5 largest capitalization companies in the oil and gas industry make huge profits

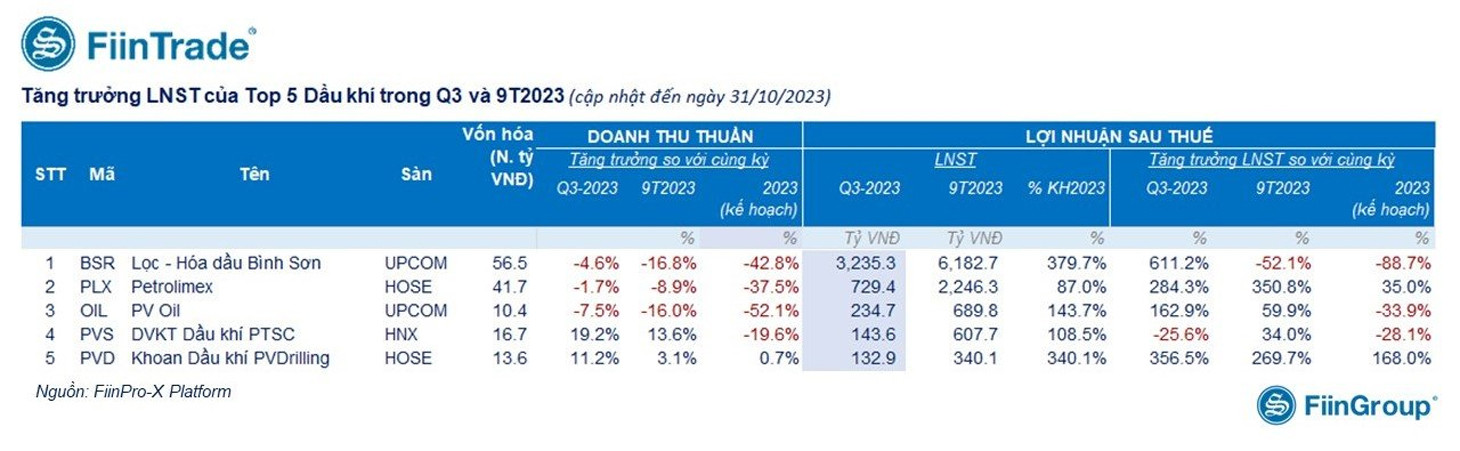

According to FiinTrade, the 5 largest capitalized oil and gas companies reported huge profits in the first 9 months of 2023 and most of them exceeded their profit plans for the whole year.

Specifically, Binh Son Refining and Petrochemical Joint Stock Company ( BSR ) reported after-tax profit in the third quarter of 2023 reaching more than VND 3,235 billion, accumulated in 9 months reaching nearly VND 6,186 billion, completing 380% of the profit plan for the whole year 2023.

Petrolimex (PLX) oil and gas giant achieved a profit of VND2,288 billion in the first 9 months, nearly completing its annual plan. Meanwhile, PV Oil (OIL) completed nearly 144% of its annual plan. PTVS Oil and Gas Drilling Services (PVS) completed 108.5% of its plan. PVDrilling Oil and Gas Drilling (PVD) exceeded its annual profit plan by 200%.

In the third quarter of 2023 alone, Binh Son Refining and Petrochemical recorded a profit after tax increase of more than 7 times compared to the same period. Petrolimex increased by more than 3.8 times. PVDrilling also reported a profit in the third quarter of nearly 133 billion VND, while in the same period it lost nearly 52 billion VND. PVOil made a profit of nearly 235 billion VND, compared to a loss of 373 billion VND in the same period.

The impressive business results of oil and gas companies are mainly explained by the increase in crude oil prices.

The leader of Binh Son Refining and Petrochemical said that the increase in crude oil prices and the good price gap have made the production and business situation improve. Crude oil prices have increased from 80 USD/barrel in July to 94 USD in September. The gap between product prices and crude oil prices is also larger than the same period last year.

Impressive business results also help improve the financial situation of businesses in the industry.

