Nam A Commercial Joint Stock Bank (Nam A Bank) has just announced its business results for the first nine months of 2024, with many important indicators having "reached" the annual plan.

Amidst challenging macroeconomic conditions, Nam A Bank promptly implemented the policies and guidelines of the Government and the State Bank of Vietnam (SBV). Coupled with the collective efforts of its staff, many of the bank's key business indicators met their annual targets, while others also achieved positive growth.

Specifically, as of September 30, 2024, Nam A Bank's total assets reached nearly VND 240,000 billion (an increase of nearly 16% compared to the same period in 2023, achieving 103% of the annual plan); capital mobilization reached nearly VND 173,000 billion (an increase of more than 5% compared to the same period in 2023, achieving 97% of the annual plan), and outstanding loans reached nearly VND 164,000 billion (an increase of nearly 24% compared to the same period in 2023, achieving 102% of the annual plan). These growth indicators contributed to Nam A Bank's pre-tax profit reaching over VND 3,300 billion (an increase of 63% compared to the same period in 2023, achieving 83% of the annual plan)...

Notably, Nam A Bank maintained an average profit of over 1,000 billion VND per quarter. Net interest income in the third quarter increased by more than 1,500 billion VND, representing a more than 34% increase compared to the same period in 2023.

This profit can be attributed to the contribution from the digital banking segment. Accordingly, Nam A Bank has continuously upgraded its digital banking ecosystem, including ONEBANK, the OPBA robot, and Open Banking. In particular, since its launch, ONEBANK has experienced remarkable growth, with transaction growth exceeding 40% per quarter. Total capital mobilized from ONEBANK accounts for nearly VND 10,000 billion (6% of total deposits).

As a pioneering bank in the field of green credit, Nam A Bank has implemented a green credit value chain, focusing on agriculture , fisheries, and renewable energy sectors, and aims to increase the proportion of green credit to 20-25% (2-3 times the current proportion).

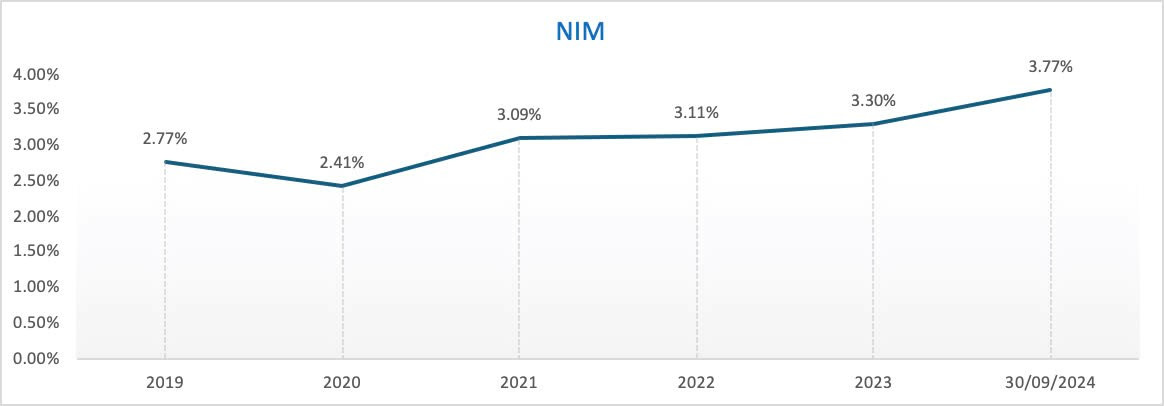

In addition, the bank's ROE, ROA, and NIM ratios have also improved significantly. As of September 30, 2024, the ROE reached 22.09%, and the ROA was 1.63%, indicating that the bank has not only grown in size but also achieved high profitability.

The Net Interest Margin (NIM) rose to 3.77% from 3.6% at the end of Q2 2024. The bank expects the NIM to remain in the range of 3.5-3.8% from now until the end of 2024, with interest rates continuing to be kept low to support individuals and businesses in the context of a challenging economy.

