According to the announcement on the Ho Chi Minh City Stock Exchange (HoSE) on the afternoon of June 29, Ms. Do Thi Kim Ngoc, sister of Mr. Do Duy Thai, Chairman of the Board of Directors of Pomina Steel Joint Stock Company (stock code: POM), registered to sell 5.5 million POM shares from July 4 to July 28 through negotiated and order-matching transactions. The purpose of the transaction is investment.

If the transaction is successful, Ms. Ngoc will still hold 9.9 million shares, her ownership ratio will decrease by 5.51% to 3.54% and she will no longer be a major shareholder of the company.

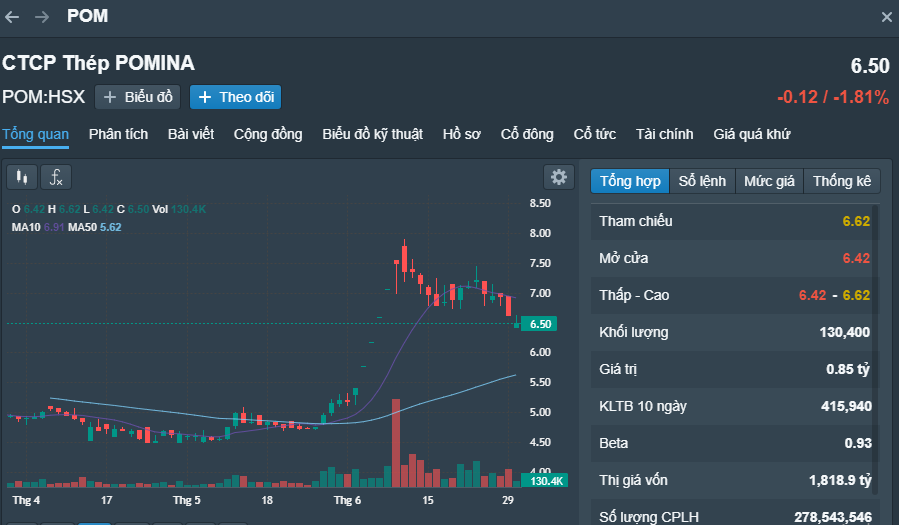

POM stock price fluctuations recently. Screenshot

A few days ago, another sister of Mr. Do Duy Thai, Ms. Do Nhung (American nationality), also registered to sell 5.3 million POM shares. The transaction is expected to be carried out by negotiation and order matching from July 3 to July 28. If the transaction is successful, Ms. Nhung will reduce her ownership ratio of Pomina to 0.71%, meaning she will still hold 1.98 million POM shares.

In addition, Mr. Do Duy Thai's sister, Ms. Truong Geb Do Thi Cam Huong (German nationality), has also registered to sell all of the more than 1.8 million POM shares she holds. The transaction is expected to be carried out by negotiation and order matching from June 30 to July 28. Previously, Ms. Cam Huong had registered to sell all of her POM shares many times but failed to sell all of her registered amount because the price had not met expectations.

Thus, Mr. Do Duy Thai's three sisters have registered to sell a total of 12.6 million POM shares.

The fact that the family members of the Chairman of the Board of Directors of Pomina have registered to sell their shares comes as POM shares are in a correction phase after the previous period of rapid growth. Specifically, POM code has increased by nearly 60% in just over 2 weeks from May 26 to June 9, climbing to VND7,900/share, the highest level in 9 months.

Since then, profit-taking pressure has cooled down this stock and it has now retreated to VND6,500/share, still nearly 40% higher than when it first started surging more than a month ago.

At the end of the morning session on June 30, POM continued to decrease, temporarily stopping at 6,500 VND/share with a trading volume of 115,400 shares. Up to now, this stock code has decreased in the past 4 sessions.

Pomina is a fairly famous steel brand, but its business activities and stock price on the market are quite modest.

According to the business results of the first quarter of 2023, Pomina achieved net revenue of VND 1,645 billion and a net loss of VND 187 billion after deducting expenses. Previously, in 2022, the company had a loss of up to VND 1,078 billion.

Meanwhile, in 2023, Pomina is targeting net revenue of VND 14,000 billion and after-tax profit of VND 300 billion.

Source

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)