Coffee export prices turn to increase again

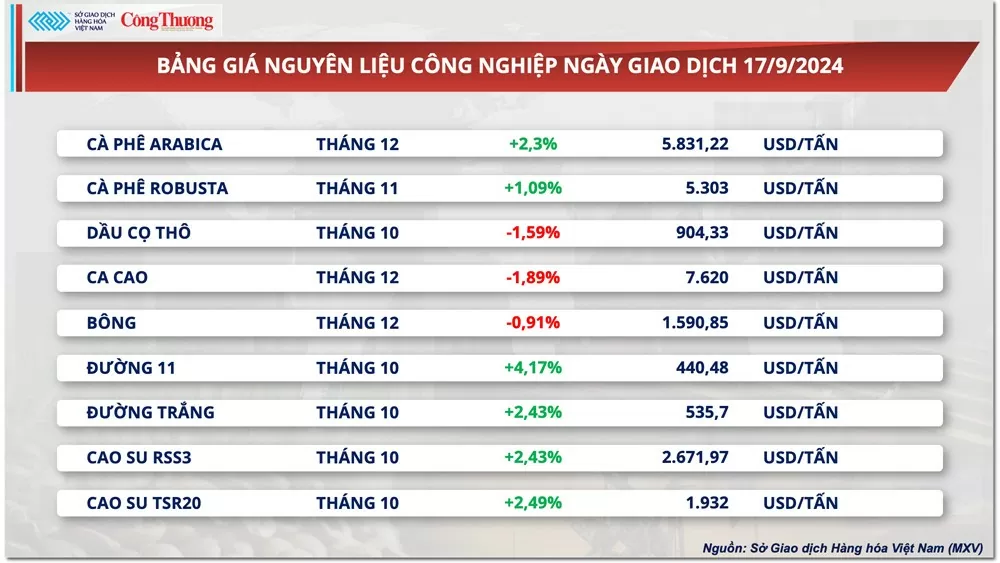

According to the Vietnam Commodity Exchange (MXV), at the end of the most recent trading session, the prices of two coffee products increased by 2.3% for Arabica and 1.1% for Robusta, respectively. The risk of a narrowing supply combined with a weakening USD/BRL exchange rate are important factors maintaining support for the prices of these two products.

|

| Industrial raw material price list |

Citi recently lowered its forecast for a global coffee surplus of 2-3 million bags in 2024-2025 due to a new harvest in Brazil that has not met expectations. Meanwhile, the market predicts that a prolonged drought in the Southeast, the country’s largest coffee-producing region, will reduce output in 2025-2026.

In Vietnam, dwindling supplies in the final month of the crop year are leading to sluggish exports. In addition, falling production is also putting pressure on coffee exports from Honduras, the world's leading Arabica producer. In August, the country exported just 280,000 bags of coffee, down 30% from the same month last year and 37.5% below the three-year average. For the entire 2023-2024 crop year, coffee exports are at a historic low.

In addition, in yesterday's trading session (September 17), although the Dollar Index recovered after three consecutive sessions of decline, the stronger Brazilian Real pulled the USD/BRL exchange rate down by 0.5%. Thereby, it limited the selling psychology of Brazilian farmers.

In the domestic market, recorded this morning (September 18), the price of green coffee beans in the Central Highlands and the Southern provinces is moving towards the 124,000 VND/kg mark, currently fluctuating between 123,300 - 123,800 VND/kg, an increase of 300 VND/kg compared to yesterday.

Coffee export turnover after 8 months is nearly equal to the record level of 4.2 billion USD

According to the General Department of Customs, Vietnam's coffee exports in August reached 76,214 tons, worth 402.2 million USD, down 9.9% in volume but up sharply 55.8% in value compared to the same period in 2023.

In the first 8 months of 2024, Vietnam exported nearly 1.1 million tons of coffee, earning 4 billion USD. Although the export volume decreased by 12.1%, the export value still increased by 35.6% compared to the same period last year.

|

| In the first 8 months of 2024, coffee export prices recorded an increase of 54.3%, reaching an average of 3,800 USD/ton. |

Coffee export turnover after 8 months has nearly equaled the record of 4.2 billion USD achieved in the whole of last year. In August, the average export price of Vietnam's coffee set a new record of 5,278 USD/ton, up 6.6% compared to the previous month and up 73% compared to the same period last year.

On average, in the first 8 months of 2024, coffee export prices recorded an increase of 54.3%, reaching an average of 3,800 USD/ton.

In the first 8 months of the year, the European Union (EU) continued to be the largest customer of the Vietnamese coffee industry. This market accounted for 39% in volume and 38% in total coffee export value of our country, with a volume of 412,179 tons, worth over 1.53 billion USD, down 9.4% in volume and up 43.9% in value compared to the same period in 2023.

Of which, the amount of coffee exported to Germany decreased by 10.9%; Italy decreased by 13%; while Spain and the Netherlands increased sharply by 17% and 13.5%... In addition to the EU, the amount of coffee exported to some other major markets such as Japan, the US, Russia... also decreased compared to the same period in 2023 due to limited supply.

At the end of 11 months of the 2023-2024 crop year (October 2023 to August 2024), Vietnam exported more than 1.4 million tons of coffee of all kinds, down 12.3% compared to the same period last year and accounting for about 96% of the total output of about 1.47 million tons of the current crop year. If not counting the inventory carried over from the previous crop year, Vietnam only has about 60,000 tons of coffee left to export in the last month of the 2023-2024 crop year.

Coffee prices hit record high for first time

Regarding the seasonal situation in Vietnam, coffee plantations have begun to produce early ripe fruits. However, due to the impact of storms and rains, the harvest may start later than usual. According to weather reports, prolonged storms and rains will affect the progress of the coffee harvest in the coming time. This year is also the first time that coffee prices have reached a record high before the harvest season begins.

The Central Highlands coffee crop peaks from November to December, so Vietnam’s current supply is at its lowest level of the year. Analysts also said that coffee prices could rise further in the coming months as the global supply situation worsens.

Mr. Nguyen Nam Hai - Chairman of the Vietnam Coffee and Cocoa Association (Vicofa) - commented that although coffee output will be abundant during the harvest season, coffee prices can still be stable at a high level, which is beneficial for farmers.

In the coming time, it will be difficult for this type of bean to decrease deeply due to the impact of climate change, the El Nino phenomenon causing drought throughout the global coffee growing regions leading to a decrease in supply. Geopolitical conflicts in the world, tensions in the Red Sea cause shipping costs and many other costs to increase. Along with that, many financial speculators in the world choose coffee (after oil and gold) to speculate. These are major factors that push up global coffee prices and keep them at high levels, including coffee prices in Vietnam.

Source: https://congthuong.vn/8-thang-nam-2024-viet-nam-xuat-khau-gan-11-trieu-tan-ca-phe-346477.html

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

Comment (0)