Recently, Agribank Securities Joint Stock Company (Agriseco - HoSE: AGR) announced its audited semi-annual financial report for 2023.

Accordingly, Agriseco's total operating revenue from the beginning of the year reached VND 172.6 billion, down slightly by 8.5% over the same period in 2022. Agriseco's pre-tax profit reached VND 106.9 billion, up 22% over the same period.

The company's securities service business segments such as brokerage, lending, issuing agency, custody, consulting, etc. achieved total revenue of VND31 billion, down 42% over the same period. In particular, interest from loans and brokerage revenue both decreased, only financial revenue increased by 44%.

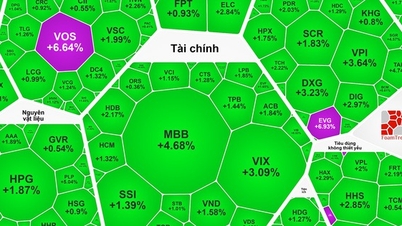

For the self-trading segment, the unfavorable market caused financial profits recorded through profit/loss (FVTPL) to reach nearly VND 18 billion, down 27% over the same period. Agriseco's total operating expenses reached VND 53.5 billion, up 61% over the same period in 2022.

With the achieved results, Agriseco has completed 59% of the annual profit plan and is one of the few securities companies that have exceeded the cumulative plan in the context of an unfavorable market in the first half of the year, with liquidity decreasing by 46% compared to the same period in 2022.

As of June 30, the company's total assets reached VND3,045 billion, up 8.5% compared to the beginning of the year, and outstanding loans also increased by 37% to VND1,372 billion.

In which, the main assets are loans recorded at 1,371.7 billion VND, accounting for 45% of total assets; investments held to maturity recorded at 1,107 billion VND, accounting for 36.4% of total assets; receivables recorded at 625.2 billion VND, accounting for 20.5% of total assets; provisions for decline in value of receivables recorded up to negative 1,101.78 billion VND... and other assets.

On August 11, Agriseco committed an administrative violation by falsely declaring, resulting in a shortfall in corporate income tax payable of VND 400.5 million according to the 2021 audit results report of the State Audit.

For this violation, Agriseco was administratively fined VND80.1 million by the Hanoi Tax Department. The total amount of fines and tax arrears that Agriseco must pay is VND480.6 million.

According to the Resolution of the 2022 Annual General Meeting of Shareholders, Agriseco plans to pay a 6% cash dividend to shareholders for the first time since 2012. In addition, on April 6, Agriseco and Agribank signed a comprehensive cooperation agreement to expand the scope of cooperation, diversify products, increase utilities and develop customers .

Source

Comment (0)