The selling pressure has not stopped, causing the VN-Index to decrease for the fourth session, down to 1,174 points.

VN-Index fell more than 18 points in the session of April 19 due to fierce selling pressure from domestic investors, thereby falling to 1,174 points and ending a negative trading week with a total loss of 84 points.

Observers expected the short break to help reduce negative investor sentiment after three consecutive sessions of decline, but in reality the April 19 trading session did not follow this scenario.

The index representing the Ho Chi Minh City Stock Exchange maintained its red color down the session due to fierce selling pressure and at one point dropped to 1,165.99 points, equivalent to a loss of 28 points compared to the reference. The VN-Index gradually narrowed its decrease in the last minutes of the session, but still closed with a decrease of 18.16 points, closing the session at 1,174.85 points. This was the fourth consecutive decrease of the VN-Index, thereby ending a negative trading week when it lost 84 points compared to the end of last week.

The Ho Chi Minh City Stock Exchange was covered in red in the last trading session of the week when 405 stocks decreased, while only 90 stocks increased. Of the stocks that decreased, 17 stocks lost all their amplitude. The VN30 basket had a strong differentiation when the selling side completely dominated, leading to 25 stocks closing below the reference, while 2 stocks increased and 3 stocks remained unchanged.

According to statistics from securities companies, BID topped the list of stocks that positively impacted the market when it increased 0.5% compared to the reference to VND48,350. MSB increased 1.9% to VND13,450 to rank second in the list of stocks that contributed the most to helping the VN-Index avoid a deeper decline.

Meanwhile, VIC lost 5.3% compared to the reference, to 42,600 VND and became the stock with the most negative impact on the market. CTG, FPT and BCM took turns sharing the next positions when all decreased more than 2% compared to the reference.

|

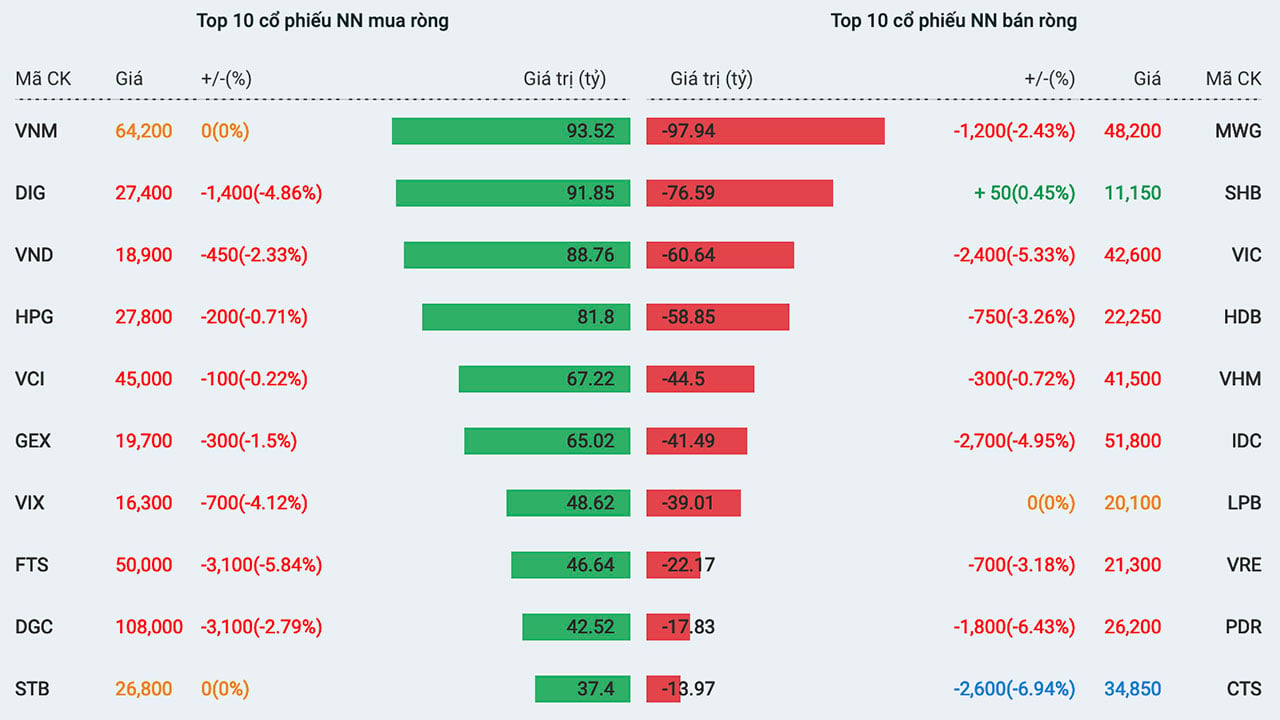

| List of stocks bought and sold most by foreign investors in the session of April 19. |

One of the positive points in the last session of the week was that liquidity showed signs of improvement thanks to cash flow disbursed at low prices when the index plummeted. Specifically, the successful order matching volume reached 1.07 billion shares, an increase of more than 200 million shares compared to the previous session. The total transaction value reached VND23,702 billion, an increase of more than VND4,600 billion compared to the previous session. The large-cap basket recorded more than 316 million shares changed hands with a transaction value of VND9,620 billion.

DIG recorded the highest trading value on the Ho Chi Minh City Stock Exchange with VND1,090 billion. SSI ranked second with liquidity of VND1,000 billion, far surpassing the next two codes, VIX (VND784 billion) and HPG (VND729 billion).

Another positive signal that appeared in the session on April 19 was that foreign investors disbursed more aggressively. Specifically, this group spent VND2,987 billion to buy 103 million shares, while only selling about 82 million shares, equivalent to VND2,300 billion. The net purchase value accordingly reached VND683 billion.

VNM continued to be the stock attracting the most money from foreign investors with VND93.5 billion, followed by DIG with more than VND91 billion, VND with more than VND88 billion and HPG with nearly VND82 billion. On the other hand, foreign investors net sold VND98 billion of MWG shares after a period of active buying. Extending the list of stocks under strong selling pressure are SHB, VIC, HDB and VHM.

Source

![[Photo] Thousands of Buddhists wait to worship Buddha's relics in Binh Chanh district](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/e25a3fc76a6b41a5ac5ddb93627f4a7a)

Comment (0)