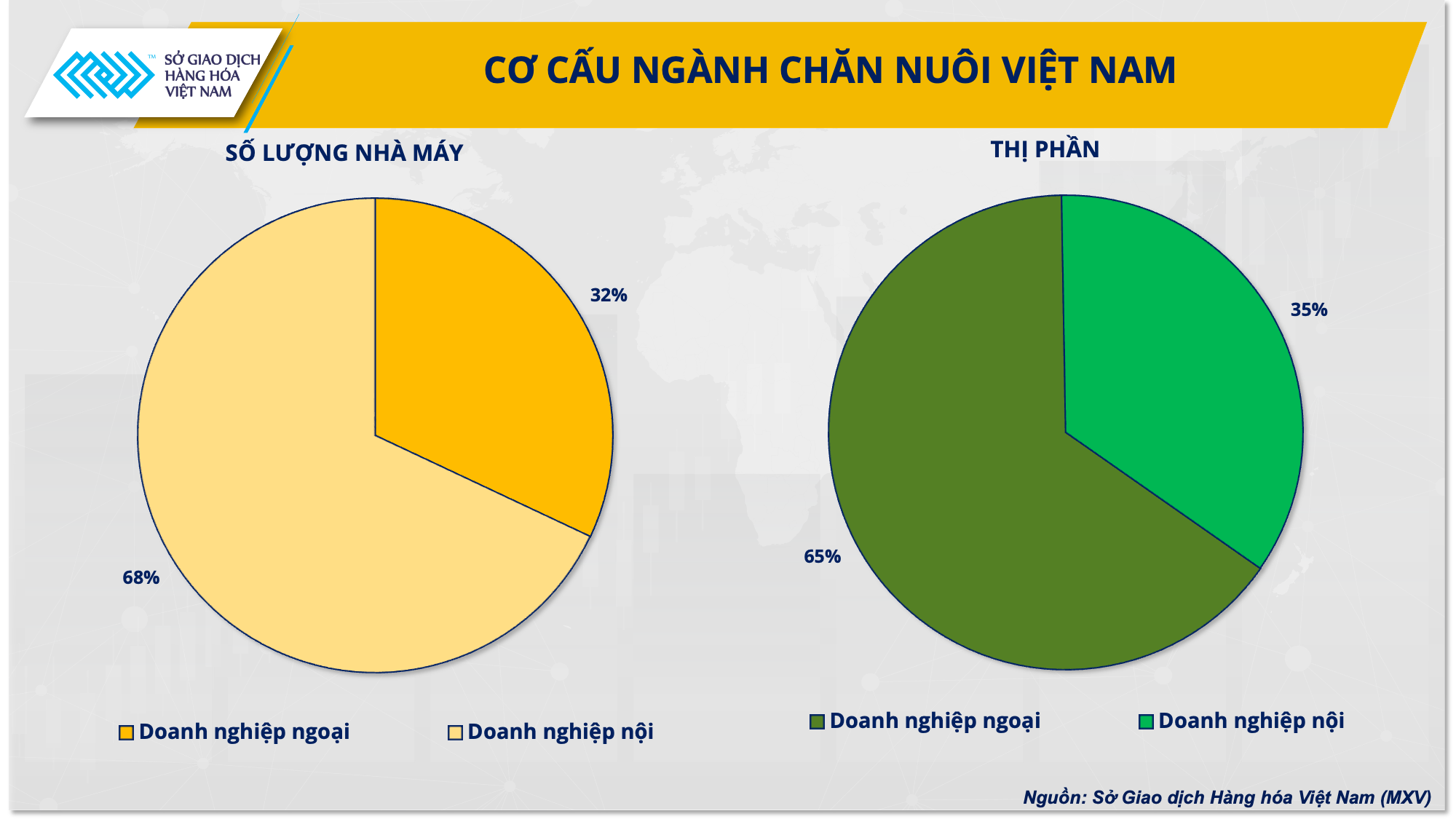

However, the difficult period has also revealed the challenges facing Vietnam's livestock industry, as foreign businesses continue to lead the race and gain an increasing advantage. According to statistics from the Ministry of Agriculture and Rural Development, there are currently about 265 animal feed factories in Vietnam, of which 85 belong to foreign businesses, accounting for 32% but holding 65% of the market share.

One reason is that foreign businesses often have well-structured business strategies and apply closed-loop production and business chains, which helps optimize efficiency. In addition, another factor that makes domestic animal feed manufacturers less competitive is their heavy reliance on imported raw materials. This not only increases production costs but also makes it difficult for domestic businesses to compete on price with foreign companies that have stable supply chains and lower costs.

Solutions to the raw material problem

Every year, Vietnam allocates a significant budget to import animal feed ingredients such as corn, soybeans, and wheat to serve domestic production. The livestock industry consumes over 33 million tons of feed annually, mainly for poultry and pig farming. However, domestic production can only meet about one-third of this demand.

According to Customs data, in April 2024, Vietnam spent US$498.82 million importing animal feed and raw materials, an increase of 6.7% compared to March 2024 and a 34.8% increase compared to April 2023. Overall, in the first four months of 2024, imports of this product group reached nearly US$1.69 billion, an increase of 9.8% compared to the first four months of 2023.

Several key imported items, including corn, soybeans, and wheat, saw significant increases in volume compared to the first four months of 2023. However, growth in the value of raw material imports remained considerably slower due to the sharp decline in global agricultural prices from 2022 until the end of February this year.

