Currently, due to the strong development of cashless payment trend, the number of e-wallets and payment intermediaries has also increased rapidly. Some brands that can be mentioned are: VNPay , MoMo, ZaloPay, ViettelPay, ShopeePay, VTC Pay, Payoo, BankPlus...

In recent years, taking advantage of the increasingly outstanding development of information technology and the number of e-wallets and payment intermediaries in Vietnam, high-tech gambling crimes are on the rise, becoming more complicated, becoming a difficult problem for society.

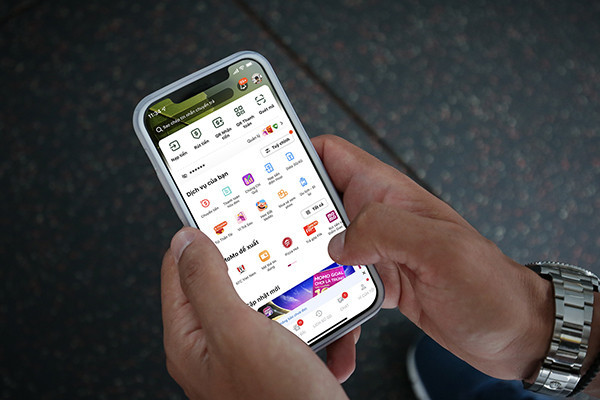

Payment platforms, such as e-wallets and payment gateways, can be and are being exploited to popularize odd/even/high/low gambling based on money transfer codes. In particular, subjects tend to choose MoMo because it is a popular super application, has a large number of users, a stable server system, and a fast and outstanding transaction speed.

Mr. Nguyen Ba Diep, co-founder of MoMo, said that in 2022, MoMo also coordinated with 318 central and local police agencies and units, providing information in more than 1,500 investigation cases, which was highly appreciated by the above agencies and units.

Notably, recently, the press reported that Bac Giang Police had completed their investigation and proposed to prosecute a number of suspects in a gambling ring using MoMo transaction codes. This case was cracked down by Bac Giang Police in December 2022.

In this case, MoMo actively coordinated and supported the Bac Giang Provincial Police Department to review and provide information on transactions with signs of violations, helping the police agency promptly detect and arrest criminals.

To contribute to preventing the problem of online gambling, Mr. Diep said, MoMo has invested in researching many technological solutions, along with more than 100 experts and engineers, with a huge cost of up to tens of billions of VND in more than 1 year from December 2021 to February 2023.

This is a very challenging problem because criminals rely on e-wallet money transfer codes to gamble. If canceled, it is impossible to distinguish between transaction types and it is impossible to check transactions across the entire system.

On February 18, 2023, MoMo changed its business process and upgraded the MoMo application to version 4.0.16. In this upgrade, the application will display the transaction code to the sender before they make the transaction, instead of displaying it later as before.

At the same time, we have purchased the copyright and integrated v-key technology into the system to prevent gamblers from using emulators to access the application and scan automatic transaction codes for betting purposes.

“After implementing the above measures, especially upgrading the system and displaying transaction codes in advance on the application, through reviewing social networks and related websites, we have recorded that most large-scale odd-even betting gambling activities have been basically prevented and eliminated. At the same time, MoMo has not received any feedback or information from the police about odd-even betting activities using the company's transaction codes,” said Mr. Diep.

Cashless payments are becoming more and more popular and easy. Besides being convenient for users, cashless payments are also exploited by bad guys.

As society moves towards a digital economy , we must face the fact that cybercrime will increase. Criminals have knowledge, high technology level, use sophisticated methods and tricks to organize gambling activities, and new forms of gambling are constantly emerging.

Recently, there has been a situation where people have rented or borrowed their identities and documents to violators to open bank accounts, e-wallets, etc., causing difficulties in checking and authenticating customers.

Sharing about this issue, Mr. Nguyen Ba Diep said that businesses do not have the authority and expertise in verifying and preventing crimes. Having to constantly compete with criminals forces businesses to invest in expensive technical solutions, which also require a lot of human resources and implementation time, affecting business operations as well as user experience.

Criminals taking advantage of payment intermediary services and non-cash payment methods to commit violations will lead to a decline in people's trust, affecting the implementation of the Party and State's policy of promoting non-cash payments.

“To address the loopholes in customer registration, since 2021, MoMo has reviewed and implemented identification and authentication of e-wallet accounts according to legal regulations. Customers must provide identification information and link e-wallets to their own bank accounts. At the same time, e-wallets can only be used when MoMo is confirmed by the bank that the e-wallet registration information matches the customer information registered at the bank. The company is also testing many new technologies such as facial recognition, fraud detection through AI, Big Data to improve efficiency in customer identification and authentication,” said MoMo co-founder.

However, bad actors still have many ways to take advantage of e-wallets to commit illegal acts such as using identities, documents and bank accounts rented or borrowed from people to create many e-wallet accounts, making it difficult to verify violations.

MoMo has also recommended to management agencies to allow payment intermediary businesses and e-wallets to connect with the National Population Database managed by the Ministry of Public Security to help with electronic identification and user information authentication quickly and accurately, contributing to reviewing and preventing suspicious accounts and transactions, increasing the effectiveness in preventing and combating technological crimes.

“MoMo affirms the company's commitment to providing and operating safe and healthy intermediary payment services in accordance with the direction and guidance of the Government and the State Bank of Vietnam. In addition, to ensure the highest benefits for users, MoMo always complies with current processes and procedures in providing information for investigation purposes, ensuring privacy and legitimate rights of users when using legal services,” said Mr. Diep.

Source

Comment (0)