Of the 1,034 businesses and business households that have registered to use electronic invoices generated from cash registers in Ha Tinh, there are 523 businesses and 511 business households.

Implementing Decree No. 123/2020/ND-CP of the Government regulating invoices and documents, in 2023, Ha Tinh Tax Department has deployed the application of electronic invoices (E-invoices) generated from cash registers. The program aims to contribute to preventing loss of State budget revenue, ensuring fairness between taxpayers and ensuring the rights of consumers to participate in the lucky invoice program.

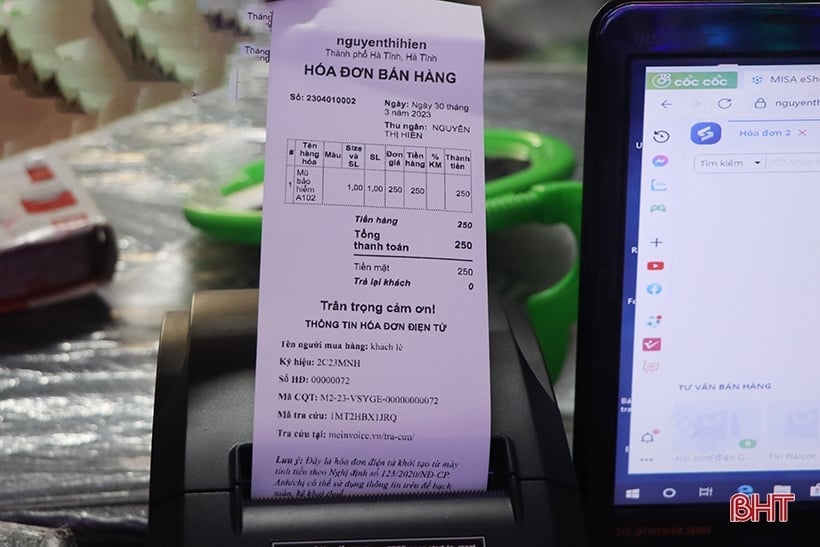

Just need a computer connected to the internet and a cash register to be able to use electronic invoices generated from the cash register.

Electronic invoices generated from cash registers are electronic invoices with tax authority codes, applied to businesses, households, and individuals who pay taxes according to the declaration method and provide goods and services directly to consumers in business groups such as: food and beverage, restaurants, hotels, retail of consumer goods, retail of modern medicine, shopping malls, supermarkets, entertainment services and other services.

Up to now, Ha Tinh has 1,034 enterprises and business households registered to use electronic invoices generated from cash registers; of which there are 523 enterprises and 511 business households. The number of electronic invoices with tax authority codes generated from cash registers has issued over 145,000 invoices.

Electronic invoice form with tax authority code generated from cash register

In the coming time, Ha Tinh Tax Department will continue to review and promote propaganda for enterprises and business households that are required to register to use electronic invoices generated from cash registers; strengthen inspection and supervision of the issuance of electronic invoices from cash registers of enterprises and business households that have registered to use them.

At the same time, promote the implementation of the "Lucky Invoice" program to encourage buyers to get invoices when purchasing goods and services to enhance business revenue management and avoid loss of State tax revenue.

Up to now, Ha Tinh has 6,292 enterprises, organizations and business households registered to use electronic invoices according to Decree No. 123/2020/ND-CP of the Government regulating invoices and documents and Circular No. 78/2021/TT-BTC guiding the implementation of a number of articles of the Law on Tax Administration. |

Phan Tram

Source

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

Comment (0)