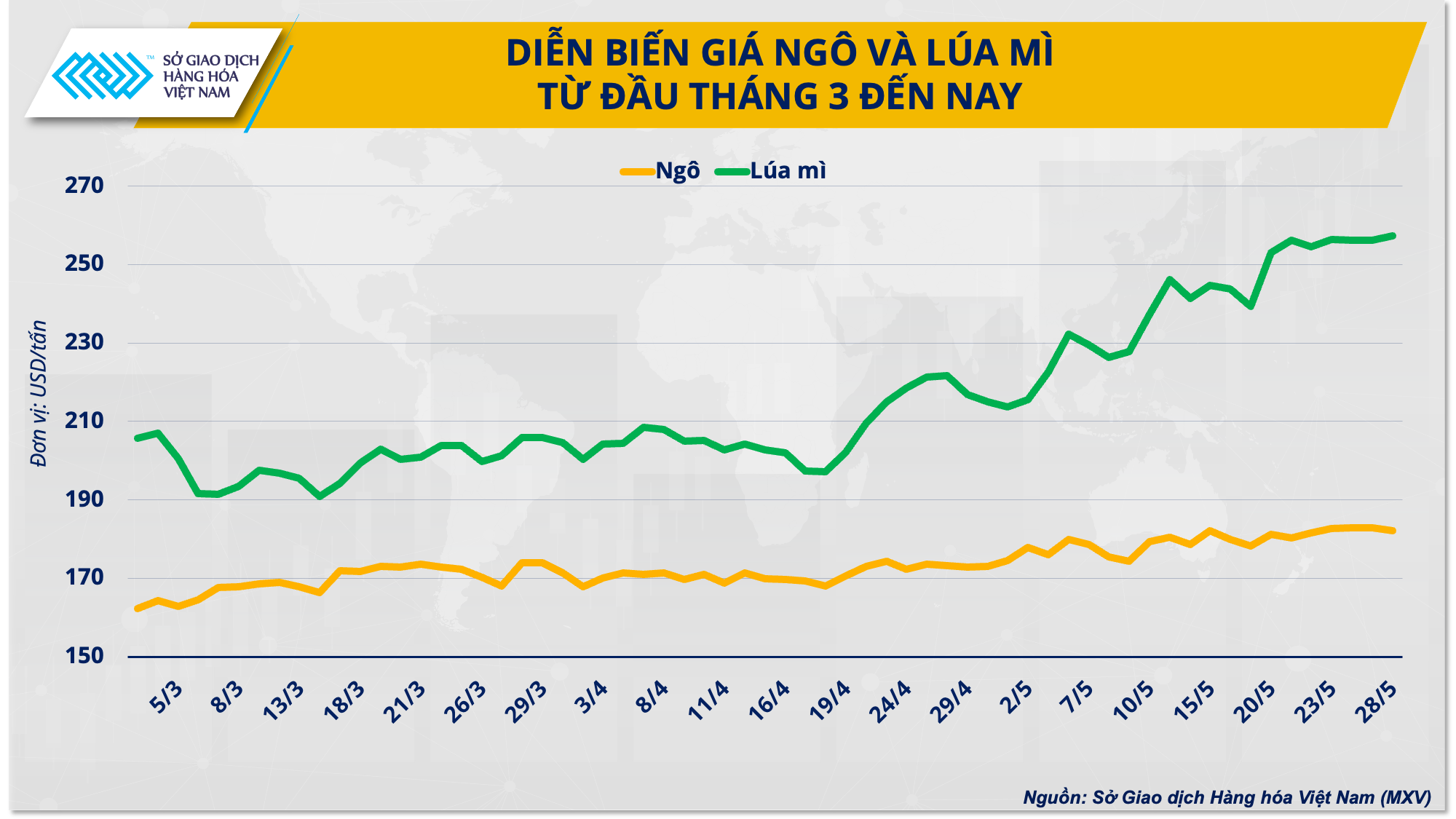

MXV stated that although higher output prices coupled with lower raw material costs have created a more favorable market environment for livestock businesses, the situation may become more challenging in the future. Import demand is projected to continue increasing slightly in 2024, while global agricultural prices are showing signs of reversal, surging in the last month.

|

Chicago corn and wheat prices have both recorded sharp increases, reaching their highest levels since late August 2023. The upward trend shows no sign of stopping as concerns about supply in major producing countries continue to grow, particularly due to recent frosts severely impacting Russia's wheat crop and the risks as the US crop enters a critical growth stage.

According to Mr. Pham Quang Anh, Director of the Vietnam Commodity News Center, to cope with the rising cost of animal feed raw materials, businesses need to implement several important measures.

Firstly, businesses should proactively seek new sources of supply and modify feed formulations to use alternative products when raw material prices rise. For example, wheat or cassava chips could be used instead of corn. This helps reduce dependence on a single raw material and provides greater flexibility in production.

Secondly, businesses need to increase investment in oil pressing plants to proactively secure the supply chain for soybean meal, a high-value and irreplaceable raw material. Vietnam can import soybeans for oil pressing, creating products such as soybean meal for animal feed, soybean oil for food, and soybean hulls for dairy feed production. This not only helps stabilize the supply but also increases the added value of domestic products.

Thirdly, to mitigate the risk of rising raw material costs, businesses should utilize hedging tools during the import of animal feed raw materials. Applying these financial instruments helps businesses stabilize input costs in the face of fluctuations in the international market.

Source: https://thoibaonganhang.vn/ba-giai-phap-cho-nganh-chan-nuoi-152173.html

![[Image] Fifth meeting of the Steering Committee for National Projects in the Railway Sector](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F06%2F1767712857541_ndo_br_dsc-0581-jpg.webp&w=3840&q=75)

Comment (0)