Vietnam Bank for Agriculture and Rural Development ( Agribank ) recently announced its audited financial report for 2023.

Accordingly, by the end of 2023, Agribank recorded net interest income of VND 55,964 billion, down 7% over the previous year.

The bank's non-interest business activities also declined compared to 2022. Specifically, Agribank earned net profit from service activities of nearly VND 4,566 billion, down 4.2%.

Net profit from gold and foreign exchange trading reached VND2,007 billion, down 30% compared to 2022. Net profit from trading securities decreased sharply from VND14,305 billion in 2022 to VND4,748 billion.

Only investment securities trading activities recorded a profit 22 times higher than the previous year to VND 2,977 billion. Net profit from other business activities of Agribank reached VND 10,529 billion, up 7% compared to the previous year.

As a result, Agribank's total operating income in 2023 reached VND76,139 billion, down 2.2% year-on-year. During the year, the bank's operating expenses increased by 9.9% to VND4,901 billion, which caused its net operating profit to decrease by 9% to VND45,206 billion.

Notably, in 2023, Agribank reduced its credit risk provisioning costs by 28.8% from VND 27,172 billion to VND 19,347 billion. Thanks to that, despite the decline in net profit, Agribank still reported a pre-tax net profit of VND 25,859 billion and a post-tax profit of VND 20,696 billion, up 14.7% over the previous year.

As of December 31, 2023, Agribank recorded total assets of VND 2.04 million billion, an increase of 9.1% compared to 2022. Outstanding customer loans reached VND 1.55 million billion, an increase of 7.4% and ranked second in the industry.

Customer deposits at Agribank increased by 11.9% to VND1,820 trillion, mainly term deposits with more than VND1,600 trillion, the bank successfully maintained its position as having the most deposits in the system.

Regarding debt quality, Agribank's bad debt increased by 10.2% compared to the beginning of the year to VND28,700 billion. Of which, group 4 debt recorded the strongest increase, up 76% to VND5,593 billion and group 5 debt increased slightly by 1.3% to VND19,248 billion. The bad debt ratio also increased slightly from 1.8% to 1.85%, lower than the system average.

Regarding banking personnel, at the end of 2023, Agribank's total number of employees is 42,083 people with the average cost for employees increasing by 7.3%, to 36.4 million VND/month.

In a recent development, in response to the State Bank's (SBV) request that credit institutions send the link of the column announcing interest rates to SBV before April 1, Agribank has publicly announced the average lending interest rate.

Specifically, the short-term lending interest rate for a number of priority sectors and fields under the direction of the Government and the State Bank of Vietnam announced by Agribank is 4.0%/year.

The normal short-term loan interest rate is at least 5%/year; the normal medium- and long-term loan interest rate is at least 6%/year.

The lending interest rate for consumer loans via credit cards is 13%/year. This is the highest lending interest rate announced by Agribank. The average lending interest rate of Agribank in March was 7.47%/year.

The average cost of capital does not include the required cost of capital for credit risk and the cost of credit risk provisioning, which is 6%/year. Of which, the average mobilization interest rate is 4.2%/year, other costs (including required reserves, liquidity reserves, deposit insurance, operating costs) are 1.8%/year .

Source

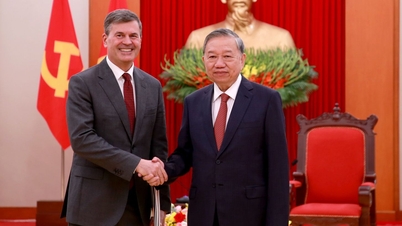

![[Photo] General Secretary To Lam receives the Director of the Academy of Public Administration and National Economy under the President of the Russian Federation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F08%2F1765200203892_a1-bnd-0933-4198-jpg.webp&w=3840&q=75)

Comment (0)