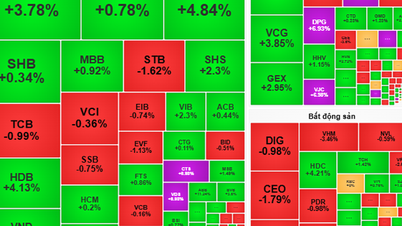

This year's rankings have many changes compared to 2022; in particular, the banking group has the participation of Ho Chi Minh City Development Joint Stock Commercial Bank ( HDBank - stock code HDB). Right from the first time entering the Top 10 prestigious and effective enterprises, HDBank made an impression when it took the 7th position on the rankings and ranked 5th in the banking industry, surpassing many big names in the industry in terms of prestige and efficiency.

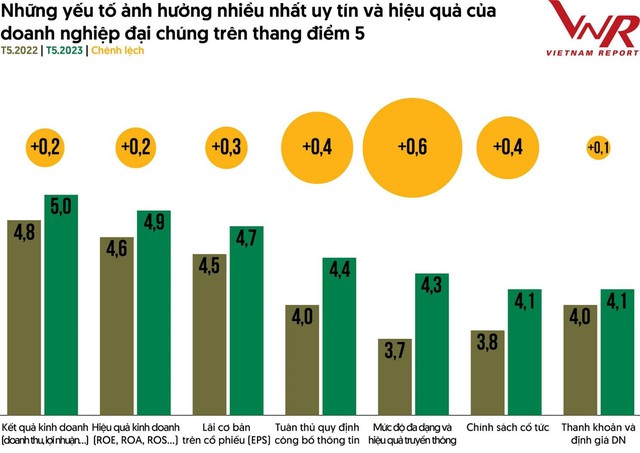

The weights that create the reputation and effectiveness of public enterprises on a 5-point scale include business results, business efficiency (ROE, ROA, ROS), basic earnings per share (EPS), compliance with information disclosure regulations, diversity and communication effectiveness, dividend policy, liquidity and business valuation, etc.

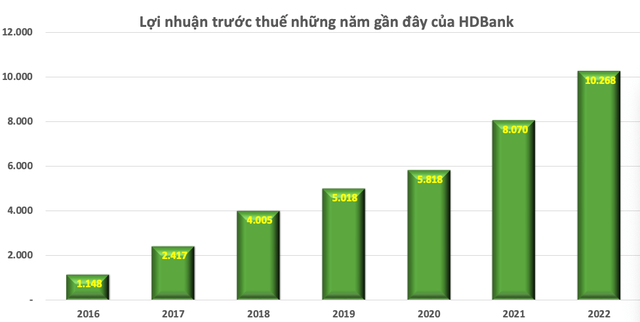

In terms of business performance, in 2022, HDBank made its first entry into the "10,000 billion VND Club" when it reached 10,268 billion VND in pre-tax profit, up 27.2% over the same period. Total assets also increased rapidly, exceeding 416,200 billion VND.

HDBank's return on equity (ROE) in 2022 reached 23.5% and return on assets (ROA) reached 2.1%, both higher than the same period last year - efficiency indexes among the top in the Vietnamese commercial banking system.

HDBank is also one of the banks that maintains a low bad debt ratio, around 1.67% - much lower than the industry average. EPS increased from VND 2,403 in 2022 to VND 3,081.

With the results achieved, HDBank shareholders recently approved the payment of 10% cash dividends, as planned, and 15% in shares. HDBank is also one of the few banks that has maintained a steady dividend payment at a high level for many years to shareholders. In the criteria for evaluating businesses, dividend policy has risen from 8th place last year to become the 6th most influential factor in 2023.

The survey results of experts and public enterprises by Vietnam Report also show that factors related to communication activities have recorded the greatest impact on the reputation and efficiency of enterprises. Experts also believe that investors now place the concern of information transparency on top.

HDBank - a new and impressive face in this year's rankings - is one of the listed companies with stocks in the VN30 basket, always strictly implementing regulations on corporate governance, complying with information disclosure regulations, and being transparent throughout its operations. This bank regularly organizes conferences with shareholders and investors to update and exchange information; conducts hundreds of meetings with investors every year to increase interaction and transparency of operational information.

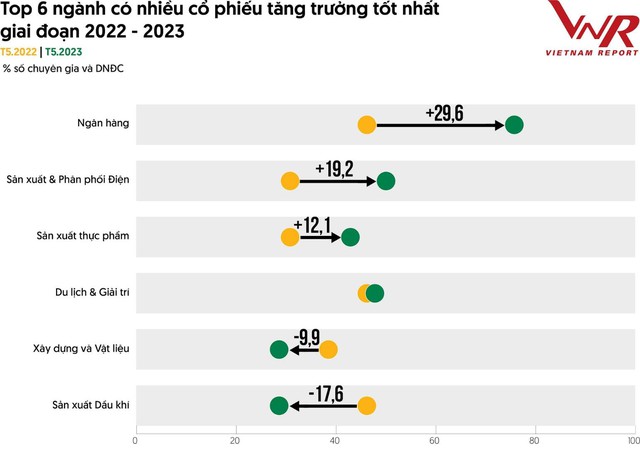

According to Vietnam Report, the top 6 industries with the best growth stocks, the banking industry group is leading. This is an advantage for HDB in particular and the banking stock group in general.

Source link

![[Photo] Closing ceremony of the 18th Congress of Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/17/1760704850107_ndo_br_1-jpg.webp)

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

Comment (0)