As of the end of September, Binh Son Refining and Petrochemical had about VND36,470 billion (equivalent to nearly USD1.5 billion) in bank deposits, an increase of more than 45% compared to the beginning of the year. The large amount of cash helped BSR earn thousands of billions of VND in bank interest, equivalent to an average of more than VND4 billion per day from savings interest.

This is the second consecutive year that Binh Son Refining and Petrochemical has recorded impressive business results.

Meanwhile, the "big guys" in the petroleum trading industry, PVOil or the Vietnam National Petroleum Group (Petrolimex), recorded an impressive comeback after a stumble, a sharp decline or loss of hundreds of billions of VND in the same period last year when oil prices in the third quarter of 2022 decreased, inventories were large, it was difficult to buy both gasoline and crude oil, and transportation costs increased, exchange rates increased...

Block B-O Mon super project has new signals, many oil and gas enterprises benefit

Recently, the Block B-O Mon mega project has seen new positive developments. On October 30, the Vietnam Oil and Gas Group - PetroVietnam (PVN) held a signing and implementation ceremony in Hanoi to start the Block B-O Mon gas-electricity mega project. The PTSC (PVS)-McDermott joint venture was awarded the EPCI 1 package with limited terms. The total value of this package (including the central operating platform, living quarters and a number of wellhead platforms) is estimated at 1.1 billion USD.

The Block B-O Mon mega project is a large-scale gas-electricity production chain, with a total investment of tens of billions of USD, expected to supply 5.06 billion m3 of natural gas per year for 23 years. The first gas flow can be exploited in 2026 and supply a complex of 4 gas-fired power plants (O Mon 1, 2, 3, 4) with a total capacity of 3.8 GW.

The project includes the upstream part (gas exploitation and processing of Block B), the midstream part (gas pipeline transporting gas) and the downstream part (4 power plants). The main investors of the project include: PetroVietnam (upstream and O Mon 3 and 4 power plants recently transferred from Vietnam Electricity Group), PVEP, MOECO, PTTEP (upstream), PV Gas (midstream), Marubeni (O Mon 2 power plant), and Genco 2 Power Group (O Mon 1 power plant).

According to SSI Research, with the new progress of Block B-O Mon, the main beneficiaries are still upstream enterprises such as PVS, PVD and midstream enterprises such as GAS, PVB.

In particular, PVS is the first beneficiary when it starts building the package from mid-2024. This will boost both revenue and profit of PVS's EPC segment (design, technology supply, construction, etc.).

PVDrilling (PVD) may also have the opportunity to participate in drilling activities during the long-term construction and development phase of the project (23 years from first gas). Meanwhile, PVB may participate in some pipeline lining contracts, while GAS may benefit when the project starts supplying gas to power plants.

In mid-October 2023, a series of oil and gas giant stocks reached historic highs thanks to bright prospects for the oil and gas industry as crude oil prices increased sharply.

At that time, PVS shares of Vietnam Oil and Gas Technical Services Corporation - PTSC were up to nearly 41,000 VND/share. PVD shares of PetroVietnam Drilling and Services Corporation (HOSE) - PV Drilling also increased sharply to 29,000 VND/share - the peak in nearly 10 years. Many other oil and gas stocks also increased sharply such as GAS, BSR, PVB, OIL, PLX, PVC...

In mid-October, oil and gas-related stocks continued to climb and were all around one-year highs and/or historical highs amid rising crude oil prices and being around one-year highs.

In addition, according to Mirae Asset, the amended Petroleum Law, effective from July 1, 2023, is expected to create major turning points for the oil and gas industry, helping to remove bottlenecks in upstream activities, when natural reserves are gradually decreasing over time.

However, in the past 3 weeks, most of these stocks have decreased by 5-15% following the general market trend. Oil and gas stocks have recovered in the last 2-3 sessions.

Although oil and gas stocks have fallen, most forecasts still have positive assessments of the industry. VNDirect also believes that the Block B - O Mon project will be the main growth driver for the oil and gas industry in the coming time.

According to MBS, world crude oil prices are an important factor affecting the business results of oil and gas enterprises. MBS expects the world Brent crude oil price to average $93/barrel in the fourth quarter of 2023 and reach $92/barrel in 2024.

Source

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)