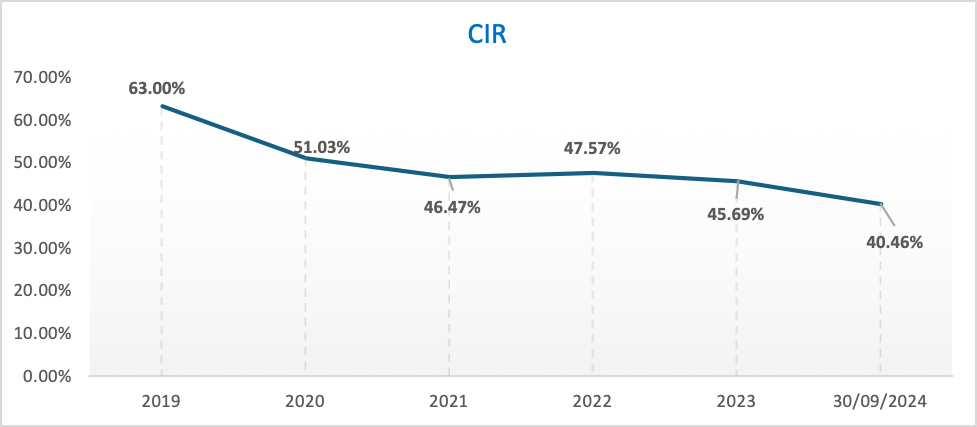

Regarding operating expenses (CIR), as of September 30, 2024, it reached approximately 40.46%, which is a relatively optimal level. Nam A Bank aims to have salaries and benefits among the top 7-10 banks in Vietnam to attract talent, along with expanding its network and investing heavily in technology to increase the technological content of its products and services. Therefore, the target CIR for this period is around 40-45% to lay the groundwork for strong growth in the coming years.

Since 2020, Nam A Bank has undergone a strong digital transformation and expanded its operations across all provinces and cities nationwide. The bank currently has nearly 250 business locations across the country, including nearly 150 traditional business locations (branches, transaction offices) and 101 ONEBANK locations. Although operating costs have increased, the CIR (Cost-to-Income Ratio) has gradually improved over the years.

Furthermore, the bank's operational safety indicators exceed the State Bank of Vietnam's (SBV) regulations. Nam A Bank complies with liquidity indicators and meets Basel III criteria. The Capital Adequacy Ratio (CAR) is over 11.11% (the minimum required by the SBV is 8%), the Loan-to-Deposit Ratio (LDR) is 75.72% (the maximum required by the SBV is 85%), the Liquidity Reserve Ratio (LCR) is 21.11% (the minimum required by the SBV is 10%), the 30-day VND Solvency Ratio is 87.51% (the minimum required by the SBV is 10%), and the ratio of short-term funding to medium and long-term loans is 17.56% (the maximum required by the SBV is below 30%). Nam A Bank continues to maintain a stable and safe liquidity strategy.

Regarding Nam A Bank's non-performing loan (NPL) ratio, it hovers around 2.85%. The bank aims to reduce this ratio to 2% and may increase provisions by an additional VND 300-500 billion to raise the loan loss coverage ratio (LLCR) to 55-60%.

In the first nine months of 2024, Nam A Bank also made several important milestones, including: Completing the financial statement conversion project according to international standards (IFRS), contributing to the transparency and soundness of financial reporting information to investors, especially foreign investors, in accordance with international standards; Moody's upgraded Nam A Bank's credit rating in two categories: asset quality from B3 to B2 and profitability and profitability indicators from B2 to B1, while also rating the issuer with a "stable" outlook; The bank completed the handover of the Environmental and Social Risk Management System (ESMS) to Pacific Risk Advisors LTD (PRA), marking an important step in implementing and perfecting the pillars towards becoming a Level 5 Green Bank; Since the beginning of the year, it is the only bank with shares listed on the HoSE stock exchange…

Huynh Nhu

Source: https://vietnamnet.vn/9-thang-dau-nam-2024-nam-a-bank-can-dich-nhieu-chi-tieu-quan-trong-2337155.html

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

Comment (0)